Interested in buying a private property? Jump right in as we guide you through the As to Zs of buying property, as well as what to consider before purchasing.

What is private property?

There are 2 types of property in Singapore – public housing and private properties.

Public housing constitutes HDBs. Private property refers to condominiums, apartments, Executive Condominiums (ECs) and landed property.

Tenure – Freehold or Leasehold?

Don’t be fooled into thinking that private property = freehold property!

Depending on the type of property, they can either be freehold or leasehold.

| Type of Property | Tenure |

| Condominiums | Freehold/Leasehold |

| Executive Condominiums | Leasehold |

| Landed Property (Detached, Semi-detached, Terrace, Bungalows, GCBs) | Freehold |

| Cluster Houses | Freehold/Leasehold |

Executive condominiums are unique in a way that they are managed under HDB for the first 10 years before privatising from their 11th year. Do take note that although they seem like freehold property after 10 years, they still hold a Leasehold 99-year tenure.

Some executive condominiums available on the market now include SkyPark Residences in Sembawang, Copen Grand, The Terrace, and The Brownstone.

They look just like any condominium, boasting the same facilities and amenities that a condominium provides. Although executive condominiums are known to be located in more “Ulu” areas, the facilities and design make up for it. ECs are also generally more affordable as compared to private condominiums, making them a popular choice for individuals and families who fancy affordability while enjoying condominium-style living.

When can I buy my private property?

Anyone above the age of 21 can buy private property. However, if you are below the age of 21, your parents can use your name to purchase another property under a trust. In this case, the child will be a beneficiary while his/her parents remain the legal owner of the property. Once the child reaches the age of 21, the legal title of the property will pass on to the child.

Who can buy private property in Singapore?

Generally, anyone can buy private property, with the exception of executive condominiums. For brand new ECs, only Singaporean – Singaporean households or Singaporean + PR households are allowed to purchase. For resale ECs, as long as the Minimum Occupancy Period (MOP) of 5 years has been achieved, any Singaporean or Permanent Resident can purchase the resale EC. In addition, you do not need to form a family nucleus to buy a resale EC, making it a great alternative for single-nucleus households.

Additional Buyer Stamp Duty

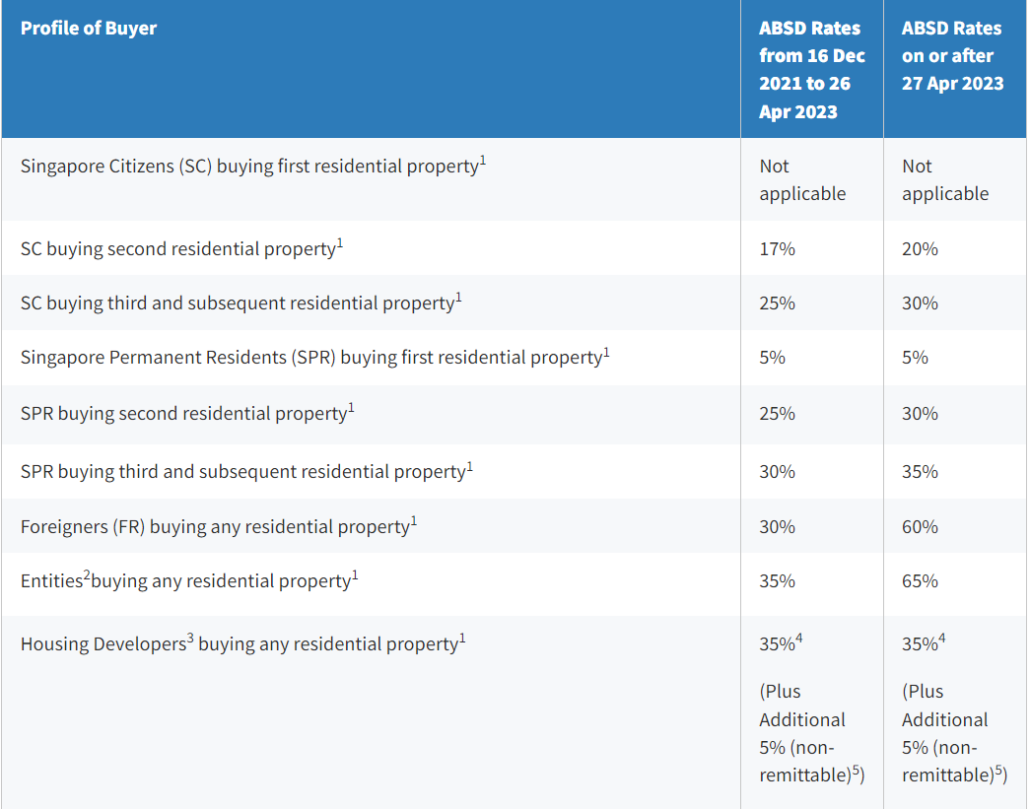

ABSD applies to all buyers if you have more than 1 property in Singapore. As of 27 Apr 2023, the ABSD are as follows.

In addition to the above, any transfer of residential property into a living trust is subject to a 65% ABSD rate.

Does Seller Stamp Duty apply to me?

Good news for you! Compared to selling HDB flats, selling your private property is a lot easier. There aren’t as many restrictions imposed on you. However, seller stamp duty does apply for the first three years regardless of whether you own an HDB flat or private property. The rates for the seller’s stamp duty are as follows.

If you purchased your property on and after 11 March 2017:

| Holding Period | SSD Rate |

| Up to 1 year | 12% |

| More than 1 year and up to 2 years | 8% |

| More than 2 years and up to 3 years | 4% |

| More than 3 years | No SSD payable |

If you purchased your property between 14 Jan 2011 and 10 Mar 2017:

| Holding Period | SSD Rate |

| Up to 1 year | 16% |

| More than 1 year and up to 2 years | 12% |

| More than 2 years and up to 3 years | 8% |

| More than 3 years and up to 4 years | 4% |

| More than 4 years | No SSD payable |

Do note that the SSD rate will be applied to the higher of the actual price or market value.

How much loan can I borrow?

You will only be able to finance your property by taking on a bank loan.

The loan-to-value (LTV) ratio refers to the amount you can borrow to finance your loan as a percentage of your property’s value. According to MAS, the maximum housing loan you can borrow depends on your age, loan duration, and property type, as well as whether you have existing housing loans. For private property, the maximum loan tenure will be capped at 35 years.

LTV limits differ according to the number of outstanding loans one has too. For loans where the OTP is granted on or after 6 July 2018, you will be subject to caps depending on the number of outstanding home loans you have:

- No outstanding home loan

- 75% if you pay a minimum cash downpayment of 5%, or

- 55% LTV limit if you pay a minimum cash downpayment of 10%.

- 1 outstanding home loan

- 45% or 25% with a minimum cash downpayment of 25%

- 2 or more outstanding home loans

- 35% or 15% with a minimum cash downpayment of 25%

The lower LTV limit will be applied if the loan tenure exceeds 30 years or the loan extends beyond the borrower’s age of 65 years old.

Do note however, that if you decide to take a loan as a joint borrower, you will be assessed using an income-weighted average age.

The formula is as follows:

(Borrower 1’s Age * Borrower 1’s gross monthly income / (Total of Borrower 1 and 2’s gross monthly incomes)) + (Borrower 2’s Age * Borrower 2’s gross monthly income / (Total of Borrower 1 and 2’s gross monthly incomes))

Here’s an example to make things simpler for you.

Mr Ong and Mrs Ong would like to take a housing loan together. Mr Ong is 63 years old and has a gross monthly income of $7,500. Mrs Ong is 55 years old and has a gross monthly income of $6,000.

Their income weighted average age will be calculated as follows.

(63 * 7,500 / ($7,500+ $6,000)) + (55 * 6,000 / ($7,500 + $6,000)) = 59.44 years old.

Now that we’ve come to the end of this guide, hopefully we’ve answered some of the most commonly asked questions about buying private property. Of course, this is a big-ticket purchase, so make sure you do more research before jumping into it!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!