If you have been reading articles on the property market and the process of property purchases, you have probably come across the phrase Option To Purchase (OTP) before. Yet, the significance of OTP is often glossed over in most article. If you are curious to learn about the legal implications of OTP and the role it plays in the process of buying a property, this article provides you with just that.

What is an Option To Purchase (OTP)?

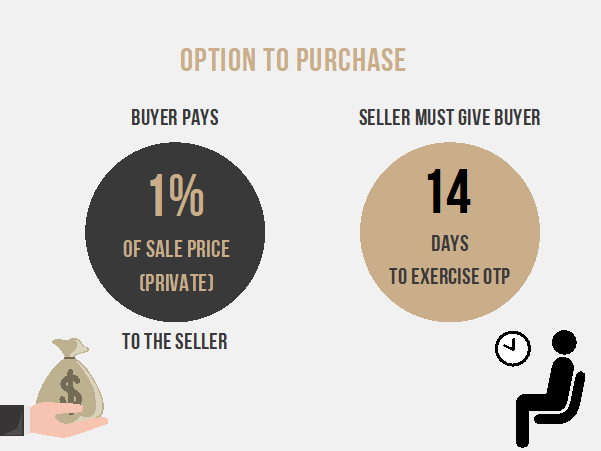

Before entering into a Sales & Purchase (S&P) Agreement for the transaction of the property, buyers and sellers usually enter into an Option To Purchase (OTP). OTP refers to a contract between a buyer and a seller that gives the buyer a period of time to consider whether he wants to proceed with the purchase in exchange for 1% of the agreed purchase price. Typically, the OTP would give the buyer 14 days (21 days for HDB) to consider if he wants to continue with the purchase of the property. In turn, the buyer has to pay the seller an option fee of 1% of the property (for private properties) or $1000 for HDB resale flats. Over the period of 14 days, the seller cannot sell the house to another buyer, else this buyer can sue him for breach of contract.

Over the period of 14 days, the buyer would secure a mortgage loan to finance his property purchase, and his lawyer should conduct legal requisitions on the property. There may be legal encumbrances on the property that cannot be told from property viewing alone, such as others having priority to the property. One example would be to check if another buyer has already lodged an exercised OTP to the property in good faith. In that case, the seller is likely to try to sell the same apartment twice, but it could end up to the first buyer instead of you as he is already in the process of transferring the property under his name.

If the buyer decides to proceed to the purchase of the property, he will have to exercise the OTP and pay an exercising fee of 4% of the purchase price. For HDB resale flats, it would be $4000 instead. The total of 5% or $5000 would act as the cash down payment of the property as the buyer and seller enters into a S&P Agreement. At this stage, the buyer would have locked-in to the contract and can no longer back out without consequences.

On the other hand, if the buyer chooses to not exercise his OTP, he will have to forgo the 1% or $1000 paid for the option fee. While there are no other consequences for him, and the seller cannot sue him for not exercising the option, it is best for buyers to consider carefully before entering into an OTP. After all, forgoing the option fee of a property worth $1 million dollars would be $10,000 which is by no means a small amount.

What happens after exercising the Option To Purchase (OTP)?

If you have exercised the OTP as a buyer or have entered into the S&P Agreement with the seller, you can get your conveyancing lawyer to lodge a caveat on the property title. What this means is that your name would be reflected on the property title and would prevent the seller from conveying the title to another buyer. Although it is not mandatory, it helps to protect your interest in the property as a buyer and is usually a precautionary step taken by buyers who are pending their transaction.

What happens if you don’t exercise the OTP in time?

If you fail to exercise the OTP as a buyer within the stipulated period, you are forgoing your option and lose the option fee paid. While you can try to negotiate with the seller to sell you the property, the seller is no longer contractual obligated to not sell the property to any other buyers.

Does signing an OTP mean you are buying the house?

No, it means you are reserving the exclusive right to buy the house, but you are not obliged to buy the property. The S&P Agreement is the contract that transfers the title of the property to your name upon its completion.

Why OTP matters to buyers

1. A short period to secure your loan

With merely 14 days to obtain a mortgage loan – be it from a financial institution or from HDB, it could be rather taxing. Many have found themselves to be in a tight spot when they realize that they are not eligible for the loan quantum they are hoping for due to the loan restrictions mentioned in this article. However, having already entered into an OTP, they had no choice but to forgo exercising the OTP as they could not get the financing they need.

To save yourself from having such troubles, you should request for an In-Principle Approval (IPA) from your preferred bank beforehand. IPA is the bank’s preliminary assessment of you and the loan quantum you are eligible for. While IPAs are not legally binding, they serve as a helpful guide to how much you can borrow and are a requirement for buyers financing their HDB resale flat purchase with a bank loan.

2. Make sure you are buying a whole flat with a complete bundle of rights

Before exercising your OTP, you and/or your lawyers will be conducting legal checks on the property. This is based on the principle of Caveat Emptor, or buyers beware, which alludes that the seller is not obliged to disclose all information to the buyer and it is the responsibility of the buyer to ensure he is buying a non-faulty item. One important check by lawyers is to ensure that there are no caveats lodged on the title, or any other person has prior rights to the property. For instance, if you are purchasing an apartment that has a tenant residing in the apartment, you may not evict the tenant if he has a lease.

Even if you were not the landlord who contracted with the tenant, the tenant has prior rights to enjoy the property till the end of his contract. If you did not learn of this early on and has chosen to purchase a resale property instead of a BTO as you urgently need a new place to live in, it may mess up your plans completely. On the other hand, you could have easily backed out from the trade at the OTP stage, which might be more desirable – although you would have to forgo your option fee. Hence, it is crucial that proper checks on the property have been conducted prior to the purchase.

All in all, OTPs are important in the process of buying a new property and are often overlooked by buyers who place greater emphasis on securing a loan. Given the short period offered by the OTP, it would be prudent for buyers to request for an IPA beforehand to ensure that you don’t have to forgo your 1% option fee.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!