Singaporeans are no stranger to taxes, more so taxes on owning properties in this land-scarce nation. In a previous article, we covered property tax, the recurring annual tax on the ownership of a property.

Today, we will explore Buyer Stamp Duties (BSD) and Additional Buyer Stamp Duties (ABSD) for residential properties in Singapore so that you will be equipped with the knowledge of calculating the true cost of purchasing your next dream home.

What is a stamp duty?

A stamp duty is a tax imposed on the documents which record the transactions, as opposed to a tax on the actual transaction. Stamp duties are typically payable on all transactions relating to real estate, even when it regards a sale of partial interest.

Stamp duties are used to tamp down on the volatility of the private residential and industrial property market, with seller stamp duties introduced in 2010. This discourages flipping of properties for capital gains over a short holding period, and curbs rapid price escalation arising from speculative real estate transactions.

The result is a real estate market where the demand from genuine buyers is reflected in the property’s price, without raising property prices to exorbitant levels. Furthermore, longer holding periods are encouraged, which prevents the overheating of the property market.

How are stamp duties calculated?

Stamp duties are calculated based on the actual price paid for the property, or the open market value, whichever is higher. This means that one cannot circumvent paying a stamp duty by buying a property priced at a nominal sum of $1.

For lease and tenancy agreements, the stamp duties are calculated on the actual rent charged on the property or the open market rent, whichever is higher. Without getting into too much detail, total rent (which includes the rent for premises, furniture, maintenance etc) is taken into consideration for the calculation of stamp duty.

Broadly speaking, BSD applies to all residential real estate transactions, while ABSD applies dependent on the profile of the purchaser.

Buyer Stamp Duty

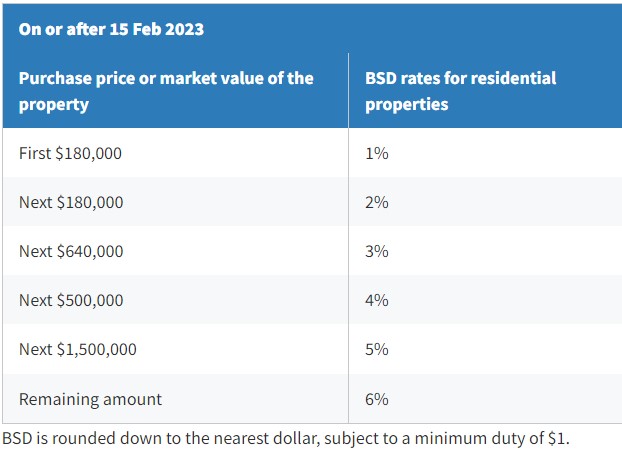

Prior to Feb 2023, the maximum BSD payable on a residential property was 4% but has since been updated to 6%.

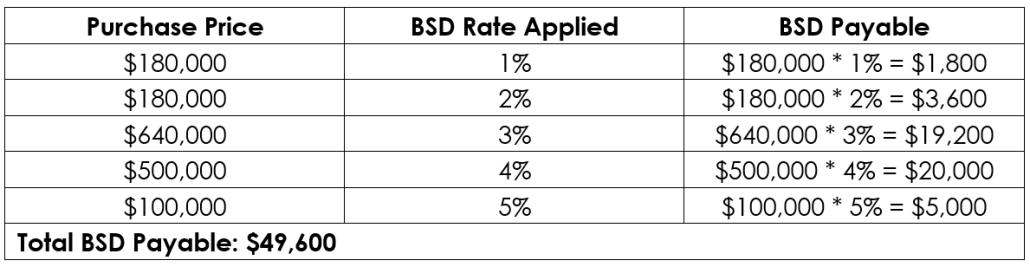

Here is an example of how to calculate your buyer stamp duty based on a property which transacted at a price of $1,600,000. Do keep in mind that each stratum charges an incrementally higher BSD rate. This is opposed to simply falling into a higher bracket and being charged a higher flat rate.

Additional Buyer Stamp Duty

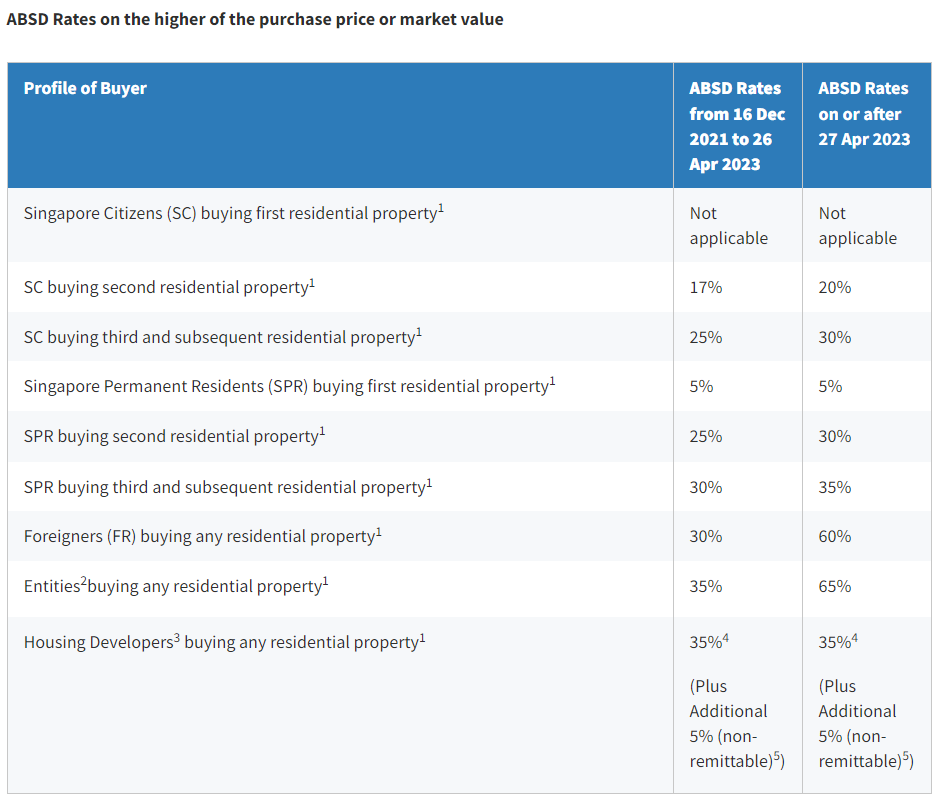

While the BSD applies to all buyers within the market, the Additional Buyer Stamp Duty (ABSD) is applied to further curtail volatility in the local real estate market. They are applied to the following groups:

- Singaporean Citizens making second and subsequent residential property purchases

- Singapore Permanent Residents

- Foreigners

- Entities

This prevents property hoarding and speculation within the market, while keeping property prices affordable for Singaporeans who wish to find a property to actually live in.

Throughout 2020-2021, low interest rates arising from measures to combat the impact of COVID-19 also resulted in a large number of property transactions.

On 15 Dec 2021, the Government announced a change in ABSD rates to cool private residential and HDB resale markets. The following changes are reflected below.

Thinking of circumventing higher ABSD rates on your second property purchase through using an entity? Tough luck.

Entities refer to:

– An unincorporated association

– A trustee for a collective investment scheme when acting in that capacity

– A trustee-manager for a business trust when acting in that capacity

– The partners of the partnership whether or not any of them is an individual, where the property conveyed, transferred or assigned is to be held as partnership property

Furthermore, as long as an individual owns any interest in a property, that property will be included in the number of “properties owned”. If you wish to purchase a property with your spouse, the profile that commands the higher ABSD will be used.

If you already own 1 property but your spouse does not, the ABSD charged on your joint purchase will be that of a Singaporean Citizen buying their 2nd residential property.

What about en-bloc purchases? Could it be possible for me to purchase all properties individually to be considered under a lower ABSD bracket instead of purchasing them collectively and paying a higher rate?

Hold your horses, aspiring developer. Stamp duties apply to the total purchase price of multiple properties if there is a single contract for the purchase of multiple properties, or if the purchases of multiple properties are dependent and conditional on one another (i.e. purchase all or none situation).

Recall that a stamp duty is not a tax on the property transacted, but on the documentation of the transaction. Therefore, such an arrangement to circumvent higher ABSDs would not be possible.

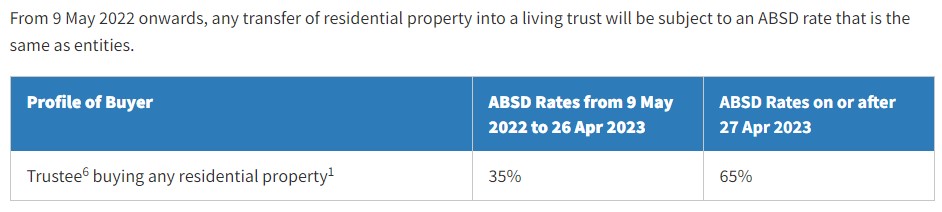

What if I am purchasing a residential property to be held on trust for a beneficial owner?

Intuitively, the ABSD will be charged on the rate applicable to the beneficial owner.

Exceptions to ABSD charge

These are not exceptions per se but rather technicalities that some potential buyers may be unaware of.

If you have contracted to sell your existing residential property before signing the option to purchase for the next property, you would not be required to pay the ABSD. In this scenario, the intention is not to hold more than 1 property and therefore, the ABSD will not be applied.

Furthermore, although foreigners and permanent residents are required to pay a significantly higher ABSD, if they do marry a Singaporean and do not own any residential property, they will not be subject to ABSD.

Conclusion on Stamp Duties

BSD and ABSD adds to the cost of purchasing a property. Although it is non-recurring unlike property taxes, it is important to take these added costs into consideration while planning the next step in your real estate journey. Do reach out to any of our friendly mortgage advisors to gain a better understanding of all the costs involved, and how you can optimise the financing for your next property purchase.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!