While not everyone would become a lawyer in their lifetime, almost every individual would own a property at some point in time. We do not deny how daunting it may be to grasp these terms, but it is crucial for you to have a sufficient level of understanding because these very phrases determine the very value of your property and what you can or cannot do with it.

By grasping the knowledge at your fingertips, the next time you head out for a property hunt, you know exactly what to search for, expect and anticipate without requiring to incur the cost of seeking professional advice. Broaden your knowledge on real estate by reading on!

Before we begin introducing the terms to you, it is crucial for you to first know where to find them. No, they are not found on property listings found on platforms such as 99.CO or Property Guru. Listings on such platforms at most provide the address, size of the unit and the asking price by the current landlord. The place to obtain all the necessary data is to purchase a copy from Singapore Land Authority’s (SLA) website via INLIS.

There, you will find all the necessary information needed on the title of the property in question for a nominal fee. Here is a screenshot of the information type(s) that you can obtain via INLIS:

Just for a quick historical fun fact for those who are interested in how property titles came about. Almost all of Singapore land today comes under the Torrens System otherwise known as the Land Titles Act and is classified as Registered Land. However, in rare occasional plots will you still find unregistered pockets of land that belong under the Registry of Deeds Act (RDA) which is far more complicated and labor intensive to proof a good title.

The Torrens System was introduced in the year 1960, to ensure that all land ownership registered thereafter is traceable and codified in a single system. This hedged against title fraud which was a common problem under the outdated RDA process. So, let’s start learning the legal jargons!

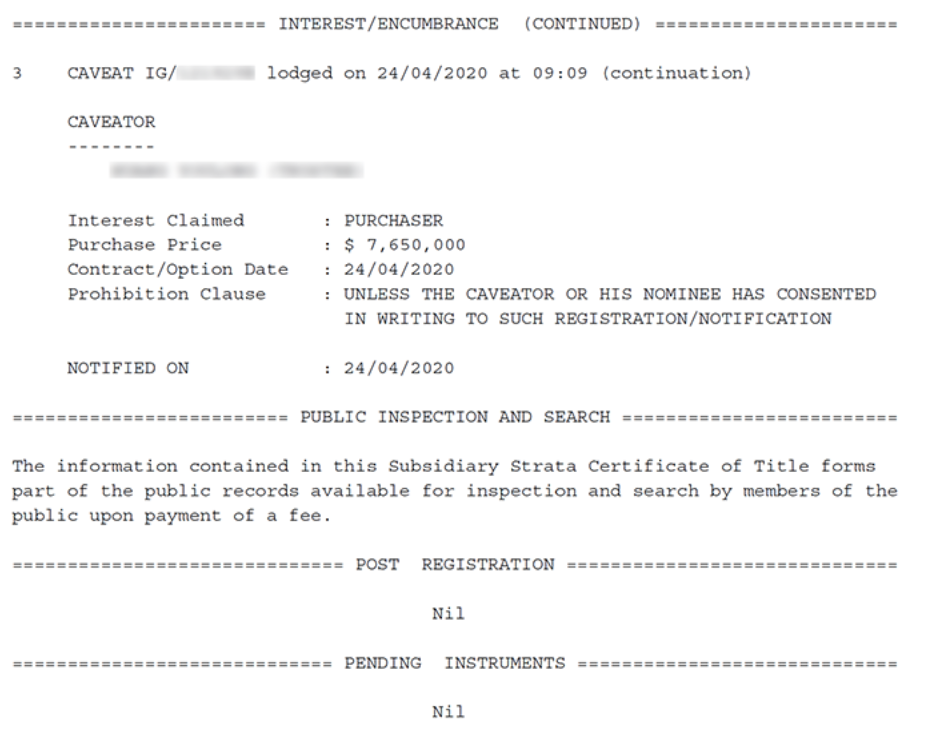

1. Caveats

One of the first few legal terms that you would be posed with is the lodgement of a caveat. A caveat is often lodged upon successful signing of the Option-to-Purchase (OTP), and the eventual exercising of the option within the stipulated period agreed with the seller. Once the Option has been exercised, your conveyancing lawyer will have to move swiftly to lodge a caveat with the SLA.

A caveat ensures that you will have an indefeasible right to the property. In other words, you officially “chope (sic)” the property in your name and no one else can claim the property thereafter. This ensures that the seller is not able to transfer or dispose the property to someone else once the Option has been exercised, protecting your interests as a buyer. In short, caveats are lodged to protect your title against any others who wish to contest their interests in the land. You are also able to fact check for existing caveats to verify and ensure that the owner and property are as accurate as promised, all for a fee of just $5.25 via INLIS.

2. Easements

Easements is a term less seen by the public, but simply put “one man’s right of way over another man’s land”. In normal context, when an outsider steps on another’s land without permission, that is considered to be trespassing and may be liable for prosecution. However, easements are special cases in which these intrusions are permitted and necessary. For example, if your home is built behind your neighbors land, and the only possible point of exit and entry is via his driveway which is situated on his land, the court will grant an easement on the land to ensure that you are able to gain unrestricted access to an exit.

Whether your neighbor is in agreement with the easement or not, it is as Singaporeans describe a necessary situation “bo bian (sic)”. The problem lies when you are purchasing a Servient Land (i.e., your neighbor’s land), where your land is being used as an easement. This will affect the amount of land you can use for your personal enjoyment such as planting trees or installing a basketball court. Being aware of any potential easements ensures that you are informed to make a decision on how valuable the property really is given the easement.

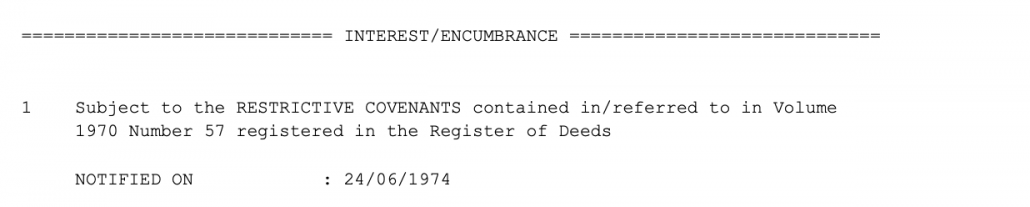

3. Covenants

Covenants is a synonym for a promise. When there is a covenant made and registered against the title, it is a binding promise to do something (positive covenant) or not to do something (restrictive covenant). The most common type of covenants registered against a title would be restrictive covenants that can be derived either by the law or the MCST for Strata Titled apartments.

Examples of such covenants can include not to change land use from residential to anything else. This means that unapproved changing of the land use from residential to commercial or industrial is illegal and are subjected to prosecution. An example would be as follows:

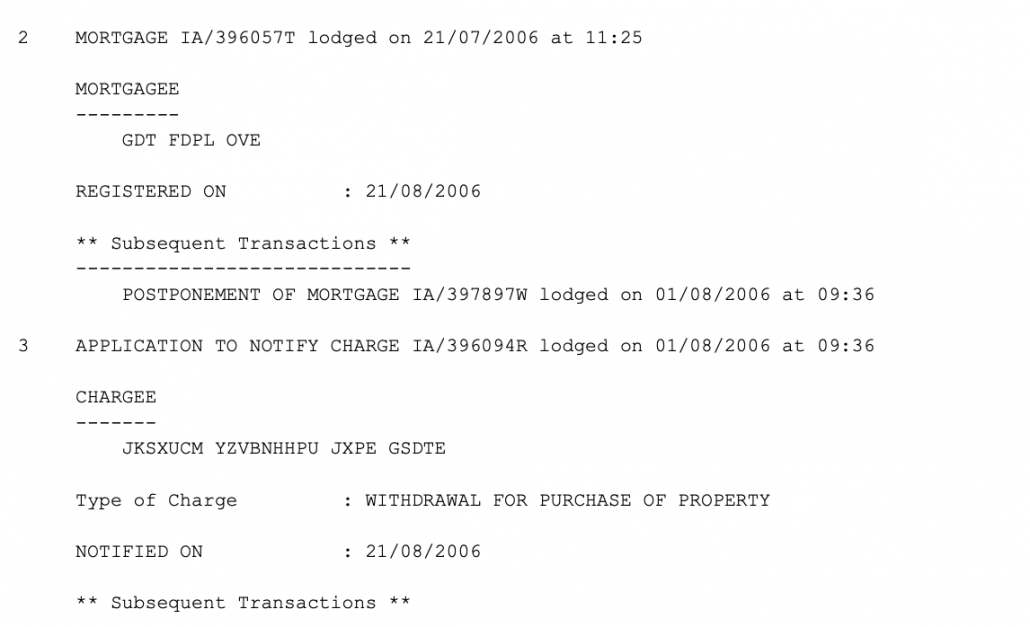

4. Encumbrances

A good title is one that should come with no encumbrances. Encumbrances refers to other’s interests in the land, including banks and creditors who have furnished a loan to the owner of the land for the subject property. Prior the date of Vacant Possession or key collection, it is crucial to ensure that your title obtained is rid of any encumbrances from the previous owner. Else, a default or mistake from the previous owner could result in banks foreclosing the property although the title has been transferred to you.

While you can still purchase a title with encumbrances at your wish, we highly advise against it to avoid any potential hassle. Here is an example of an encumbrance you want to avoid seeing on your new title:

We hope that this article had aided you in your future property ventures. This is by no means a substitute for legal advice, but a quick and easy way to understand the various jargons to ensure that you make informed and smart decisions regarding your property!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!