Did you just purchase your first HDB flat? Buying a HDB flat is not cheap, and many of us would therefore take up an affordable home loan from either the bank or HDB.

However, as many of us know, the interest rates for bank loans have recently risen. So, which should I choose between a bank loan and a HDB loan?

We would be going through the differences between bank loans and HDB loans. At the same time, we will also discuss frequently asked questions about them.

HDB Loan

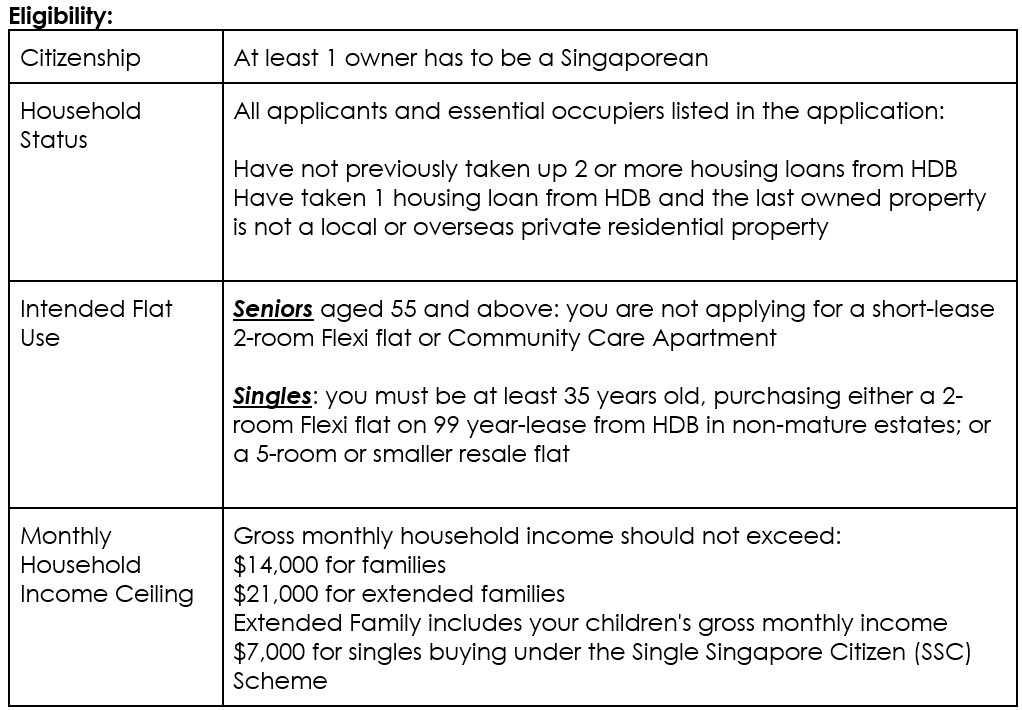

Eligibility:

Can I take up a HDB Loan if I have an interest in another property in Singapore or overseas?

If one of your co-owners own or have an interest in any local or overseas private residential property, you will not be able to take a HDB Loan.

Bank Loan

Also known as a home loan, you can choose a bank loan to finance your property. Each bank has their own eligibility criteria. This could include loan quantum, minimum monthly income and residency status, among others.

Do note that if you have a variable income or are self-employed, the bank will implement a haircut of 30% to your income. This means that your Total Debt Servicing Ratio (TDSR) will be affected. Therefore, allowing you to borrow less than you could have with a fixed income.

It is generally harder to get an (affordable) home loan if you do not have a fixed income. However, as long as you can demonstrate your ability to service your monthly instalments, lenders are generally willing to grant you a home loan.

There are many banks that offer affordable home loans. So, make sure you do your research to find the one that offers the best affordable home loans before committing to one of them!

How much down payment am I required to pay?

If you have taken a bank loan, you are required to pay 25% of the purchase price of your unit, of which 5% should be fully paid in cash. HDB loans, on the other hand, will require a 20% down payment, of which can be paid by either your CPF Ordinary Account or cash.

Affordable Home Loans – Which is the more stable option?

HDB Housing Loans are concessionary, pegged at 0.1% above the current CPF Ordinary Account (OA) interest rate. Currently, this stands at 2.60% p.a.. Bank loans, however, are more unstable in that they differ according to market situations. On 5th October 2022, the fixed home loan rates hit a high of 3.85%.

This is the highest interest rates have been in a long time, a result of the rising interest rate environment. DBS’ new fixed home loan package offers its clients a two, three, four, and five-year fixed rate package, at a rate of 3.5% per annum. As compared to previous packages offered by DBS, this is 0.75 percentage points higher.

How much loan I can take?

For HDB Loans, the maximum amount a flat buyer can take up is up to 80% of the flat’s purchase price for new flats and up to 80% of the lower of the resale price and value for resale HDB flats. If you have taken a bank loan, the maximum loan quantum you can take is 75%.

On the other hand, if you plan to use CPF to pay your HDB loan, the amount of CPF you can use is dependent on the extent of the remaining lease that can cover the youngest buyer to the age of 95. If the remaining lease of the property at the point of purchase (i.e. flat application date for HDBs, and either the Option to Purchase or Sale & Purchase Date for private property and ECs) is at least 20 years and can cover the youngest buyer till the age of 95, you can use CPF to pay for the property up to the valuation limit. However, if that is not the case, your use of CPF will be pro-rated.

The online CPF Board calculator is a handy tool for you to determine your allowable CPF usage.

Am I subject to any penalties if I were to terminate my loan?

Depending on the bank loan you have chosen, if you were to terminate your loan before the end of your lock-in period, you are subject to penalties. This is usually 0.75% to 1.5% of your loan amount. This may differ for different banks, so make sure you ask your bank clearly before taking an affordable home loan from them!

On the contrary, if you take an HDB loan and wish to prepay, you will not be subject to any penalties. Do take note, however, that once you decide to refinance your HDB loan with a bank, you will not be able to take an HDB loan again.

Does credit score matter?

Regardless of whether you are applying for a bank loan or HDB loan, credit scores are extremely important. Your credit score indicates the likelihood for you to default on your payments. Before financial institutions decide on whether or not to lend to you, they will refer to your credit report to weigh their willingness. Naturally, if you have a low credit score, it is likely for banks to grant you a lower loan amount.

However, even if you do not have an excellent credit score now, you can improve it in the future. Your credit score calculation is kept on a 12-month rolling basis, so make sure you repay your loans on time.

Which is better – HDB loan or Bank Loan?

The answer to this question is quite simple – there is not one that is better than the other. At first glance, a HDB loan seems like the better choice. On assumption that you will benefit from the lower interest rates (given that interest rates have been rising).

Depending on your risk appetite, HDB loans might be more suitable if you are more risk averse. However, if you are more of a risk-taker, is confident in the market conditions, and are not financially strained, bank loans may be the better choice for you as ultimately, it may be the cheaper option. Therefore, it is even more important to research before committing to one of them!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!