When you first meet Bernard Tong, it may be hard to believe that prior to joining the company, the Managing Director of The Edge Property Singapore had zero experience in the real estate industry.

The Edge Singapore, which runs its publications both online and offline, takes pride in their highly analytical and data-driven content, as compared to other news publications that cover mostly headlines and topical stories. This sophistication is also reflected in the user demographics of The Edge Property portal – property investors who are generally more tech-savvy and have an appetite for luxury high-end properties.

For Bernard, he has learnt to apply the problem-solving skills previously picked up from his appointment as a management consultant, to his current position as managing director of The Edge Property. Read on to find out more about the portal, what he thinks of the policies U.S. President Donald Trump has made, and of his guilty pleasure – zombie movies.

The Redbrick Team (RB): What does The Edge Media Group comprise of, and how is The Edge Singapore different from The Edge Malaysia?

Bernard: The Edge Media Group started in Malaysia, about 21-22 years ago. Then we moved to Singapore in 2001/2002. The Edge magazine is published once a week, and it’s split into property and non-property. Our subscribers are mostly professionals, bankers, and property agents.

The content and analysis we provide are pretty similar, but the only difference is probably the competitive landscape. In Malaysia, The Edge is the main business publication, but in Singapore we compete against the likes of Business Times, and even the Straits Times business section, so it’s a very different competitive landscape. Also, because we’ve been longer in Malaysia, the team and the sections are much bigger in Malaysia than in Singapore. In Singapore, including the property people, we have about 60-70 people. But in Malaysia we have 150-200. So definitely more presence in Malaysia, but over the last 2-3 years, we’ve spent a lot more effort in Singapore trying to build our presence.

RB: What is the company’s goal?

Bernard: We want to continue to provide the best financial advice to our subscribers, and that’s something we’re very proud of. If you look at the way we write, versus the way other business publications write, we tend to be more data-heavy. We focus a lot more on data, on analysis, on in-depth study. It’s less newsy, but more data-driven. This is something we’ll continue to do.

We focus a lot more on data, on analysis, on in-depth study. It’s less newsy, but more data-driven.

RB: What is the team behind The Edge Property like?

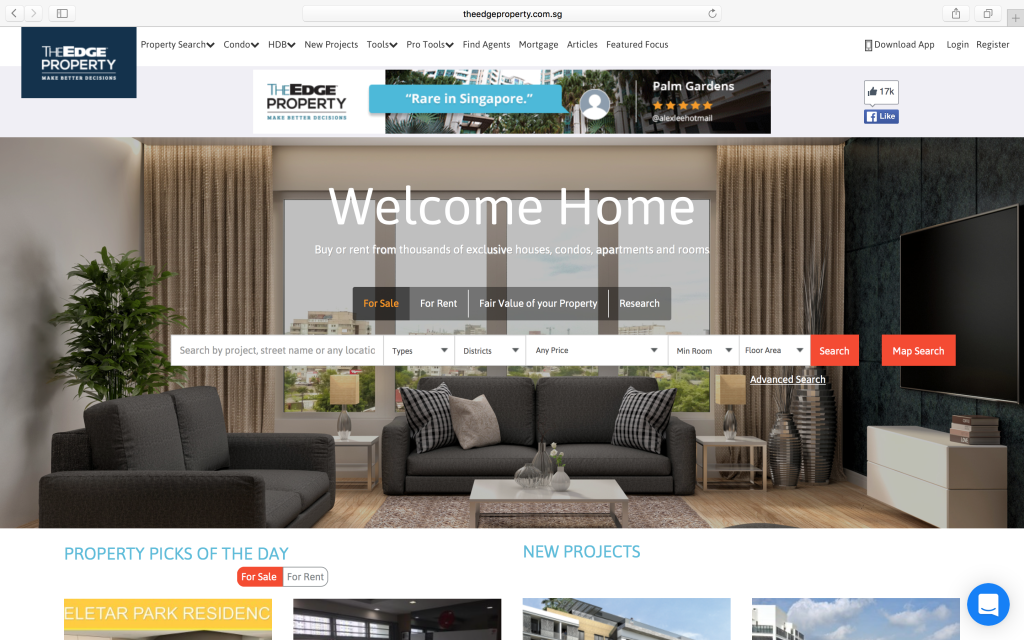

Bernard: The team is fairly new. We started in July 2015. The whole foundation of the company was established when we acquired Square Foot Research, which provides data to agents. When we acquired them, we used them as the basis to grow into the listings market. If you’re a developer or agent you can advertise on the platform, which is quite different from the subscription data model, which we still continue to do as well.

I manage the team in Singapore, and we currently have about 25-30 people, but we’re looking to expand to 40-ish this year. It’s a young and dynamic team; the average age is around 31-32. And the reason why we chose to go down this direction is because advertising is moving online. A lot of attention and media planning is going online, so it makes sense as a business publication to have an online portal to capture online presence. That was primary reason why we decided to set up The Edge Property.

RB: Who are your target customers?

Bernard: The Edge Property follows the same principle of The Edge. In our editorial content and our approach to the portal, we tend to be a bit more analytical. You can look up things like past transactions for a particular building, amenity score, or find out how much your home is worth by keying in your address. It follows the same principle of The Edge which is using data to help users and subscribers make better decisions with regards to property or the equity market.

As a result of that, a lot of our target customers are the savvier ones. More investor-focused. Maybe a bit more money also to invest in different types of property. So naturally our target market is not the mass market, as most of our readers and visitors are looking for high end luxury condos. They come to our website, do a bit of research, read articles that are interesting to them, and then start their search journey. That’s how each property works, and that’s how we focus on our target customers.

RB: Where does your revenue come from?

Bernard: We basically generate revenue from advertising. That’s the existing business model, and in addition to that, we also charge users a subscription fee to use some of our tools. If you come to our portal today, we have free tools and paid tools.

The paid tools are mainly for agents and investors paying to use some of these tools. You can use them to analyse different locations, slice and dice different things. For example, if you want to know which property in Singapore generated the most capital appreciation over the last 5 years, you can do that easily.

RB: Who are your partners?

Bernard: We are quite flexible and we work with everyone in the property business. We strive to be the destination for all things property. We help our users make better property decisions, so partners we work with mostly are developers, banks, mortgage brokers, lawyers, and agencies. The 2 core groups of partners are probably developers and property agents.

But we also work with companies who take care of the ancillary stuff like Nippon paint, who is one of our largest partners in Malaysia. We also work with furniture, interior design, and renovation portals.

RB: What sets you apart from other property portals?

Bernard: We don’t go after the mass market, as that is not our target audience. We focus on the investors group and the upper mass, and naturally you’ll draw a crowd that is slightly more sophisticated and tech-savvy. We are probably the only truly integrated property portal, in the sense that we have both a significant online and offline presence.

RB: How do you think the new Trump policies will affect the property market in Singapore/Asia?

Bernard: I think Trump is going to focus a lot on the domestic economy, which means the inflow back to the United States would be fairly significant. There will be less foreign money being invested in overseas markets, so there will definitely be implications on the property market in Singapore and Asia in general.

The second implication he’s creating is that there is a lot of uncertainty. People don’t know what’s really going to happen. Not just because of Trump, but what’s going to happen in Europe as well. Uncertainty creates a lot of fear in the market, and people will just stop buying. People are more risk-adverse and look at investing in more safe haven assets. Naturally, the property market will then be affected.

Uncertainty creates a lot of fear in the market, and people will just stop buying. People are more risk-adverse and look at investing in more safe haven assets.

If you ask me if Trump is good or bad for the property market in Singapore or Asia, I think I’m more inclined to say a bit more negative than positive, just because of the sentiment that he’s creating. We’re hoping that he will sing a different tune after a few months, but based on what he’s saying these days, it’s a bit scary, so the implications could be quite significant.

When the economy does well in the U.S., and it will, because a lot of money is going back, the U.S. government is going to start raising interest rates, and that will create pressure on our SIBOR rates – again it will be bad for the property market. That said, Singapore is a small market, relative to what’s happening around the world, and a lot of it is dependent on government policies such as cooling measures, etc. So, I’m sure the government will know what to do when the time comes.

RB: What is your short-term outlook on the property climate?

Bernard: Volume might pick up, but prices are sort of going to remain the same. Our stats showed that last year, in the high-end market, there was a hint that it was on the recovery. That said, it’s not a fairly representative basket of high end properties. The high-end market has sort of stabilised, although there are no signs of huge recovery, unless the global economy goes into a severe recession which is not unlikely, given what’s happening.

Obviously, Singapore as a trade nation will be affected. If you track the historical property prices, the strongest correlation is to GDP. It has nothing to do with things like speculation or cooling measures, but historically, property prices track GDP growth. So if GDP growth declines significantly, then property prices will follow.

RB: What are your hobbies/what do you do in your free time?

Bernard: I read a lot. Mostly non-fiction, as I get my fiction from movies and TV shows. Currently I’m reading this book about how algorithms can determine your life. Before this, I was reading a book about essentialism. The whole principle of the book is that, in life you are always asked to do a lot of things by the people around you, and learning how to say ‘no’ is very important. Being able to decipher what’s important for you, versus what’s not very important. So that book teaches you how to say ‘no’ appropriately and diplomatically.

RB: What is one interesting fact about yourself that people don’t usually know?

Bernard: I had zero property experience prior to this – I was a management consultant at the Boston Consultant Group. I dealt with a lot of MNCs and government sectors. But, property has always been interesting to me. I think in life, no matter what you do, you must have passion and apply different things you learn throughout your life to what you do. If you don’t like what you’re doing, then there’s no point in doing it. One thing I’ve learnt from my experience as a consultant is that there are no business problems that cannot be solved. It’s just how you apply a problem-solving approach to it. At the end of the day, a lot of the methods used to solve a problem is the same.

I also love watching Zombie movies, that’s my favourite genre. Movies, and not TV shows because I’m someone who hates uncertainty so I need closure in everything I do. When I watch a movie, I know that there’s an ending to it. So I love shows like Train to Busan, World War Z, etc. I love playing zombie games too, and I think I’m a pretty morbid person.

Catch the team from The Edge Property Singapore at the upcoming instalment of Property Quotient, Redbrick’s real estate seminar series that will be happening on 25 February, 2017. To find out more, click here!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!