The world stock market declined a whooping 20.4%1 this year.

So what is a tried and proven way to ensure that fortune favours you through this extremely tumultuous investment storm? The often-heard D.C.A. Or Dollar Cost Averaging has proven itself to be a stellar recipe for times like this.

What happened?

As COVID-19 receded from the headlines, the Russia-Ukraine war took over. And what COVID-19 surfaced as weak links in the global supply chain, the war exacerbated them. This war is also an inflationary one, compounding the 40-year high inflation that the US is experiencing. Food, commodity and energy prices have all soared, and no one knows exactly how long the war will last.

Now the US Federal Reserve (Fed) is caught between a rock and a hard place, as they have to cool inflation by raising interest rates, and yet not raise interest rates so much that the economy falls into a recession. And besides raising interest rates, the Fed had also just started Quantitative Tightening (QT) on 1st June, reducing their balance sheet by $47.5B a month for the first 3 months, and after, a full $95B a month. This reduces the money supply in the economy, and the effect on the stock market could probably be like air being sucked out of a balloon, due to the speed of the QT. However, as QT has just started, it does not look like it has been priced into the market yet.

As the European Central Bank announced that it would raise interest rates next month for the first time in 11 years to combat inflation3, the global stocks fell even more following this latest reminder that central banks “now care more about fighting inflation than propping up markets4”.

How would you take advantage of this market situation currently?

The uncertainties are causing the stock markets to be down currently and especially volatile, and this is when you should adopt the Dollar Cost Averaging (DCA) strategy.

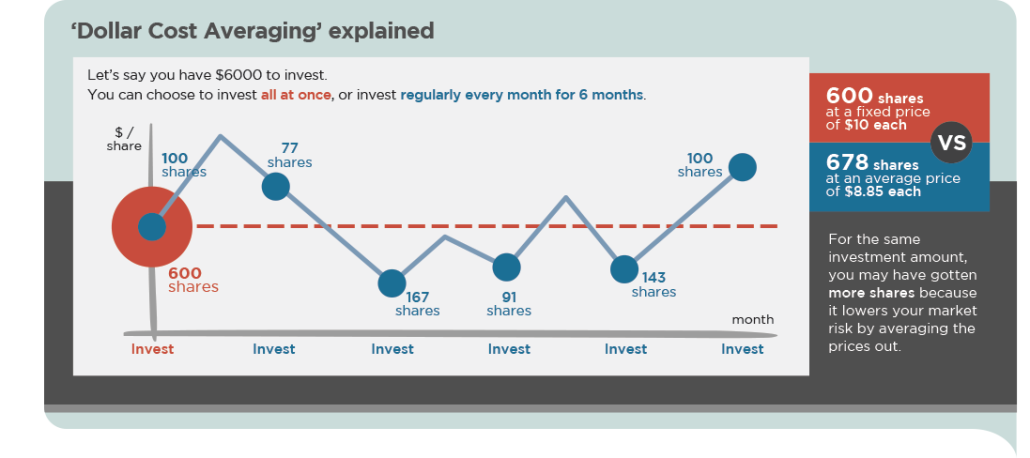

DCA is a disciplined, investment habit that will enhance your portfolio significantly. You put your investment portfolio on autopilot which will enable you to put a fixed amount of money into an investment at regular intervals, i.e. monthly. If the market drops, your pre-set amount goes further, buying you more shares than the month before. You could even choose to outsize your monthly investments for a period of time, e.g. over the next 12-24 months.

If the market goes up, your money buys you fewer shares. This system prevents you from either investing in the market just when it seems most attractive (and is actually most dangerous) or refusing to buy more after a market crash has made investments truly cheaper (but seemingly more ‘risky’). DCA is the type of strategy that prevents your emotions from interfering with your investment framework5. See here for further action to take.

With DCA, you can now look forward to taking advantage of the discount in equities over time.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!