As a student, Kazumasa Tomita never ever envisioned himself working in the finance industry, much less pursuing it as his lifelong career.

Perhaps, he simply did not have the time to think about it. While pursuing a degree in Economics, he was made the Captain of the university’s soccer club. In his free time, Kazumasa even set up IN2, an advertising agency that connected students with relevant design and marketing experience with companies who needed marketing work.

In fact, Kazumasa’s first foray into the finance industry was when he first joined Nomura Securities straight out of school. It was a good job, but he soon noticed his circle of friends struggling with finances after they got married and started families.

Kazumasa understood the importance of financial literacy and knew that he needed to make a difference. That’s when he decided to make it his personal mission to help his peers – and people around the world – to fill the financial literacy gap.

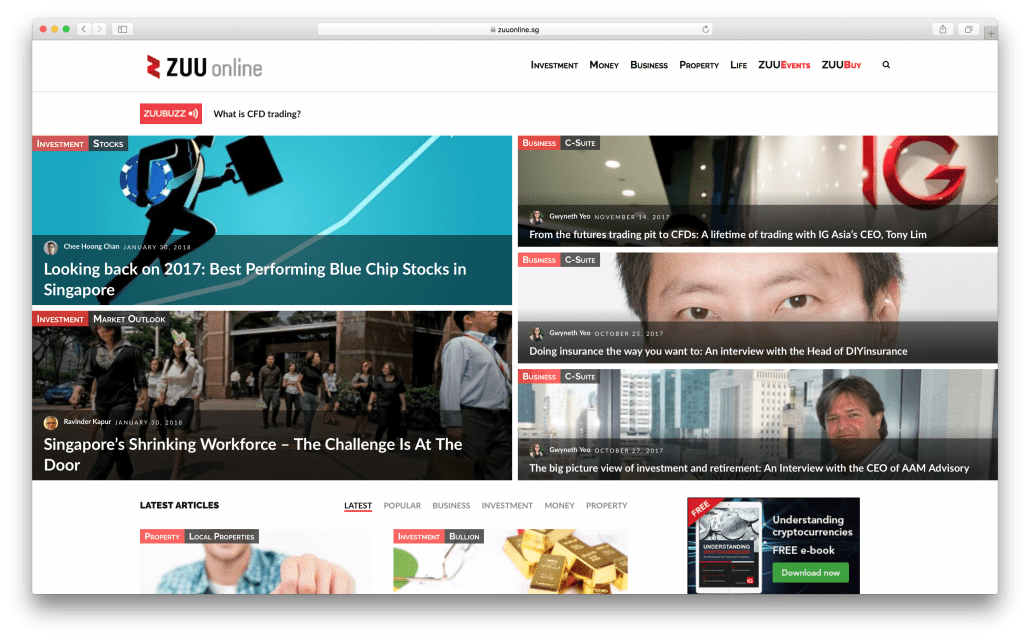

Today, a little over 10 years after he first stepped into Nomura, he has become the Founder and CEO of ZUU Online, a financial-focused media technology platform that has been reported as the platform with the #1 growth rate in Japan.

We had the opportunity to meet with Kazumasa when he was visiting Singapore in late December 2017, and managed to snag a short interview with him. Here’s how it went:

The Redbrick Team (RB): What is ZUU, and when and why was it founded?

Kazumasa Tomita (KT):

ZUU online is a financial-focused media platform with more than 3.5 million unique users and over 10 million page views every month. It was launched almost 5 years ago on April 2013, right after I left Nomura Securities.

Whether you are in Japan, Singapore, or anywhere – you’ll find that most people lack financial literacy. This keeps them from making the right decisions in their finances.

That is why I decided to create a platform like this, with a focus on financial literacy, media and education. What is unique about ZUU is that we do not focus purely on equity or forex.

I used to be a private banker, so I’m accustomed to how private bankers operate. They take care of all their clients’ assets, ranging from banking services to insurance, and even down to their real estate portfolio. The asset management aspect of private banking basically takes care of everything.

What does that mean? Essentially, this means managing a client’s individual profit & loss (P&L) statement and balance sheet (BS). You might be familiar with these terms being used in corporate financial management, but in private banking, these are used in financial management for individuals.

So ZUU online aims to equip individuals with the ability to manage their personal P&L and BS, by educating them on topics like bank deposits, credit cards, insurance, loans, and other intangible assets.

RB: What were you doing prior to starting ZUU?

KT: I started working as a private banker in Nomura’s Tokyo headquarters before moving to Singapore. After which, I moved to Nomura Thailand in Bangkok to set Nomura’s corporate strategy for Southeast Asia, and visited Malaysia to assess its feasibility as a new brunch for Nomura.

Before that, while I was in University, I considered myself to be an entrepreneur and built a social networking marketing startup from scratch. There was no Facebook at the time, and I had to use a mixture of social media networks that were available.

So, you could say that my experience was first as an entrepreneur, then a private banker, and then ZUU.

RB: What made you decide to start ZUU?

KT: I was around 27 or 28, when my friends told me that they were facing financial challenges. At that age, some of them were getting married, some were having kids. They had their wives and children to care and provide for and they were worried about money.

So I thought about how financial knowledge could change lives.

Everybody has their own goals and dreams that they work for, but financial challenges often hinder them from achieving these goals. This is why financial literacy is important for everyone. I felt that my experience in the financial industry could help to solve this problem, so I started this company.

RB: What does a regular work day look like?

KT: There are more than 70 of us in the team, including the ones in Singapore, so my current focus is on management tasks. At the same time, I’m committed to create new business models.

In Japan we started a financial-focused HR** business just half a year ago, and we are the second largest player of Japan in the area already. I was the one who created the new model along with a manager of CEO office.

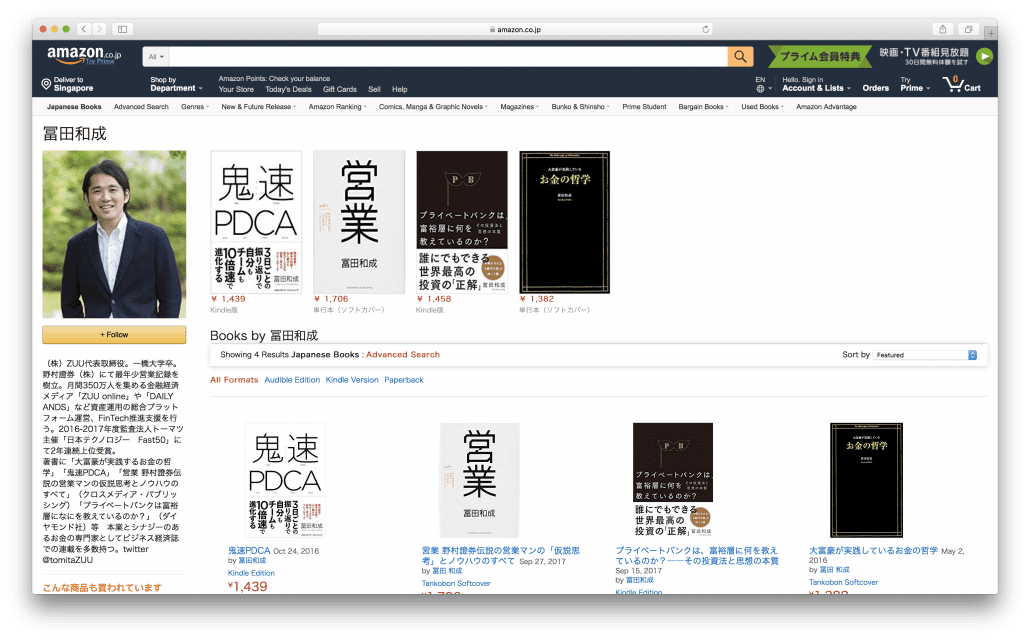

I have also written four books so far, and most of these books are the #1 best seller in their respective categories, like private banking. Some of these books have also been republished in other languages.

(**financial-focused HR refers to a recruitment site for financial professionals/positions)

RB: What kind of challenges do you face?

KT: We aim to be #1 in the world, so we always need to move quicker, and do things faster.

Last year, Deloitte announced that ZUU was the fastest growing technology company in Japan. In the Asia Pacific region, we placed 8 out of 500 companies. A lot of people say that we’re a fast growing company, but it’s not fast enough for me. We can never grow fast enough, so this is one of the biggest challenges I’m facing.

Global expansion is another a challenge we face. ZUU was set up in Singapore 1 and a half years ago, and we target to establish ourselves in Malaysia, Thailand, Philippines and Indonesia.

RB: What are your plans for the future?

KT: The back of my name card has my goal for ZUU to be achieved by 2038.

Our dream is to make everybody in this world challenge their own goals and dreams, and work towards it. I believe that financial literacy stands in the way of our goals, and by removing this barrier, we can work towards our dreams.

For us, it’s a lot about the empowerment of financial literacy; we try to empower users with financial literacy, so that they can pursue whatever they want in life, to have a more fulfilling life.

RB: How is ZUU Singapore different from the ZUU Japan platform?

KT:

Here in Singapore, we started on the financial media platform business with advertising and content marketing models.

In Japan, we have a much wider scope of business, ranging from B2C to B2B. The B2C model for ZUU online [in Japan] is the same as that in Singapore. The differences are that Japan side has subscription model for memberships and lead generation model where users can create accounts and manage activities like applying for seminars.

On the B2B front, we provide Fintech support business. In Singapore, we are supporting content marketing, but the Japanese team has a larger product offering that includes marketing automation, consulting and strategy, data marketing, as well as HR training.

RB: ZUU is a provider of financial education. As the CEO, what is your personal financial/investment portfolio like?

KT:

I don’t have a property portfolio at the moment. Nearly all of my assets are in ZUU’s shares, as I own more than 70% of the company. I’m also investing in some listed companies in Japan and the US, focusing on the entertainment, IT, and education sectors. We are planning for an IPO in the near future, so I need to have liquidity.

I wish I had property. In my private banking days, my work revolved around asset management, and most of my clients had a property portfolio as part of their assets. Entrepreneurs often hold property through REITs because they need the liquidity. However, the entrepreneurs whose companies are more established would have stocks and lots of assets, so most of their assets were in property.

RB: What do you do in your free time?

KT: Work. I don’t have free time (laughs). I’m always committed to my dream, which is of course, ZUU’s dream.

Of course, I love visiting new places and I’ve seen most places in Southeast Asia. I also love going to cafeterias; here in Singapore, my favourite is P.S. Café.

I like spending my time at the beach as well, but to work. I love Tanjong Beach Club in Singapore. In Japan, I often go to the beach to working there. I enjoy the environment, and it helps me to focus.

–

With Kazumasa’s sheer tenacity and diligence, it’s no surprise if ZUU Online is able to achieve their ultimate goal well before 2038.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!