Several have testified to increasing tensions between family members during the lockdown phase, with everyone trapped at home with nowhere to go apart from the supermarket nearby. If you are the lucky few with strong family ties, a dual-key unit might just be your best home option to consider next!

Dual-key homes remain a relatively new housing concept to Singapore which started back in 2009 beginning with Caspian by Fraser Centrepoint Homes but have gained tremendous popularity given the various upsides and benefits that they bring.

While you probably have heard the praises of dual-key units being ‘rental-friendly’ offering plenty of privacy between housemates, are you aware of the potential cons of owning one? In this article, we will look into what owning a dual-key unit really entails and whether it is truly a worthwhile 2-for-1 deal.

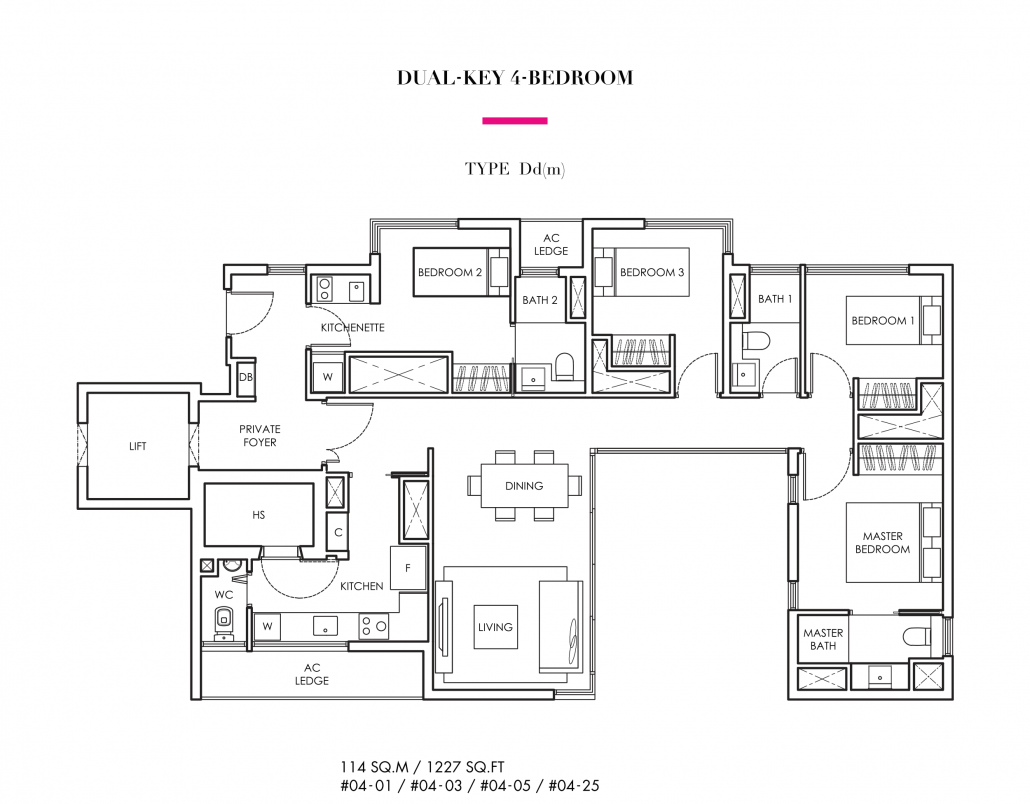

Before we begin, some might not have ever heard of dual-key units! Essentially, dual-key units have two separate living spaces (each having its own toilet, kitchen, bedroom, and balcony) while sharing a single address, living hall and foyer. A dual-key unit is usually larger than its regular private condominium counterpart by a difference in floor area between 3-5%, although they may have the same number of rooms. Such units serve multi-generational families that are interested in living together without compromising on each family unit’s privacy, or as a suitable investment unit that can service two main tenants at the same time in one single apartment.

Let’s look at what makes dual-key units an attractive choice in the market and the benefits that comes along with it.

Bulk is always cheaper than a standalone purchase

Because dual-key units allow for clearer division of the land use, landlords are able demarcate a sub-unit from the main. Apart from the benefit of greater privacy between landlord and tenant, it is found that on average, a sub-unit of the same size fetches a higher per square foot rental yield overall than a similar-sized standalone rental studio unit in a private condominium.

Logically, it makes complete sense because a ‘bulk purchase’ of the dual-key unit would have an overall lower average cost per square foot, a cost saving in which landlords can pass on to tenants. On the other hand, private studio condominiums bought as ‘ala-carte’ tend to have significantly higher cost per square foot due to maintenance amongst other costs.

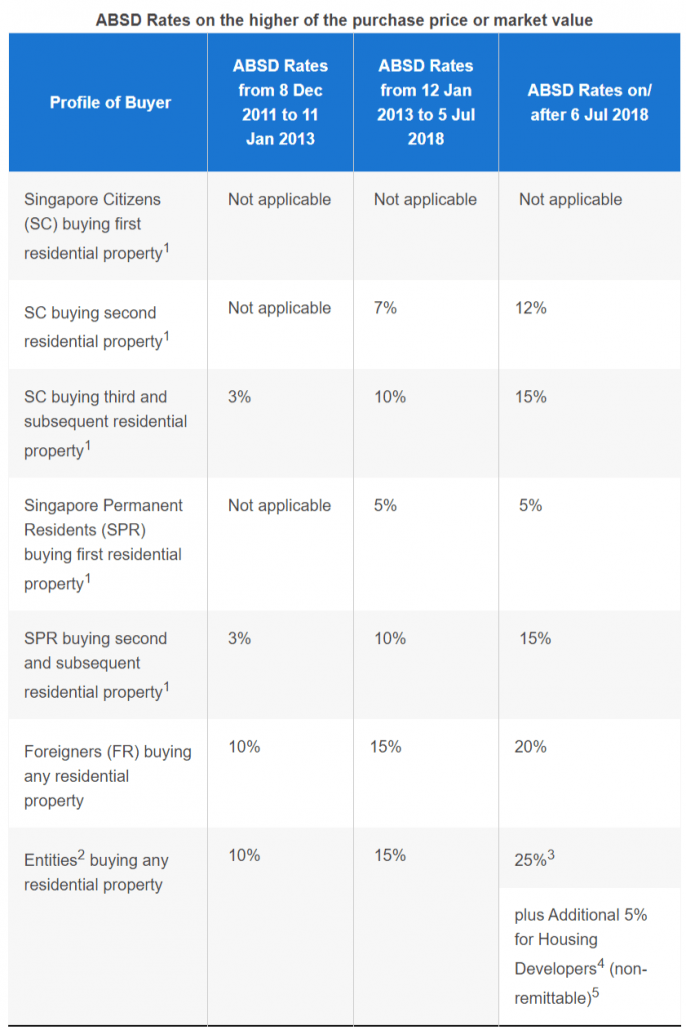

Not subjected to additional stamp duties payable

If you are looking to get a dual-key unit as your matrimonial home with investment as a secondary purpose, you will not be subjected to Additional Buyer Stamp Duties (ABSD) if this is your first property purchase. If it is, ABSD can go up to 15% of the property price for Singaporean citizens, and 20% for foreigners. A dual-key unit can also cater to the needs of 2 standalone condominium units combined. Let us put things into perspective for you with a case study:

Assuming you have a budget of $2million, and two options stand before you. Option A would be to purchase 2 separate condominium studio apartments, each going for $1 million, and Option B would be to purchase a luxury dual-key unit. Let us assume option A as your choice and what the financials will be like.

Using the ABSD table above, the first condominium purchase will not be subjected to ABSD. The second property, as it is purchased after 6 July 2018, will be subjected to 12% ABSD on the purchase price. Assuming the property is purchased at $1 million, the ABSD payable will be $120,000. Hence, the total cost of acquiring two properties alone would require $2.12 million.

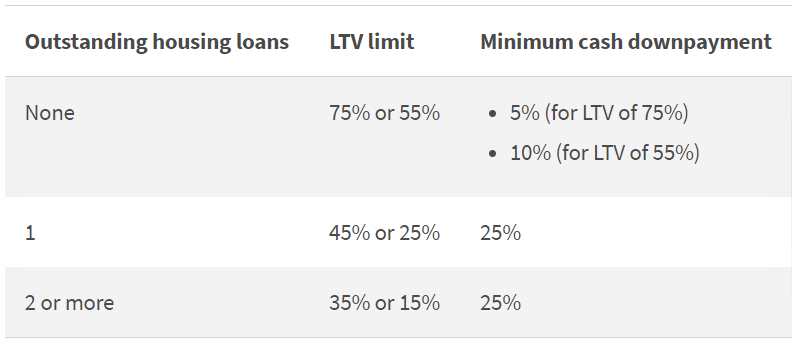

Factoring the Loan-to-Value (LTV), for the first mortgage, you can get 75% loan. If you already have 1 mortgage, the LTV for the second unit will be capped at 45% max, with mandatory cash outlay at 25%. Also, you will need to be aware of the amount of CPF used; if CPF has been used on the first property, you would have to maintain the Basic Retirement Sum (BRS) in your CPF account, and only anything in excess of that can then be used. So, there will be a significant amount of cash outlay required.

On the other hand, if you had decided to go with Option B, a budget of $2 million could likely land you a dual-key unit in a decently prime location at $1.8 million, without being subjected to ABSD payable! Now comes the not-too-pleasant part, the cons of owning a dual-key unit.

Greater difficulty when disposing property

Dual-key units are usually bought primarily by families with the intention of living with an extended family unit, i.e., parents, whilst still having their personal space. There will also be families who choose to stay in the unit and rent out the other unit as a source of rental income.

Owners of dual-key units belongs to a niche market and if you do intend to make changes to your property portfolio after acquiring a dual-key unit, it may not be that straightforward.

One disadvantage of dual-key condominiums is that they may be more difficult to sell in the future. As dual-key condo apartments are often built for multi-generational living, your target audience for selling the unit will be focused on specific demographic profiles in the market. As a result, finding a buyer for your dual-key condo apartment may not be easy.

With Singaporeans choosing to start families later and a preference for smaller household sizes, dual-key units may not appeal to the majority. Especially so if there is no intention to rent out a sub-unit or have one’s parents move in together. For a young couple with 2 children, having to pay for extra space such as an unused kitchen is a huge no-no.

Dual-key units are tailored to the needs of a niche market. This can be proven to be a negative point in times of financial duress, where a sale has to be conducted at the soonest. Because it is a niche-type property, more time is required to source for buyers. Unfortunately, in times of uncertainty, time is not on the owner’s side, which would likely result in the owner stomaching a potential loss for the unit.

Potentially higher priced per square feet

When the demand for dual-key units surpassed supply, some developers may had charged considerably higher for dual-key flats than for normal condominiums with the same number of bedrooms. During those times, dual-key units could command premiums ranging from 16% to 25%. Hence, it is important to factor the financials when considering purchasing a dual-key unit.

In Summary

Developers are still apprehensive about building mass numbers of dual-key units at one go, because market demand seems uncertain in the further future with a rapidly changing demographic. Having many dual-key units in a single development can be a double-edged sword, with the possibility of vacant dual-key units if the demand is not strong. As such, developers have adopted the strategy of selling the units as a single unit, for example, a 3 bedder, whilst optimizing the layout such that it can be converted into a dual-key unit in future, thereby leaving the option to the consumers.

The Housing Development Board (HDB) has also adopted the concept of a dual-key unit, launching their very own version named the “3Gen Flats” in the hopes of encouraging inter-generational living and support. With Singapore heading towards an ageing population in the coming years ahead, we can expect to see more of such flats popping up. Would you buy a dual-key unit yourself?

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!