Meet Yuet Whey Siah, the under 30 femalepreneur behind property portal DREA, which stands for Digital Real Estate Assistant. As a former investment banker, she first conceived the idea of DREA when she was in the shoes of a consumer – when she was looking to buy her first home in Singapore.

Despite the already competitive real estate portal scene, Yuet believes that DREA is different. Apart from the insights and analyses, DREA allows business users – developers and agents alike – to specifically target and reach out to select types of people. Her vision is for DREA to be the go-to app where all real estate-related questions can be directed and answered. Additionally, she hopes that through DREA, real estate advertising can potentially transit from traditional to digital media.

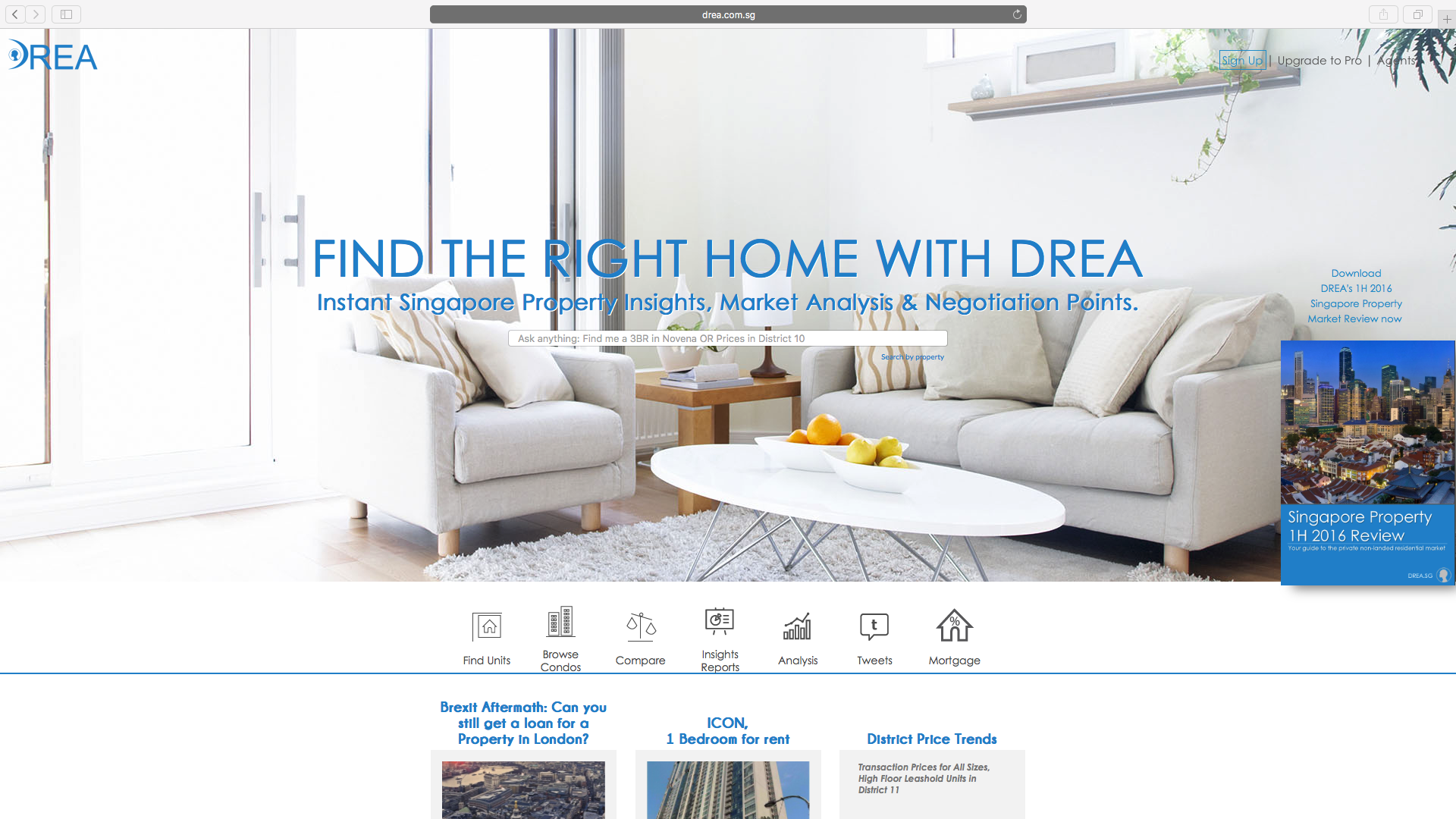

With DREA, we bid goodbye to keyword search, and hello to natural language search. Instead of having to choose from a drop down list of options between properties for sale or rent, the type of residential property, or even selecting a specific price range, natural language search can be done as easily as typing “Find me a 3BR in Novena”. Think of DREA as the Google of property portals.

Read on to find out more about Yuet’s accomplishments and how she thrives in a heavily male-populated environment, her thoughts on whether property transactions can be carried out solely online in the future, and what she does outside of DREA (hint: when she’s not working, she’s still working!).

The Redbrick Team (RB): What does DREA do?

Yuet: DREA is a real estate website. We serve anyone and everyone. You have your buyers, sellers, tenants, and landlords. You can go to our site and instantly get access to real estate information, insights or even negotiation points on your dream home. We are the only platform in the market today where you can instantly flip out your phone and you can see things like prices in the area, or it could be a review of a particular condo you were going to look at, or you could even ask it something like “is there a show flat nearby?” and so on.

RB: What is the company’s goal?

Yuet: Our goal is simple, but very ambitious. Our goal is for anyone and everyone who goes into a show flat, or into a negotiation about the home or discussion around homes in the area, to flip out their phone and actually use DREA for information, for facts or things like insights or various information like analysis or tools.

But from a commercial standpoint, our objective is to be a global player, where we would meaningfully shift a lot of the real estate advertising spent on the market today from traditional media like newspapers and classified ads, to digital media.

RB: Who are your target customers and how is the platform charged?

Yuet: From a consumer standpoint, we address the information need for anyone and everyone, so this would be your daily buyers, tenants, sellers, landlords, as well as your financial investors. DREA is absolutely free to use for consumers; at the end of the day, we want to educate the market about the value of real estate information and analysis.

On the commercial front, we serve developers. We serve real estate agencies and agents as well, where we help them on 2 fronts: listing generation and lead generation. There is a subscription plan for these groups of people, and the plan gives them access to all sorts of tools; tools that are information-based, as well as for their listing or lead generation needs.

We are moving away from the traditional model to what I call the active model, where agents have full control over who they reach out to and how they reach out to them.

RB: Where does your revenue come from?

Yuet: Since we currently serve institutional clients as well, we offer a subscription plan for our developers and agents.

Our platform today is the only platform where instead of hosting listings and waiting for phone calls to happen, we’re taking a 180-degree turn because we are allowing real estate agents to specifically target select types of people. For example, as an agent with a 2-bedroom unit in Orchard, I can reach out to all the people who are interested in 2-bedroom units in Singapore, or 2-bedroom units in Orchard, or it could be 2-bedroom buyers in a specific condo like Cairnhill Nine.

We are moving away from the traditional model to what I call the active model, where agents have full control over who they reach out to and how they reach out to them.

RB: What made you leave investment banking to do this?

Yuet: I came up with the idea for DREA about 3 years ago, while I was still in investment banking. Arguably when I was doing it, it was quite challenging, because I was toggling between 2 roles and both roles required a lot of time and attention. So I spent a lot of time on the ground, over the weekends, trying to understand the market landscape. What kind of problems do agents really face? What business model would really work in a market that’s so competitive?

Because there’re so many players in the market, I finally decided to leave investment banking and run DREA fulltime when I was quite confident that we would be able to hit the market, and with a good product.

RB: Why another property portal?

Yuet: The way I started DREA wasn’t a Eureka! moment, it wasn’t a light bulb idea, but more of a slow burn process. I first started out and thought about DREA when I was looking to buy my first home in Singapore and I was looking for a few things.

The first thing was looking for a home that would give me at least 4% yield, but it was very challenging because you won’t be able to find homes this way in the market today. The second thing was looking for a lot of information on a particular property, or a review of a property, or even things like information to validate where or not the home is appropriately priced.

That was when I realised there was an information gap in the market, and there would be an appetite for these sort of information. Real estate insights, and more importantly, insights that you can access on the go, so that each time when I walk into a show flat, I know what sort of questions to ask. Or when I go to a home viewing, if the agent tells me something, I can easily flip out my phone and say, “that’s not right”. To be able to do that, I thought there would be a lot of demand for this sort of information.

RB: How many users does DREA have?

Yuet: We currently have about 4000-5000 people visiting our site every week, and they come to us for property information. We’re actually monitoring user behaviour such as what sort of things they are engaging with, or things like property price trends. Or even on a condo listing, understanding each condo’s amenities or things like prices for that specific condo.

What we notice is that people are really using it to access whether or not the homes they are looking at is appropriately priced. It’s good, and it’s in line with what we set out to achieve.

RB: How do you feel about being a female entrepreneur in this trade?

Yuet: In the tech space itself, you don’t have that many female founders. And then in the real estate space, there are even lesser females. But I think the advantage of coming from investment banking is that it’s so predominantly male in those industries anyway, so you learn how to thrive in an environment which is 90% male.

There have been studies where female founders are apparently less likely to be funded when you go for fundraising, but there’s no way of us ever validating to see whether it’s true. Each time when I walk out from a funding discussion with my series A investors and so on, instead of focusing on whether or not they’ll invest in me because I’m a female, a better approach would be to focus on the things I can really change. Things that are truly actionable – what can I do more, how can I better address some of their concerns, or what else can I do better?

Each time when I walk out from a funding discussion with my series A investors and so on, instead of focusing on whether or not they’ll invest in me because I’m a female, a better approach would be to focus on the things I can really change.

RB: What challenges does DREA face?

Yuet: The biggest challenge today is actually hiring. Getting the right people on board. Today you compete for talent with so many people – start-ups, tech giants, MNCs, SMEs, and even the government. There’s just too much competition for talent in Singapore.

RB: Who are your investors?

Yuet: We’re currently in discussion with several series A investors, so we haven’t really revealed who the final investor is going to be, but this is something that we should be releasing fairly soon, maybe in the next few months.

RB: Where do you see yourself/DREA in 5 years?

Yuet: In 5 years’ time, we hope to achieve a part of our objectives, which is for anyone and everyone who goes into a show flat, a home viewing, or even a discussion with friends about property, to flip out their phones and use DREA.

And from a commercial standpoint, we would hope to be one of the key and one of the global players who would have shifted a lot of this real estate advertising from newspapers, flyers, classifieds and so on, onto digital media.

RB: Do you see property transactions done solely online in the future?

Yuet: Yes and no. There are certain parts of it that can be potentially automated, such as your documentation processes. But beyond that I would say that I don’t think that Singapore as a market would be ready for it.

In Singapore, real estate tends to be one of the few, if not the only big-ticket item that anyone would purchase in his or her lifetime. So if that was the biggest purchase in your entire lifetime, I struggle to believe that you would want to do the entire process online without putting a face to the person you are transacting with, without physically stepping into the resale home or even the show flat that you’re looking at. Just to get a sense of it.

Personally, I would want to see the home, or even just drive to the area that it is going to be built along, unless it’s a foreign investment.

RB: What properties do you own?

Yuet: I own a property in Kuala Lumpur (KL) and a property in Singapore. I haven’t actually moved in to my property in Singapore; I’m currently renting a place. The one in KL is for financial investment.

RB: What are your best and worst investments?

Yuet: The best investment for me would be time. Time I spent working in larger organisations – I started out in KPMG, then subsequently to a Japanese bank, and then to Barclays. So I think the best investment would be the time I spent there. It’s a good learning opportunity because you learn how to grow things very quickly.

The worst investment is probably the investment I didn’t make in myself, like not spending enough time reading to build up my knowledge. There’s always something that’s more urgent, something that really requires your attention, something that’s more pressing, and so on.

RB: Apart from Singapore, any plans on expanding overseas?

Yuet: We have (near term) plans to expand regionally. So Southeast Asia, obviously my home country, Malaysia, is one of it. Other than that, Indonesia, Thailand and so on.

RB: What is your short-term outlook on the property climate? (Local/Overseas)

Yuet: Let me disaggregate that into two parts – supply & demand. On the supply front, there are at least over 17,000 unsold units in the market today. Most of these units are in the heartlands of Singapore – district 19, in Hougang, Punggol, and Sengkang – that’s where a lot of these units are concentrated. The question is really whether or not there is enough demand to absorb all these units. Our personal take on this is that there is definitely demand for all these units, but not necessarily at the current price levels. Many of these units are also capped out by the current cooling measures, things like your TDSR and so on.

And if I were to also take a look at the prime districts – districts 9, 10, 11, and so on, there’s not much supply in those districts, but if you look at the rental market for those 3 districts, rental prices have come down, and rental volume has come down on all those districts. They’re getting slammed on both fronts – lower rental volume, harder to rent out, and on top of it, rental rates have also gone down. The question would be: do people have holding power?

One way we can validate that assumption or hypothesis is if we look at the resale transactions in the past years for those districts. In the first half of 2016, when I looked at the transactions for those three districts, I noticed that at least 20% of all the retail transactions in those districts were loss-making. That gives me a sense that 20% of the people in those districts do not have the holding power, so that would be a more interesting takeaway on the market.

RB: Any buying opportunities whether local or overseas?

Yuet: In terms of buying opportunities, I’d say that if you were looking to buy, focus on homes that are vintage – any homes bought before 2007, or homes that were bought in 2008-2009. That was when the property prices were either very low or when the property price cycle bottomed out, so for people looking to buy a resale home from these homeowners, you would have the largest room for price negotiation.

I’d say that if you were looking to buy, focus on homes that are vintage – any homes bought before 2007, or homes that were bought in 2008-2009.

RB: Which tech company do you take inspiration from? Why?

Yuet: I don’t think there’s one specific tech company that I take inspiration from, but I follow a lot of these stories very closely, and from each of their stories I try to learn something. For example when Airbnb first started out, instead of thinking of Craigslist as a competitor – Craigslist being a place where a lot of people would post listings for vacation home rentals – what they did was they allowed the people who used Airbnb to also post the listings directly onto Craigslist.

That actually gave their users better results, and on top of it, it drove traffic to Airbnb. So that was a very good strategy because it allowed them to grow very quickly. Instead of always focusing on your competitors being competitors, why not use them to your advantage?

So with every single tech company that we hear of and read about, we try and learn something from them.

RB: Who are your role models? / Who do you look up to?

Yuet: My role models are my parents, because are very resourceful people. Every time they have problems, they are able to come up with solutions that are out of the box, and they’re very resilient. It doesn’t matter what the situation is; they can find strength from somewhere to resolve it. So I think that gives me strength to take up new challenges and for me to potentially risk failure and accept failure.

RB: What are your hobbies? / What do you do in your free time?

Yuet: My free time is all about DREA. I spend all my free time today on DREA. Outside of thinking of DREA is thinking about new business ideas. I have a notebook, a collection of things I want to do in the long run, outside of DREA. Different business ideas, different ideas that I think could work.

Some of them are very nascent, some of them are just an idea, so I sit down and think about different ideas. Some of them are more in the marketing space; some digital marketing, some out-of-home marketing, and things like converting every surface into a marketable advertising platform. Thinking of new ideas would be my hobby.

RB: What is one interesting fact about yourself that people don’t usually know?

Yuet: Everyone always thinks that I’m very delicate, that I refuse to get my hands dirty, but that is actually quite different because I am willing to get my hands dirty. When I was in high school, I was in girl guides, but no one believes me. Every time I say that people are like “really? Are you sure? Are you faking it?” so contrary to what people believe, I can actually get my hands dirty.

Catch Yuet at our upcoming event if you would like to hear more from this real estate digital whiz!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!