With effect from 15 February 2023, the Government announced in as part of Budget 2023 that Buyer’s Stamp Duty for both higher-value residential and non-residential properties will be increased. This measure reflects the government’s commitment to ensure affordable housing by enhancing the progressivity of the Buyer’s Stamp Duty regime. Additionally, the revised Buyer’s Stamp Duty regime is estimated to garner an additional $500 million in revenue per year, though the exact revenue will be dependent on the property market.

Buyer’s Stamp Duty is a tax paid on documents signed when you buy or acquire property located in Singapore. Hence, Buyer’s Stamp Duty is an inevitable tax that property buyers will incur when purchasing local properties.

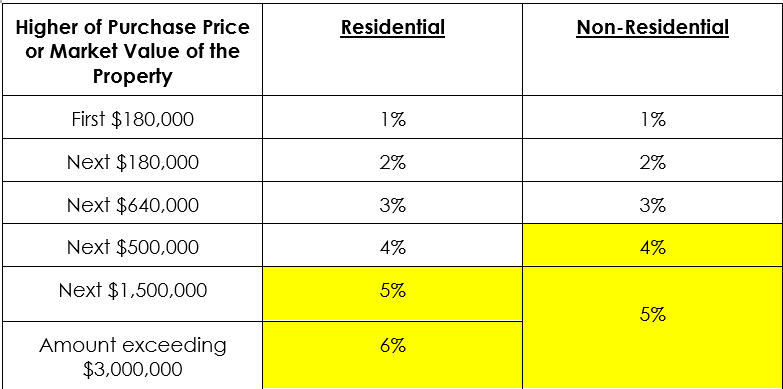

Higher Buyer’s Stamp Duty for higher-value residential and non-residential properties announced in Budget 2023

The government introduced 2 new marginal tax tiers for residential properties as well.

The portion of property value in excess of $1.5 million and up to $3 million, there will be a 5% tax. For the portion of property value in excess of $3 million, there will be a 6% tax. This is an increase from the current Buyer’s Stamp Duty tax rate of 4%.

Deputy Prime Minister Lawrence Wong mentioned that these changes would affect 15% of homes. For property value below $1.5 million, there is no change in Buyer’s Stamp Duty rates. Hence, it is evident that the revised Buyer’s Stamp Duty regime announced in Budget 2023 targets the wealthier assets while ensuring public housing remains affordable.

The government also introduced 2 new marginal tax tiers for non-residential properties as well.

The portion of property value in excess of $1 million and up to $1.5 million, there will be a 4% tax. For the portion of property value in excess of $1.5 million, there will be a 5% tax. This is an increase from the current Buyer’s Stamp Duty tax rate of 3%.

The revised Buyer’s Stamp Duty on non-residential properties would impact more buyers as it is expected to affect 60% of non-residential properties such as industrial or commercial properties.

In summary, with effect from 15 February 2023, property buyers will be affected by the new Buyer’s Stamp Duty rates (highlighted in yellow) as announced in Budget 2023.

Budget 2023 reveals the latest increase in Buyer’s Stamp Duty rates. The previous adjustment to the Buyer’s Stamp Duty regime was in 2018 where the residential Buyer’s Stamp Duty rate was increased from 3% to 4% for the portion of the residential purchase price or market value (whichever higher) exceeds $1 million. In 2018, there were no changes to the Buyer’s Stamp Duty regime for non-residential properties.

Transitional Buyer’s Stamp Duty Provision for affected recent buyers

The Government has provided a transitional provision for properties purchased on or after 15 February 2023 in which the former Buyer’s Stamp Duty rates will apply. This is subjected to approval and is only applicable for cases who fulfill all 3 conditions below:

- The Option to Purchase (OTP) was granted by sellers to potential buyers on or before 14 February 2023

- This OTP is exercised on or before 7 March 2023, or within the OTP validity period, whichever is earlier

- This OTP has not been varied on or after 15 February 2023

The OTP is considered exercised when the Acceptance to OTP or Sale and Purchase Agreement is executed.

The transitional provision is only applicable for residential properties with purchase price or market value (whichever higher) which exceeds $1.5 million. For non-residential properties, the transitional provision is only applicable to those with purchase price or market value (whichever higher) which exceeds $1 million.

Impact of the Property Market with revised Buyer’s Stamp Duty regime

The revised Buyer’s Stamp Duty regime may not significantly affect the residential property market given that it imposes a higher tax rate on wealthier assets. With the increase of Buyer’s Stamp Duty tax rate from 4% to 5% or 6% for homebuyers purchasing properties over $1.5 million or $3 million respectively, it is highly likely that the purchasing power of the wealthy remains strong. Hence, demand for residential properties is likely not to drop because of the revised Buyer’s Stamp Duty regime.

This comes in tandem with the higher property tax imposed at the start of the year 2023. The higher property tax was announced in Budget 2022, which will take effect over 2 years from 2023 with steeper hikes for higher-value residential properties. For example, the property tax on owner-occupier property with an annual value of above $100,000 is increased from 16% to 23%. Whereas for properties that are not occupied by the owner, the tax rate is increased from 20% to 27%. With the steep increase in annual property tax, homebuyers with high-value assets will feel the pressure in the long run. Thus, this will serve as a cooling measure to tamper down the demand from wealthy homebuyers.

The recent revisions to the Buyer’s Stamp Duty regime reveal that the Government is progressively enhancing the regime and with rising inflation, it is possible that one would see higher tax brackets in years to come. With increased Buyer’s Stamp Duty rates, the Government can receive higher tax revenue annually. Nonetheless, Budget 2023 has also revealed stronger housing support from the Government through increased CPF Housing grants.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!