Are you looking at valuing your property, but am unsure of which method – direct comparison, residual or income method to use? Look no further! In this article, we will be focusing on the direct comparison method.

What is property valuation?

Property valuation is getting an estimate of the value of a property at a specific date. This is an extremely important piece of information for homeowners when deciding on either buying or selling a home. It will tell you if you are overpaying or if you have snatched yourself a good deal.

Of course, the valuation may be different from the actual sale or purchase price, but the value is usually very similar to its price.

What is the Direct Comparison Method?

The Direct Comparison method, also known as comparative market analysis, is said to be one of the easiest and most convenient methods of valuing a property. This is the method most people are familiar with.

Based upon the Principle of Substitution, the concept states that any logical and rationale person will be unwilling to pay more for a property than the cost of a substitute property with the same attributes in the open market. Some of these attributes can include the area your property is located, size, amenities, floor level, and more.

How is the Direct Comparison Method carried out?

This is perhaps, what you are reading this article for. There are 3 steps in the Direct Comparison method process.

- Identify Comparable Properties

- Identify value-sensitive factors and characteristics

- Adjust comparable sales values and value-sensitive factors to reflect the final property value

Of course, before going on to these 3 steps, you must make sure that you know what the highest and best use of the property is. This will include the legal permissibility, financial feasibility and physical conditions.

The first step, identifying comparable properties is an extremely crucial step in the direct comparison method process. In order to achieve the most accurate valuation, comparable properties should be as similar to your subject property. This will simplify the process a lot, as fewer adjustments have to be made. In addition, the fewer adjustments you make, the better your valuation will be.

The next step in the direct comparison method process is to identify value-sensitive factors and characteristics. Some of these value-sensitive factors include – geographical location, size, floor level, neighbourhood amenities, and even the date of sale, amongst others. Lastly, the value of your property will be adjusted according to the value-sensitive factors and characteristics. If your subject property is superior to that of the comparable, a positive value will be recorded, and vice versa.

Let’s use an example to illustrate the Direct Comparison Method.

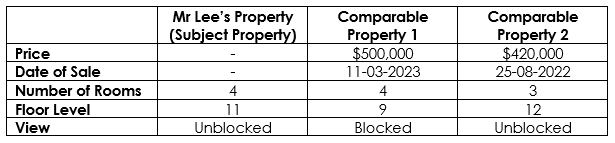

Mr. Lee wants to sell his 4-bedroom HDB flat in Bishan and is unsure of the value of his property. A similar 4-bedroom HDB flat was sold 3 months ago for $500,000. Mr. Lee feels that his property should be worth more as it is located on a higher floor with a better view.

In this case, the valuer will take the $500,000 HDB flat as a comparable property, and identify 1 other comparable property to compare Mr Lee’s property to.

The necessary adjustments are as follows.

- Year-to-Year Premium (2022 – 2023): +5%

- Unblocked View Premium: +5%

- Higher Floor Premium: +1% per floor

- Number of Rooms premium: +5% per room

Taking these into account, the comparable property’s value will be either added or subtracted.

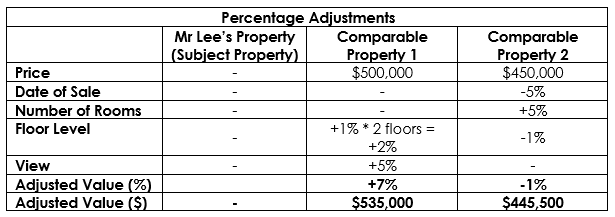

The following table illustrates how the adjustments should be carried out. A + value indicates that the subject property has features that are superior to the comparable property. On the other hand, a – value indicates the opposite – where the subject property is inferior to its comparable.

For example, as comparable property 2 is located 1 floor higher than Mr Lee’s property (subject property), there should be a 1% deduction in price, as the comparable is superior. However, as it only has 3 rooms, compared to the subject’s 4 rooms, there is a 5% addition to the price. Furthermore, comparable property 2 was sold 1 year earlier. Thus, a -5% value is added. Adding these together, there will be a total adjusted value of -1%, which translates to $450,000 x (1-1%) = $445,500.

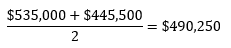

The average adjusted values for comparable properties 1 and 2 will be taken.

As seen from the adjustments above, Mr. Lee’s property should be worth $490,250.

This is, in essence, what the Direct Comparison method is about. However, do note that the factors that are stated are not exhaustive, as many other factors are taken into consideration when valuers conduct a valuation exercise.

This is a comprehensive explanation of how valuation is done using the direct comparison method, and hope it has been a useful guide for you.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!