Following the announcement of the Singapore Budget 2022, we have observed increments in wealth taxes across the board. In this article, we explore what property owners can expect to pay in property taxes, how they are calculated and how this may affect the property market in Singapore.

Annual Value – The Basis of Property Tax

Property tax serves as a wealth tax and is a tax on the ownership on the property as opposed to the functional usage of a property. Unlike income tax, property tax is therefore not dependent on the rental income of your property, but rather the Annual Value (AV) of your property as determined by the Inland Revenue Authority of Singapore (IRAS). This distinction is important as it means that if you own two properties, you will be taxed on both accordingly, regardless of whether your second property is vacant or occupied.

The AV of the property is the value that will be considered when applying the property’s relevant tax rate. Without getting into too much detail, the AV generally relates to the gross amount at which the property can be reasonably be expected to be let on a yearly basis. Depending on the type of property, inclusions and exclusions of expenses may vary according to the Property Tax Act.

There are multiple ways to determine a property’s AV, but residential properties are typically benchmarked against other comparable properties. The valuer would then make various adjustments based on any differences in existing physical condition and orientation.

The AV can be revised on a yearly basis but is ultimately dependent on market values. AV is used instead of Capital Value for a handful of reasons. Firstly, data on Capital Value is retrieved by tracking sales transactions. In comparison, the data is rental values (which serves as a basis for AV calculation) is far more available than sales transactions data. Secondly, sales prices tend to vary more than rental prices, leading to a greater amount of volatility.

Property Tax

As Singapore’s population continues to grow, stronger demand for property in this land-scarce country will continue pushing property prices higher. The property tax therefore serves to disincentivise multiple property ownership, firstly through progressive tax rates on annual value, and secondly through higher tax rates for non-owner-occupied property.

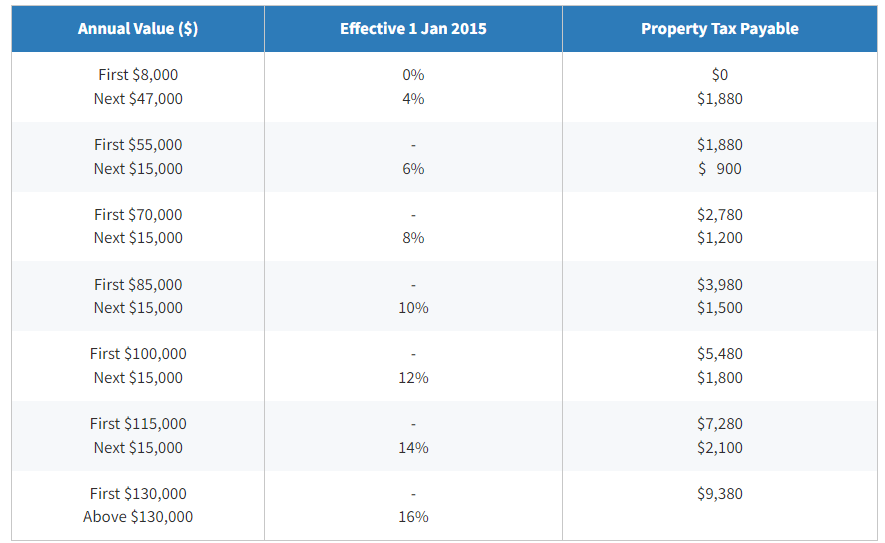

Changes for owner-occupier tax rates

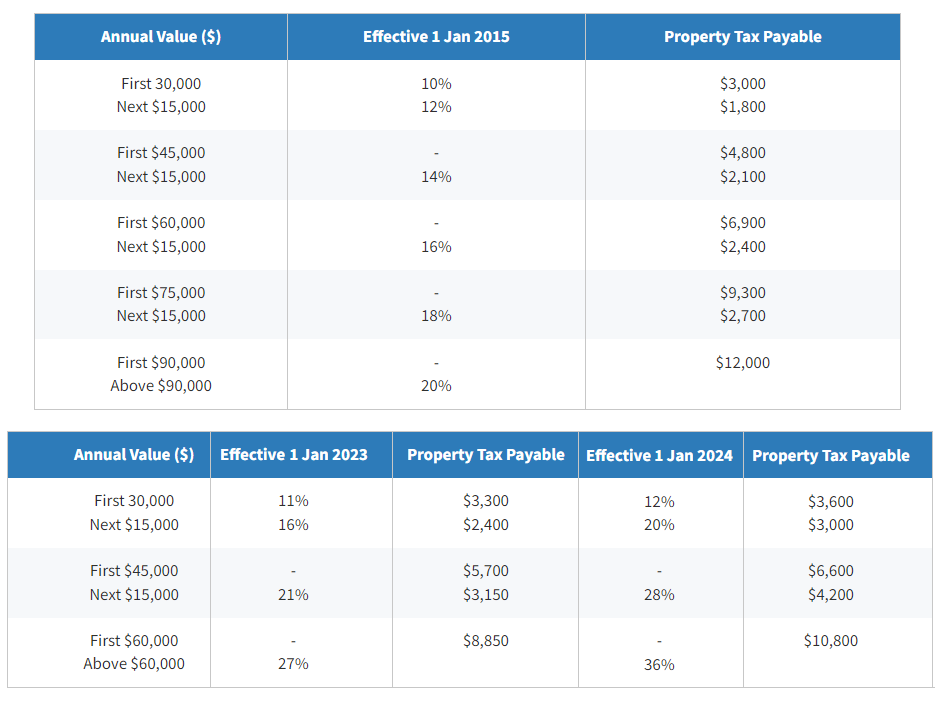

Here’s an illustrative example.

This table illustrates three hypothetical properties with varying monthly rent. Immediately, we observe that the new changes in property tax rates affect homes with a higher annual value to a significantly greater degree. Following the changes in 1 Jan 2024, properties with an AV of under $55,000 experience only a slight increase in property taxes. However, properties with an AV of over $70,000 will be most affected by these new measures, with an extreme scenario shown in the example above.

While the former tax measures put properties with an AV over $130,000 in the same bracket, the new measures do the same with properties beyond $100,000. Similarly, we see greater stratification amongst properties that fall into the lower AV range, which may be a response to the strength in demand for smaller quantum units as seen throughout 2020-2021.

However, the AV for most Singaporeans fall below $30,000 for HDBs and below $40,000 for private residential properties, which means that the incremental property tax on our existing property is less substantial. In fact, the largest increase in property tax would only affect approximately 7% of homes in Singapore, belonging to those who own Good Class Bungalows and large landed properties.

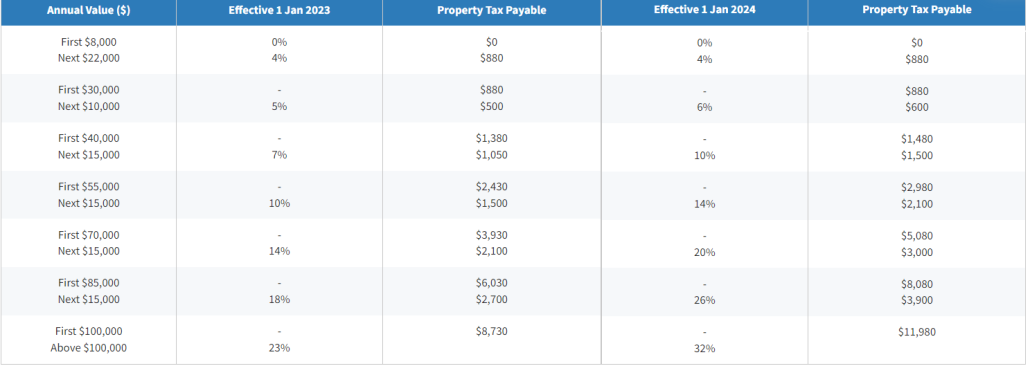

Non-owner-occupied residential tax rates

For non-owner-occupied residential tax rates, increases were more significant across all brackets. This is likely aimed at curbing the purchase of multiple properties beyond one’s means.

For landlords, the increase in property tax decreases their holding power, unlike the stamp duties which are charged once during a transaction. Over a long period, property taxes are likely to make a large impact on the overall yield of the property since a large proportion of the income from property investments are derived from capital gains. Currently, the government has not imposed any new taxes on capital gains.

One response that we may expect from landlords would be an increase in rent such that the annual rental income becomes sufficient to cover the cost of the mortgage and the property tax. Whether the rental market is willing and able to accept this remains to be seen. However, if the market does accept higher rents, the AV of property within the market will increase as well, which would then relate to an increase in gross property tax payable.

Overall, when purchasing a property, it is important to consider these longer-term factors that relate to recurring costs. While additional fees like stamp duties are initial hurdles to consider, the impact of property taxes may limit your ability to renovate or upgrade your property. As always, we recommend taking all these factors into consideration when deciding whether to purchase a second property or when deciding which property should be listed as owner-occupied to optimise your property taxes. After all, higher taxes do not mean all opportunity has been eradicated, instead, astute homebuyers will have to search deeper for more value.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!