In the latest announcement jointly made by the Ministry of Finance (MOF), Ministry of National Development (MND) and Monetary Authority of Singapore (MAS), the Government has made adjustments with regard to the Seller’s Stamp Duty (SSD) and Total Debt Servicing Ratio (TDSR) framework, with effect from 11 March 2017.

No changes have been made to the Additional Buyer’s Stamp Duty (ABSD) and Loan to Value (LTV) Limits, to continually encourage prudence among borrowers.

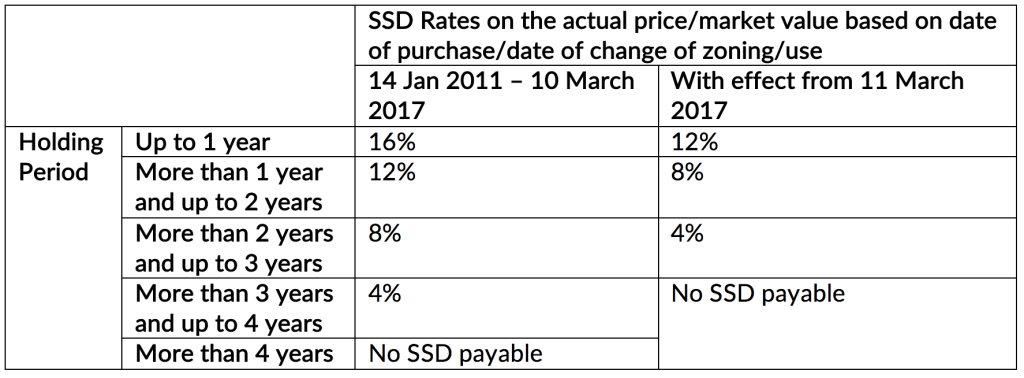

Seller’s stamp duty (SSD) has been revised, and the timeline has since been shortened from 4 years to 3 years, from the time of property purchase. SSD payable has also been brought down by 4% per tier. Changes made to SSD can be found in the table below:

Total debt servicing ratio (TDSR) is no longer applicable for mortgage equity withdrawal loans where the existing LTV ratio is 50% and below. TDSR at 60% is still applicable for property loans issued by the banks.

Lastly, there will be a change in stamp duties applicable with regard to the transfer of equity interest in entities. Stamp duties will be applicable to the purchase of shares on owners of residential property-holding entities.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!