Thinking of valuing your home, but unsure about how to do it? There are 3 different methods you can use to value your home – Residual Method, Income Method and Direct Comparison Method. In this article, we will be focusing on the residual method of valuation.

Valuation is not only limited to buildings or houses! Oftentimes, we forget about the land itself. Valuation can be done on the land, and the best method to use to value the land is the Residual Method.

What Is Valuation?

Property valuation, simply put, is the process of estimating the value of a property as of a specific date, based on several factors, including location, size, amenities and condition, amongst others.

Valuation is usually done by a professional surveyor, known as a valuer, who will produce a valuation report. This valuation report will tell you an estimate of what the property is worth, and is extremely helpful for both buyers and sellers, as you will know if your property is over or undervalued.

What Is The Residual Method?

The Residual valuation method is typically used by developers that are interested in buying land and is looking at forecasting a project. It is a method used to assess the value of a development site or land that has the potential to be developed or redeveloped, as well as a property with potential for upgrading.

It assumes the highest and best use of a site. Developers often use this method as its starting point when deciding on whether or not to invest in the land. Through the residual valuation method, developers will be able to receive an estimate of the current market price, and thus determine if they can afford the piece of land.

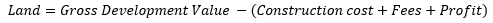

However, daunting it might sound, this method of valuation is in actual fact, very simple and easy to calculate. In simple terms, you determine the realistic value for the land, and deduct other expenditure components to find out if you will be able to profit from the project.

The Residual Valuation Method Is Calculated As Such:

What Do These Terms Mean?

– Land

This refers to the cost of acquiring the piece of land. This is the largest component of the property and can be found on the URA website. However, as HDB site land costs are not released, you cannot apply this method of valuation to HDB sites.

– Gross Development Value

The Gross Development Value, GDV in short, refers to the projected market value made by a valuer, of a proposed development that will be built on the land parcel once it is fully completed. This is one of the most important components of the equation.

A slight error or miscalculation can have huge impact on the financial projections of the land, thus developers will often seek the opinion of two to three professionals to ensure the forecasted GDV is as accurate as possible.

To calculate the GDV, the income, profits or direct comparison method is often used to determine its market rate.

– Construction Cost and Fees

This includes all the building and construction costs related to site works. This includes site preparation costs, labour costs (i.e. architects, consultants, quantity surveyors), material fees and building insurances.

Estimates of the construction costs are usually obtained from quantity surveyors or published documents.

At this point, stamp duties, legal fees and property taxes should also be taken into consideration.

– Profit:

This refers to the reward developers expect for undertaking a risky project. Though this is just an estimate, it is important for developers to forecast their profit and establish their rate of return. The industry standard profit margin falls between 10% to 15% of the GDV.

Here Is An Example Of How The Residual Method Is Used

A developer is deciding on whether or not to bid for a piece of land in Tanjong. In order to deduce the value of this plot of land, firstly, the GDV of surrounding properties should be checked.

The table below shows the costs of components.

| Cost | |

| Gross Development Value (GDV) | $70,000,000 |

| Construction Costs (i.e. Labour and Material Costs) | $30,000,000 |

| Professional Fees (7% of construction costs) | 7% x $30,000,000 = $2,100,000 |

| Developer’s Profit (10% of GDV) | $7,000,000 |

| Expected Land Value | $30,900,000 |

This shows that the maximum a developer should pay for this piece of land is $30,900,000.

Of course, the Residual Valuation method has its weaknesses too. Firstly, estimating costs are easier said than done. Construction costs may suddenly increase due to sudden situations, such as the Covid-19 outbreak and lockdowns, causing land value to fall. Furthermore, the time value of money is not considered. This may have a sizeable impact, as development of properties can take a long period of time.

Lastly, remember that every developer’s risk appetite is different. Some may be more eager for high risk, high return projects, whereas others may rather invest in a stable but profitable project. As we can see, the residual valuation method is a relatively straightforward, and easy method in valuing land. However, it is important for you to consider not just the best scenarios. But also the worst scenario that can occur before jumping into investing in a project.

Most importantly, managing your finances is the key to a successful land investment, so make sure you consider the different factors and financing options available to you.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!