Districts and Regions in Singapore

Assessing property locations? Have you ever wondered how districts and regions in Singapore are divided? Though we are a small nation state, Singapore is divided into 28 districts and 5 regions. The 5 regions subdivided by the Urban Redevelopment Authority (“URA”) are: Central, East, North-East, North, and West.

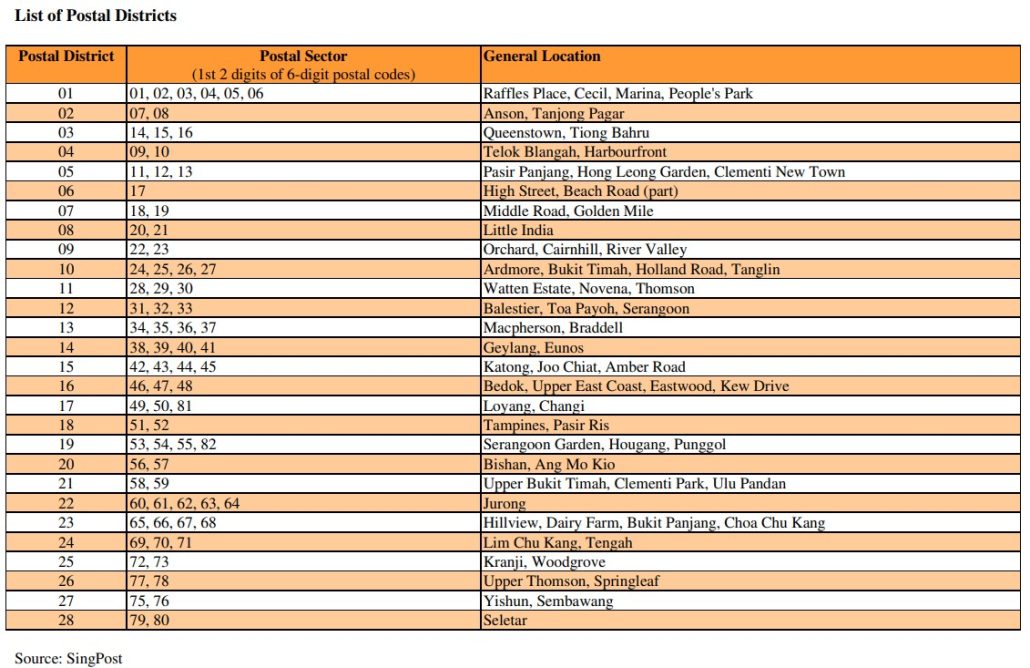

These regions cover a total of 55 planning areas which come with their own detailed development guide! Districts on the other hand are derived from postal districts, hence you may be in a different planning area and district within the same street due to this slight distinction. The corresponding locations to the 28 districts can be found below:

Many of you will then ask: Which of the districts and regions in Singapore are hotspots for property investment? Based on the latest (2Q 2023) median resale prices of HDB flats, the top 5 areas with the highest year-on-year (“y-o-y”) growth for prices are; Sembawang, Bukit Merah, Tampines, Woodlands, and Punggol.

The median prices for 3 rooms to 5 rooms have increased on average, 8% to 13%, showing growth in that range.For private residential transactions in 2Q 2023, prices increased the most for Outside Central Region and Rest of Central Region.

As we can see from these figures, certain districts gained from the opening of the newest train connection while private property purchases are moving away from the Core Central Region. This is because mature estates are well developed while areas closer to town are seen as prime locations.

Remember that location is always the key to real estate investment! That being said, living beyond the city fringes may not necessarily be worse off than living in areas closer to the Central Business District (“CBD”). Living away from the hustle and bustle, you get more open-air recreational spaces and more purpose-built community facilities to wind down after work.

Factors to consider when choosing a Property Location

Besides housing prices, one should look at other factors e.g. accessibility, amenities and growth potential when considering the location of a property.

Firstly, let’s take a closer look at accessibility. You may ask: why is accessibility important? Well, I am sure none of you would like to take a lengthy amount of time to reach your workplace. Choosing a property, which is situated near expressways and key artery roads, will help to cut travelling time.

Moreover, choosing a property near MRT stations may be something you would want to consider for the convenience of all members of the family. Time saved on travelling is precious time that can be spent on family or leisure instead.

As part of the nation’s effort to go green and car-lite, taking public transport is greatly encouraged. Staying near bus interchanges and MRT stations will help reduce travelling time and increase convenience.

Though shorter travelling time to the CBD has always been seen as a prime factor, this premium is less substantial now as the government is actively developing regional centres and business parks scattered across the nation. Much more of the CBD working crowds would be working in regional hubs with these developments.

Next, let’s talk about amenities. Other than transport, amenities such as: schools, malls, healthcare, sports facilities, parks, and food places are important considerations as well. Staying near your ideal entry primary school for your child increases the chances of getting in! Close proximity to a mall means that you can stroll over to the mall for all your needs within minutes.

Living near healthcare amenities is essential especially for those living with the elderly and young. Waking up to a view of lush greenery from your house helps you to brighten your mood. Who will resist living near your favourite comfort foods or complain having too many choices to decide from?

Lastly, you should consider the growth potential as non-mature neighbourhoods are likely to see larger increases in housing prices once they are better developed. One such neighbourhood is Canberra. With the opening of Canberra MRT station, Canberra Plaza and Bukit Canberra, properties in the vicinity are likely to see an increase in demand.

Furthermore, Canberra is not far away from more mature estates such as Yishun and Woodlands which are well equipped with various amenities. By contrast, mature estates may see slower growth with shorter leaseholds remaining and older amenities.

Areas with more vacant land may have a higher growth potential. This is because the land can be developed into various amenities which increase housing prices. The Master Plan from URA shows the land use of vacant land which is useful for investors in assessing property locations in terms of the growth potential of an area.

Evaluating Property Valuations

Property valuations are heavily influenced by the various Districts and Zones in Singapore. Prime locations have a higher per square foot valuation due to its high demand. Accessibility and distance to various amenities are also factors which would affect housing prices. These property valuations have a direct impact on your mortgage financing so it is essential for you to understand how it works!

Property valuations determine both the amount of CPF that you may use to finance the house and the amount you may borrow from banks and HDB. A valuation limit is determined by the property valuation, which then determines the withdrawal limit. This withdrawal limit refers to the maximum amount you may withdraw from your CPF to finance the property.

The maximum loan you may get is pegged to a fixed loan-to-value ratio limit which is also determined by the property valuation. Knowing how much in the budget for CPF and the loan, will set the stage for how much cash is needed, and often this is the tightest to manage.

Overall, assessing property locations is an important determinant in your property purchasing decision! As housing prices are fluid, it is essential to monitor the developments of the various areas to ensure you maximise your returns. Do not forget to look at the area’s growth potential, accessibility, amenities, and various financing options in deciding which is the best investment that suits your needs and budget!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!