With the current hot property market, the transacted prices of many resale HDBs have become higher than their valuation. This has led to rising Cash Over Valuation (COV). If you are keen to purchase a resale HDB flat with limited funds in the bank, COV is a key item you should keep a lookout for.

What Is Cash Over Valuation (COV)?

As the name suggests , Cash Over Valuation (COV) refers to the difference between your property price and valuation price and can be paid with cash only.

Imagine this – you finally found the perfect HDB Resale flat and negotiated with the seller to the price of $700,000. However, the valuation report from HDB highlighted that HDB values the property at $600,000. The COV would be $700,000 – $600,000 = $100,000. This COV of $100,000 must be paid by cash and cannot be paid using CPF.

What this also means is that your maximum 75% bank loan is taken on your valuation, which is $600,000 instead of $700,000.

75% x $600,000 = $450,000

vs

75% x $700,000 = $525,000

How do we know which property is a COV property?

The problem is you won’t.

In order for you to get the valuation report from HDB, you are required to request for Option to Purchase (OTP) first. This means that you must place a $1,000 option fee beforehand to request for the valuation of the HDB flat.

So, if you don’t have the $100,000 cash to pay COV, you would have to forfeit the $1,000 option fee.

On the bright side, COV is not applicable if the valuation of the property is higher than the transacted property price. This means that if the selling price is $500,000 and the valuated price is $550,000, you would not need to fork out any cash for COV. However, in today’s market, the transaction price for most properties have risen far higher than valuation prices.

It is important to note that COV almost only happens with HDB resale flats, as Built-to-Order (BTO) flats are purchased directly from HDB, so the valuation will almost always be the same as the selling price.

What About My Loan Amount?

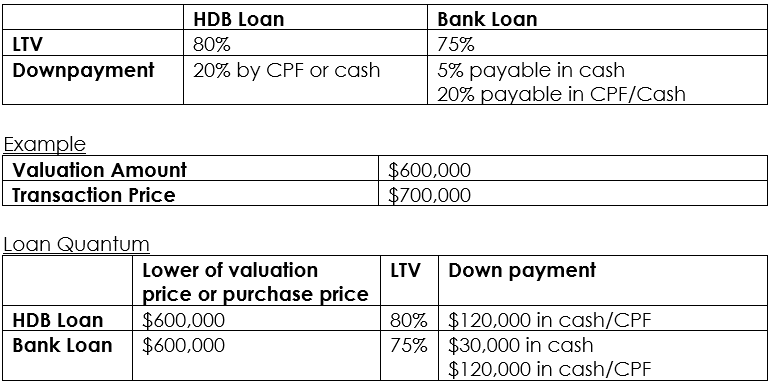

We mentioned this briefly earlier. One key ratio that determines the loan amount is Loan to Value (LTV) which refers to the ratio of the loan to the lower of the valuation price or purchase price.

What About Stamp Duty?

Buyer Stamp Duty is based on the higher of the valuation price or purchase price.

In the example above, Buyer Stamp Duty (BSD) would be based on $700,000.

$600,000 x 3% – 5,400 = $12,600

vs

$700,000 x 3% – $5,400 = $15,600

There is a difference of $3,000.

Can I Avoid Cash Over Valuation?

Unfortunately, no.

However, you could try to gauge the valuation of the property using the following factors. One common valuation method used by IRAS is Direct Comparison Method, in which they reference properties with similar characteristics as basis of comparison and adjust the prices of these comparable properties based on a few key factors. These factors include location, accessibility, amenities, flat condition, size of flats and buyer’s urgency to move.

Key to Determining Property Valuation

1. Location & Accessibility

Proximity to CBD and HDB flats located in mature towns are typically more in demand than others. With high demand, generally means higher pricing.

Accessibility to public transportation also typically fetch higher prices as car ownership is expensive in Singapore with COE taxes. Moreover, BTO flats located right next to MRT Stations are also sold at higher prices.

Thus, it is not surprising that homeowners would seek to recoup their purchase through asking for higher sale prices.

2. Nearby Amenities

One key reason for the HDB flats in mature towns having higher prices is due to the established amenities in the area. Similarly, HDB Flats in mixed-use establishments or located right next to shopping malls also have higher valuation.

Additionally, young families might be willing to pay a high premium to be located closer to acclaimed good schools based on the priority admission balloting system for primary schools.

3. Age of Flat

HDB Flats can only be sold after the Minimum Occupation Period (MOP) which is typically 5 years for existing HDB Resale Flats. Since BTO Flats have 99-year lease, HDB Resale Flats have on a countdown from 94 years of remaining tenure.

As most might predict, properties with shorter remaining tenure would fetch lower prices as owners get to enjoy the HDB flat for a shorter period, and older buildings typically have common areas in deteriorated condition despite upgrading schemes.

Furthermore, remaining tenure affects maximum CPF usage and if you are purchasing the HDB flat in hopes of reselling the property in the future, it is notable that the price of flats decay exponentially once they pass the 60 years mark with remaining tenure (may not be true for all cases).

That being said, older flats might not necessarily mean that the value of the flat is lower. Well-maintained older HDB flats may still fetch handsome prices as prospective buyers get to save on renovations and restorations, but this also depends on whether buyers like the existing renovations.

4. Size of Flat

Larger flats typically fetch higher asking prices despite having lower price per square foot (PSF). Some flat types are more sought after due to scarcity and thus command higher prices, such as maisonettes, DBSS and 3-Gen Flats.

If you’d like to estimate the value of your property, a good way is by looking up the prices of other resale flats in your estate. Check how much they have sold for. This way, you won’t undervalue it, but you also won’t inflate it to an unrealistic amount.

5. Buyer’s Urgency to Move

Some new homeowners might be unwilling to wait for a BTO, which usually takes 3 to 5 years to build. Resale HDB offers buyers an alternative with a shorter timeline , and buyers with urgency might be willing to pay more to expedite the sales process. Thus, if you are a buyer who is urgent to move, transacted prices might be higher than valuation.

Check Past HDB Resale Transaction Data

Aside from the list of aforementioned factors, you may wish to look up the transacted prices of other resale flats in your estate to get a quick estimation of the value of the HDB flat you are interested in.

This would allow you to have a good gauge of the price to prevent undervaluation or inflation of the property price.

Using HDB Resale Portal, you can check for the past transacted prices based on flat types and time period in specific HDB Towns, or Street Name.

Conclusion

All in all, be sure to do your homework on the property value vs your needs and budget.

This can be done by tallying against the various factors and checking the past transacted prices before placing your option fee of $1,000.

Aside from having a better gauge of the cash required to purchase the flat, it would also give you a clearer idea of whether the price agreed with the seller is fair and competitive in the market.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!