Thomas Chew, Associate Director at Redbrick Mortgage Advisory will demystify the topic of decoupling, especially for many of our readers who are seeking to maximise their wealth through real estate, the choice to decouple is often not a clear one.

The essential goal of decoupling is to acquire multiple properties under the ownership of your household, without having to incur greater stamp duties. He will shed some light on this topic so that you can ask the right questions in your next steps in wealth accumulation.

Background

Since April 2016, married couples who own a HDB flat are not allowed to decouple. Currently, the Additional Buyer’s Stamp Duty (ABSD) of 20% is imposed on secondary home purchases for Singaporean Citizens. However, this does not apply in the case of an essential occupier.

Since essential occupiers are not considered to be homeowners, after they complete the Mandatory Occupation Period (MOP), they would be considered first-time property owners and hence are not subject to ABSD when purchasing a private property. The title of essential occupier also entitles one to take up a 75% loan on their next property, as opposed to the 45% limit imposed on individuals wishing to purchase their second property.

However, the individual designated as the essential occupier cannot use their CPF to fund the purchase of their HDB. This means that if you are a young couple, you require careful consideration of your available funds. Furthermore, in any unfortunate circumstance of death without any estate planning, the Intestate Succession Act will take effect and you will be unable to dictate who you wish to leave your property to.

Mistake 1: Intestate Succession Act

For many, succession planning is a matter that many of us consider only as we approach our golden years. For those in the know, a lack of planning means that your assets will be subject to the Intestate Succession Act – a process of allocating your proceeds to your family members in the absence of a will.

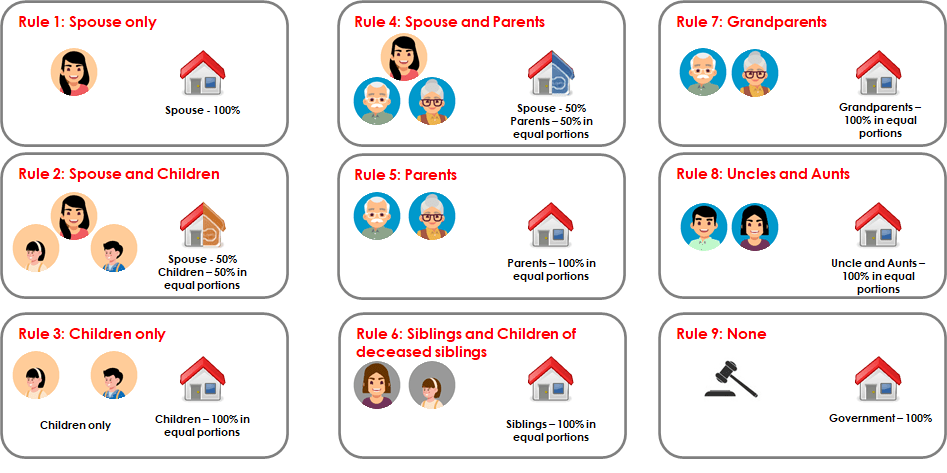

The Intestate Succession Act prioritizes family members in accordance with 9 tiers, equally dividing your assets where required. Spouses are allocated first, followed by children, then the deceased’s parents.

In a scenario where a decoupled spouse has passed away without prior succession planning, the Intestate Succession Act may allocate a larger proportion of the property value to his children or his surviving spouse’s family. This may also be true where both parties pass away.

Fundamentally, a lack of succession planning may result in an allocation of your real estate assets which is not to your wishes due to the implications of the Intestate Succession Act. Other implications include leaving the estate to non-intended beneficiaries, non-financially mature individuals or ineligible beneficiaries. We recommend proper legacy planning for every possible scenario, and to consider the impact to any surviving family members as covered in the next point.

Mistake 2: Protection

Once again, if you have failed to plan ahead for any unfortunate circumstance, the Intestate Succession Act dictates your surviving family’s share of the assets and liabilities.

Your family members may be subject to any outstanding loans and mortgage payments on the property or any other asset – an untimely and unwanted burden. While purchasing insurance may add on to costs, we suggest the safest path forward in your pursuit.

Mistake 3: Ownership structure

In a decoupling scenario, ownership weightage can vary between 1/99 or 50/50. There is no secret formula here for the most optimal payment structure, but since the goal of decoupling is presumably to acquire more properties as a family unit, it would be natural to adopt the structure that maximises cash flow to that family unit.

At Redbrick Mortgage Advisory, your advisor will walk you through the benefits and limitations of different ownership structures and calculate which weightage will offer the best cash flow outcome. This way, you can immediately minimise your cash outlay in the decoupling process and focus on maximising your funds for your next property purchase.

So, what plays the greatest role in determining the ownership structure?

Mistake 4: Usage of CPF

The ownership structure hinges considerably on the CPF contribution by either party in the initial purchase. This is because after selling your interest in the property, you are required to refund your CPF account with the principal and accrued interest in accordance with the CPF Housing Scheme.

For example, in the case of 99-1 In the decoupling process, one party exits and holds a minority share of the property, while the other party holds a majority share. For this discussion, let us assume that Sally is planning to hold this majority share of the property, and will be known as the ‘staying’ party.

When Sally purchases her husband’s share in the property, worth $1.0 million. She has to fork out 25% of this amount ($250,000) for her down payment and take a bank loan for the remaining 75% of the share ($750,000). On top of which, she has to incur stamp duty fees and legal fees associated with decoupling.

Her husband, George, ‘earns’ the proceeds of $1.0 million, but has to repay his initial CPF contribution (with accrued interest) that he had used to purchase the property with Sally, on top of his loan repayment. Hypothetically speaking, if the sum of his CPF contribution and loan repayment was greater than $1.0 million (plus the stamp duties and legal fees), the family unit would experience a net cash outflow. This makes decoupling less reasonable than he had imagined!

Bottom line, a general rule of thumb would be that on an individual basis, the person who contributed more of their CPF to the initial purchase should retain a larger percentage of the property when decoupling.

Mistake 5: Nationality of Spouse

Singapore is no stranger to the effects of globalisation, with international and interracial marriages becoming more of a norm. What few know is that there are certain situations in which this would be beneficial for households to acquire more properties.

As of today, the ABSD rate levied for foreigner’s purchase of residential properties in Singapore is 60%. However, under certain Free Trade Agreements (FTAs), Nationals or Permanent Residents of Liechtenstein, Iceland, Norway and Switzerland will be accorded the same ABSD treatment as Singaporean Citizens. This also applies for Citizens of the United States of America.

Consider George and Sally again, who now have a private property in Singapore. George, it turns out, is a Swiss Citizen, while Sally is a Malaysian who is currently a Permanent Resident in Singapore. With his knowledge on ABSD remission, George decides that it will suit their family best if he holds a 1% share in their existing property.

This means that Sally only needs to pay 5% ABSD on the 1% bought over from George and George can now go out to purchase another property without ABSD.

Mistake 6: Difference in Value

The decision process involved in decoupling is generally founded on enriching the family unit as a whole. In monetary terms, this means considering cash inflows and outflows regardless of which spouse it comes from. However, this tends to overlook CPF or cash contributions at an individual level.

Added complications like selecting the right ownership weightage also play a role in the decision-making process – who has the final say in the decision to sell and what to do with the proceeds? Even if behind the scenes, both spouses agree to contribute to the same family wallet in cash, on paper, the one who holds a majority share of the property often gets the final say.

In unfortunate circumstances such as the demise of a spouse, potential problems can be circumvented through the use of good legacy planning as mentioned earlier. And if any one of the spouses change their mind, you could always opt to recouple for the benefit of joint decision-making.

In the case of a divorce however, asset division is left to the decision of the courts. We recommend consulting a lawyer on this matter.

However optimistic one may be, it is imperative to consider such scenarios in view of the high value of property in Singapore.

Mistake 7: Added Financial Costs

The costs of decoupling go beyond CPF repayments and a transfer of share of ownership. Here are some costs that you may expect to encounter:

25% deposit

It would be impossible to conduct a decoupling if sufficient funds are not readily available to purchase 25% of your spouse’s stake.

Legal Fees

This is a standard added cost that must be included in your overall calculations

Stamp Duty

Do you have the sufficient funds to negate these effects? Will it still be viable to purchase a property after incurring the stamp duties associated with decoupling?

CPF Refund

While this can be mitigated through varying the share of ownership between you and your spouse, careful calculations would have to be made to produce a desirable outcome. We recommend speaking to your mortgage advisor about this.

Loan Eligibility

The person who exits the initial property must be eligible for loans when attempting to purchase the second property. The staying party must also be eligible to take on added loans and mortgage payments when purchasing the remaining share of the initial property.

Wills, Trusts and added Insurance

These will demand added cash outlay, some of which may be recurring.

Mistake 8: The Process

Having a comprehensive understanding of the process will allow you to be more prepared for the road ahead. That way, decoupling will not be more of a hassle that thwarts your financial goals.

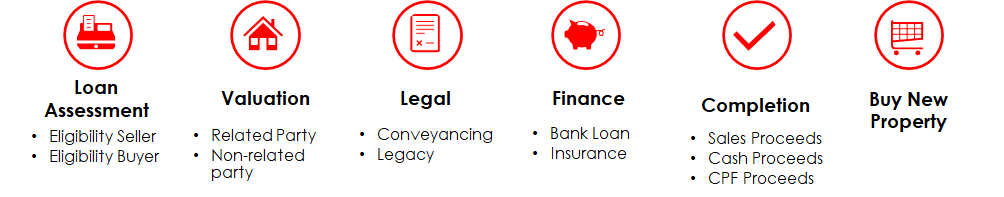

A typical process is as follows

- Conduct a loan assessment for the buyer and seller

(i.e., which party will be selling their share to the other) - The valuation process

- Conveyancing

- Sales and Purchase agreement

- Financing and reassessment of bank loans

- Finalising insurance

- The decoupling and the subsequent search for second properties

We recommend an early consultation regarding financing and reassessment of bank loans to avoid incurring costs along the way only to be told that decoupling is not financially viable.

Mistake 9: Valuation

IRAS requires valuations to be based on arms-length transaction, regardless of whether the transaction occurs between related or non-related parties. In essence, the valuation of the property should reflect fair market value.

Nonetheless, there is some free play within the range of valuations deemed to be “fair market value”. Similar to our earlier discussion of how the ownership structure and weightage affects cash flows to the family unit, the valuation determines the amount a spouse would sell for that given share, affecting cash flows in a similar way.

One added consideration is that in isolation of ownership structure, selecting a higher valuation for the transaction would result in a higher gross amount paid in stamp duties. Deciding on your goals for decoupling, to minimize stamp duty payments or to maximize cash flows would play a role in deciding the right valuation for your transaction.

Mistake 10: Gifting

Some may ask: why go through the hassle of decoupling? Why not simply gift the property to my spouse, leaving me free to purchase another?

For one, gifting of property is still subject to buyer stamp duty and refund of CPF with accrued interest. Gifting the property to your spouse may render them ineligible to borrow against that asset in order to take on new loans for future property purchases.

In the same vein, gifting your property to your children does not mean that they could flip the home for cold hard cash the very next day.

Since the bankruptcy act was repealed by Insolvency Act in 2018, creditors now have 3 years to repossess gifted property even if it is not under your direct ownership. As such, your beneficiary would face difficulty in borrowing against that gifted property for a certain time frame, essentially locking up funds unnecessarily.

Conclusion

Decoupling is not a straightforward process and requires careful consideration of the processes and added costs involved. Even when all rational steps have been taken across documents and excel sheets, it is also important to plan for the worst-case scenario, to protect all that you have worked so hard to achieve!

We hope you have enjoyed this article. We welcome you to reach out to Redbrick Mortgage Advisory to assist you in navigating towards your goals.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!