Moving into a new home is one of the most transformative stages in many of our lives. It is the manifestation of countless sacrifices, multiple viewings, negotiations, discussions with family members and a step forward in our journey. You have worked so hard to get there, surely you deserve a break? But no. Nothing truly prepares you for the less glamorous, often under-whelming and exhausting stage ahead.

No, it is not having to pack and unpack your entire life in cardboard boxes.

No, it is not having to decide on the interior design with your spouse.

No, it’s not even adjusting to the new commute patterns.

It is that mortgage broker who did not tell you that your interest rate payables are soaring through the roof! What happened to the “best rates in town”? What happened to always being “at your service”? Your new home looks great and all your friends love visiting you, while you slowly forgo little weekend luxuries to make good on those monthly payments.

As your friends leave after an enjoyable housewarming party, the reality starts to set it – mortgage payments will be at the back of your mind for the next 30 years.

How can you avoid this?

Owning a home should be a pleasurable experience! It is the largest investment in your lifetime, wouldn’t you want to have the peace of mind to enjoy your safe personal/family space? Here’s how to spot a mortgage broker who might get you into this sticky situation.

1. Does not understand your financial needs

Mortgage brokers are representatives who have extensive knowledge of loan packages offered by the various banks. Ideally, a competent mortgage broker ensures that all recommended packages are tailored to your long-term financial goals.

Banks offer loan packages with varying lock in periods, such as 2, 3 or 5 years, respectively. In this period of time, you would be able to enjoy low interest rates as written in the letter of offer with the bank.

However, post lock-in periods, interest rate payables on a monthly basis will differ based on existing board rates that depend on prevailing market conditions.

Beyond rates, it is also very important to understand and compare features that may be useful, if not crucial, to your financial well-being with regards to your mortgage. Features like penalty waivers, interest matching accounts, clawback periods, free switches, subsidies are all important components that may impact the trajectory you have towards reaching your financial goals.

If your mortgage broker does not walk you through these implications and how they may affect you down the road, RUN!

2. Does not go into detail about how loans vary with the economy

There are a handful of important details to take note – Interest rate payable after the lock-in period is just one of the many numbers to look at. In an economic upcycle, rising interest rates and consequently, rising board rates may work against you.

Assuming a 2-year lock-in period of 1.3% p.a from 2019-2020 on a $1 million loan

Year 1 and year 2: 1.3% p.a (fixed)

Year 3: Board rate = 0.6% + spread rate of 1% = 1.6%

From the above worked example, from the 3rd year onwards, you will be paying an additional 0.3% up from the previous year. On a $1 million dollar loan, this is an equivalent of an additional $3,000 spent on interest in that single year. If you are not made aware on time, this could leave you stressed and unprepared! These cost differences add up significantly over time, so be on guard if your mortgage broker fails to mention this!

3. Rushes to close the deal and… disappears

Real estate market conditions vary according to many economic and regulatory factors, and this affects the financing of your loan. Given that the average loan tenure extends anywhere between 10 to 30 years, an agent who is not keen on staying for the long term will definitely NOT be able to advise you on your life-changing situations like refinancing.

New and independent brokers are unable to provide clients any seamless nor pleasant transition nor timely advice as there is uncertainty how long they stay in business. If the company does not have a dedicated team of hand-picked mortgage brokers who have gone through rigorous training to be equipped with both the technical knowledge and the experience in navigating the real estate market cycles, you better think twice before signing anything.

4. Does not have strong bargaining power

Let’s face it. Size matters.

Low-volume independent mortgage brokers usually do not enjoy preferential rates and the vast resources that a broker from a high-volume company often benefit from.

5. No professional training on underwriting policies

Perhaps you have already heard of the tightening of regulations in the real estate market such as a Total Debt Servicing Ratio (TDSR) of 55% and a Mortgage Servicing Ratio (MSR) ceiling of 30%. However, did you know that different banks compute and offer differing loan capacities, despite these seemingly “fixed” rules?

If your mortgage broker is not aware of the varying underwriting and technical definitions used by each financial institution, and the impact of your liabilities on the total loan sum, you can be certain he has not had the necessary exposure!

Why do you take your chances on greater transparency?

6. Little reviews online

When you shop on e-commerce platforms like Lazada and Shopee, besides price, what is the next thing you will check before making the purchase?

Reviews – good reviews, detailing how well the product had worked for its purpose.

Ratings – star ratings, indicating how happy customers with their purchase.

Similarly, when you are looking for a service/advice, you should be looking out for reviews of the company or mortgage broker you before engaging their services.

When a company has little to none reviews on their service, it goes to show there may be little to no quality of advice or service to be expected.

Reviews or testimonials should be extracted from social media platforms such as Facebook and Google. It is important to check for recent reviews from social media platforms as they are good indicators of quality/service rendered by the company and mortgage advisor.

7. Dangles vouchers to entice you

Like many businesses, mortgage brokers sometimes offer incentives and shopping vouchers to induce clients to transact the mortgage through them. If your mortgage broker sells you an “opportunity of a lifetime” without a long-term assessment, stay on high alert!

In a released statement by the Monetary Authority of Singapore (MAS) under section 2.2.18, “Given that customers rely on the information and recommendation provided by representatives to decide whether to make a purchase, it is important that representatives provide accurate product information and sound advice that will allow customers to make informed decisions. Financial institutions should ensure that their representatives do not actively promote or draw customers’ Guidelines on ⁸Standards of Conduct for Marketing and Distribution Activities 17 attention to the gifts being offered as this may influence customers to purchase a financial product or service which does not meet their needs or which they do not need”.

Imagine, you are in dilemma between different packages proposed by 2 different mortgage brokers, A and B. You decided to choose mortgage broker B because he offered you $2000 worth of shopping vouchers. 6 months later, you realized that the package signed with mortgage broker B was actually not beneficial and not aligned with your long-term goals at all. Alas, it’s all too late as documents has all been in effect.

When you finally get in touch with mortgage broker B, you can expect to hear this, “I have already given you $2000 shopping vouchers, what more do you want?”

Giving vouchers disguises his/her ability to give proper advice. Dangling vouchers create a fog to reduce your ability of judgement and tempts you with temporary gratification. By accepting vouchers, you are being induced to make that decision with the mortgage broker and that rushed decision may have you perpetually fearful of the consequences.

Accepting poor advice is more expensive than whatever vouchers you can receive. By accepting the vouchers, you are essentially giving up your rights to get what you rightfully deserve – professional advice and obligations owed to you.

8. No digital security measures to safeguard your personal information

To begin the process of your loan application, there is a significant amount of important information that you will be handing over to the mortgage broker – your salary slip, your identification number, your CPF statement, your mailing address, your mobile number, the list goes on.

Now imagine if the information gets lost in the digital world when the mortgage broker “accidentally” exposes your personal information online, the potential danger that you will be putting yourself into – call scams, online identify theft, phishing attacks via emails, etc.

Usually small and young startups hardly have the financial ability to adopt strong digital security measures to manage the amount of personal information.

Therefore, it is immensely critical to ensure your personal information is securely encrypted so that you have the assurance that your data and confidentiality is handled safely in compliance with the Personal Data Protection Act (PDPA).

What you need to know in your next search of a mortgage broker

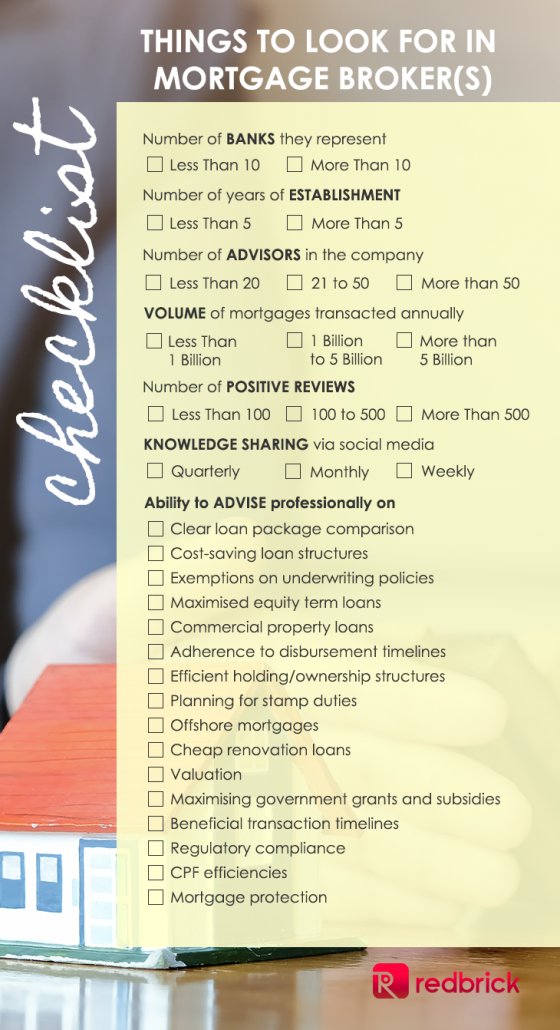

Here is a reference checklist when you search for your next mortgage broker.

Redbrick Mortgage Advisory has taken on the duty of preventing new homeowners from facing this very real phenomenon.

Our advisors have access to all 16 banks in Singapore and able to provide updated rate comparisons alongside with package details.

Our promise to our clients is a seamless, pleasant transition and year-round support.

Our confidence is founded on a dedicated team of over 80 hand-picked mortgage brokers who have both the technical knowledge and the experience in navigating the real estate market cycles.

Our advisors have built strong relationships with all banks in Singapore.

We are, therefore, equipped with knowledge on the underwriting policies for each bank, which should be maximized for your journey of real estate financing! Now, you know who to trust and look for with regards to mortgage financing.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!