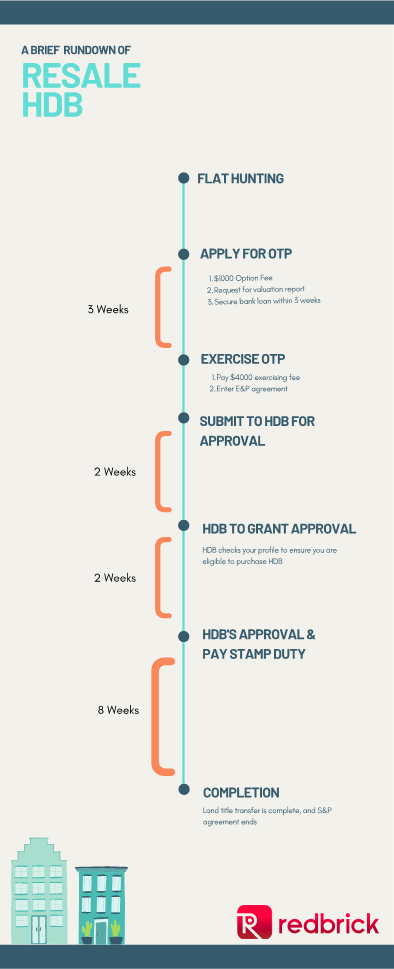

So you have finally found the perfect unit of your dreams – now how do you go about purchasing it? Unlike Build-To-Order (BTO) which you liaise directly with Housing Development Board (HDB), buying resale flats could be more complicated as HDB would not be present to guide you through the process. If you have been struggling with the process of purchasing a resale HDB, this 6-step guide might be just what you need.

BEFORE PURCHASING

1. CHECK YOUR ELIGIBILITY

Like most public housing systems, only Singaporeans and Permanent Residents (PRs) can own a HDB. To do so, you may apply for an Intent To Buy on HDB Resale Portal. To get a better view, a variety of schemes are available on the HDB site here, which includes options for purchasing with a family nucleus, or having multiple single individuals to jointly purchase a HDB.

2. MAP YOUR FINANCES

Another major factor would be financing the HDB Resale flat.

Based on your current income, you could get a rough gauge of the bank loans available to you using this article. Aside from the cost of the apartment, don’t forget the furnishing costs and renovation costs! They could add another few thousands to your budget. With these numbers worked out, they may paint a better picture of the price range for your house.

As further articulated in the article, you only have 3 weeks to exercise your OTP which may be insufficient for you to check the most suitable loan options on the market. Additionally, you also need to consider the grants available to you and decide whether you prefer a loan from HDB or a private bank. Hence, it would be wise to apply for an In-Principle Approval (IPA) or HDB Loan Eligibility (HLE) Letter at this stage, or while you are searching for the perfect property.

An IPA includes the bank’s preliminary assessment of you alongside the loan amount they would offer and is usually valid for 30 days. While it is not legally binding on the bank, it would serve as a useful guide for your financial considerations. In the event you do not apply for an IPA and have trouble securing a loan after signing the OTP, you will have to forfeit your option fee of $1,000 and the seller is now free to sell his apartment to other interested buyers.

On the other hand, if you prefer a lower down payment and stable interest rates, the HDB Concessionary loan may be more suitable for you. Instead of an IPA, you would have to apply for a HLE Letter which is the equivalent to IPA for HDB Concessionary loans.

Since either a valid IPA or HLE Letter is require for prior to signing an OTP for a resale property, it would be prudent to apply for either or both beforehand. It also provides insight for financial structuring that you may need to work around if you would like a higher loan quantum than what you are offered.

STEP 1: FLAT HUNTING

This is possibly the most exhausting step. You will need to hunt for the perfect flat for your needs. Although everyone has different requirements, a rule of thumb would be to consider the remaining length of the lease. Not only would it affect how much you are eligible for under Enhanced Housing Grant (EHG), it also affects the price of the flat if you were to sell it in the future. Flats with only 20 years left on the lease may fetch a lower price and be more difficult to sell.

Additionally, location is another important factor. Aside from the proximity to public transport nodes, it would also be good to consider housing options near your parents or children. Under the Proximity Housing Grant (PHG), you may receive grants of $20,000 if you live within 4km of your parents (as well as meeting other criteria).

Lastly, do take note of the layout of the apartment. While some flats have larger footage, odd spaces may result in more space wastage instead.

STEP 2: OBTAIN AN OTP

Now that you have already found an apartment of your choice, you could apply an OTP. Essentially, it is a legally binding contract with the seller for him/her to keep the offer open to you for a fixed period of time. Until then, the offer cannot be revoked, and the property cannot be sold to another buyer. In exchange, you will have to pay the seller $1,000.

This period usually spans over 2-3 weeks, and following the principle of caveat emptor, buyers take advantage of this period to conduct legal checks on the property title before exercising the option. This means that your lawyers will be investigating the title by writing to the various government agencies and conducting checks on the legal title and ensure there are no encumbrances on the title. For instance, if the seller has mortgaged the property to OCBC and filing for bankruptcy, the property may belong to OCBC instead of the seller. It is crucial that your lawyer does their due diligence to ensure that the conveyancing of the title would be the entire interest, as such legalities cannot be detected through house viewing.

You should also secure your bank loan during this period in accordance to the sum.

STEP 3: EXERCISE OTP

Upon exercising the OTP and paying the $4,000 exercise fee, buyers can lodge a caveat on the property title. Since your interest as a buyer would be reflected on the property title, it is important to prevent the seller from re-issuing the OTP.

Concurrently, the buyer and seller enter into a Sale & Purchase (S&P) agreement for the transaction of the house. Roughly 6-8 weeks will pass between now till the completion of the contract, as your lawyers continue with the legal requisitions to ensure an equitable land title.

STEP 4: SUBMIT TO HDB FOR APPROVAL

Buyers will also have to submit their exercised OTP to HDB for approval. Aside from ensuring that you have met the citizenship requirements, it is also important to achieve other quotas such as EIP and SRP.

STEP 5: PAY STAMP DUTY

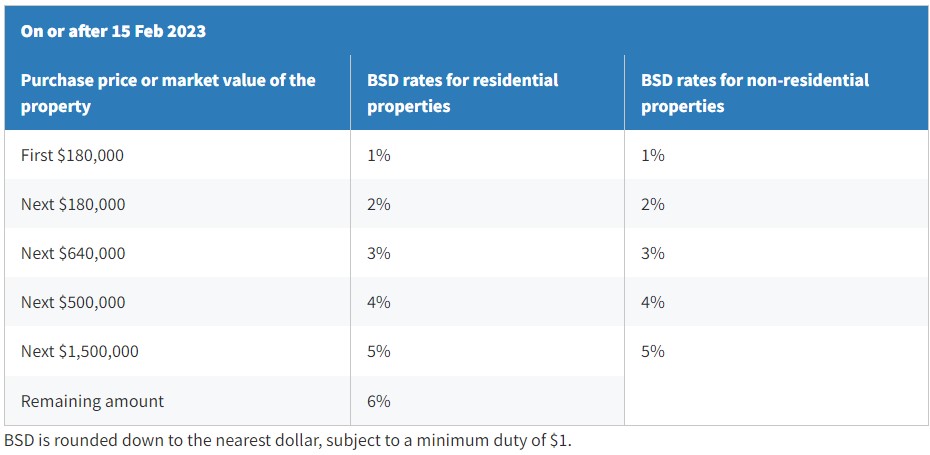

It takes HDB approximately 2 weeks to approve of the application. Over this period, HDB may conduct technical inspections on the property, and you would have to endorse documents on the HDB website. Don’t worry, HDB would notify you via SMS. Concurrently, both you and the seller would need to pay conveyancing fees alongside Buyer Stamp Duty, which can be calculated using IRAS Stamp Duty Calculator.

STEP 6: COMPLETION

Typically 8 weeks after HDB approves of the resale application, your name would be reflected as the legal owner of the new HDB flat.

Congratulations on acquiring a new home!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!