When it comes to buying a home in Singapore, one of the major decisions that you will have to make is the length of your home loan tenure. While some may opt for shorter tenures, such as a 15-year loan, there are many benefits of choosing a longer tenure, such as a 30-year loan.

This does not only affect the monthly installment amount, but also whether you will be required to continue repaying your loans when you turn 60. In this article, we will explore why you should consider opting for a longer home loan tenure in Singapore.

1. Lower Monthly Payments

One of the main benefits of choosing a longer home loan tenure is the lower monthly payments. By spreading the loan amount over a longer period of time, the monthly payments become more manageable, making it easier to afford a home.

When you take out a long-term home loan in Singapore, it’s important to keep in mind that interest rates may change during the loan period. Banks offer two types of home loans: fixed rate loans, where the interest rate stays the same for a certain period of time before it changes, and variable rate loans, where the interest rate is tied to a reference rate.

Consider the scenario whereby interest rates increase: your monthly payments will likely increase as well. Choosing a longer loan tenure can provide you with protection against unexpected increases in interest rates.

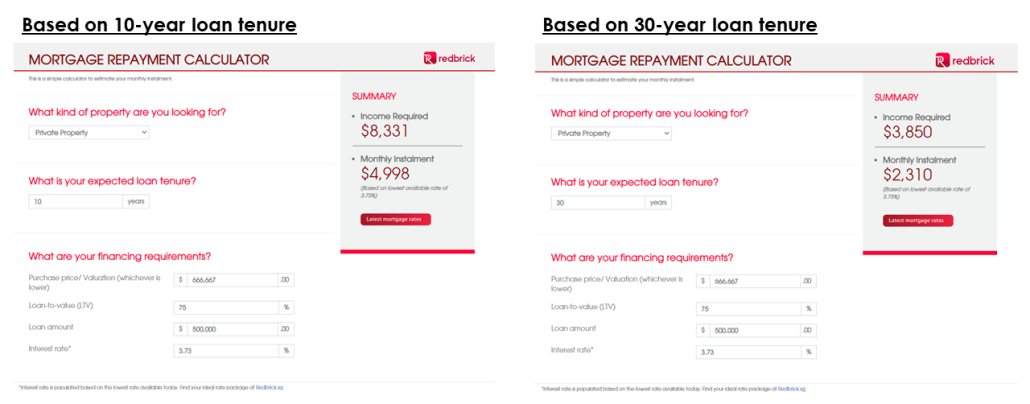

For example, Mr. and Mrs. Ong are taking a mortgage of $500,000, with the lowest available rate of 3.73% today. Using the calculator, if they were set for a loan tenure of 10 years, their monthly payment would be about $5,000 monthly. On the other hand, if they were to pay their loan over 30 years, they would be paying about $2,310 monthly. Despite the mortgage principal amount remaining constant, their monthly mortgage payments became much more manageable. This is particularly helpful if the couple is struggling to make ends meet and must use cash top-ups to pay for their monthly mortgage payments to get by.

Assuming they are taking a bank loan with floating interest rates, if there is a hike in interest rates, it would be much easier for Mr. and Mrs. Ong to cover the additional required mortgage installments if they were on the 30-year loan tenure scheme.

2. Opportunity Cost

Another advantage of choosing a longer home loan tenure is the ability to invest and save more money. With a longer loan tenure, you will have more disposable income each month, which can be used to invest in stocks, mutual funds or other savings vehicles. For stocks, you can invest in companies listed on the Singapore Exchange (SGX) and potentially earn returns through capital appreciation or dividends. Mutual funds, on the other hand, allow you to invest in a diversified portfolio of stocks, bonds or other securities and can offer returns that are higher than the average returns of the underlying securities. Additionally, there are also Real Estate Investment Trusts (REITs) which are also listed on the SGX and can offer annual returns of around 6-8%.

While it is notable that all investments come with its own set of risks, you will still be benefitting from having a longer loan tenure, if these investment options offer you higher returns than the 3% interest rate on your mortgage. Thus, although Mr. and Mrs. Ong are paying higher interest cost of about $258,000 for the loan tenure of 30 years instead of $79,000 for the 10 years tenure, there could be upsides if they plan their finances right. It’s important to remember that while a longer loan tenure means higher interest costs, it also gives you more financial flexibility and the opportunity to invest in other savings vehicles that may offer higher returns.

3. Flexibility Offered by Longer Loan Tenure

A longer home loan tenure allows flexibility in terms of making changes to repayment. It aids in extending time with borrowers to stretch out their repayments in smaller bite size.

Majority of the banks have policies that limit the remaining loan tenure at the point of refinancing. For instance, you may be eligible for a 30 years loan tenure today based on your TDSR, MSR, age and the remaining tenure on your apartment. If you refinance 3 years later, you may only be eligible for 27 years loan tenure regardless of your age and other details. In other words, you can refinance a longer loan tenure to a shorter loan, but not the other way round. If you aren’t quite sure of your ability to repay your monthly loan installments and would rather pay extra payments as and when you prefer, a longer loan tenure might be preferred.

Conclusion

In conclusion, choosing a longer home loan tenure in Singapore, such as a 30-year loan, offers a range of benefits, including lower monthly payments, the ability to invest and save more money, and flexibility in terms of making extra payments or prepaying your loan. While a shorter tenure may be more appealing in the short-term, the long-term benefits of a longer tenure make it a more viable option for those looking to make a long-term investment in a home in Singapore.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!