The Singapore government announced a reduction in the supply of private residential houses under the Government Land Sales (GLS) Programme. This comes after there was a dip in demand for private residential properties following the cooling measures implemented in 2018, which resulted in a large oversupply of private residential houses.

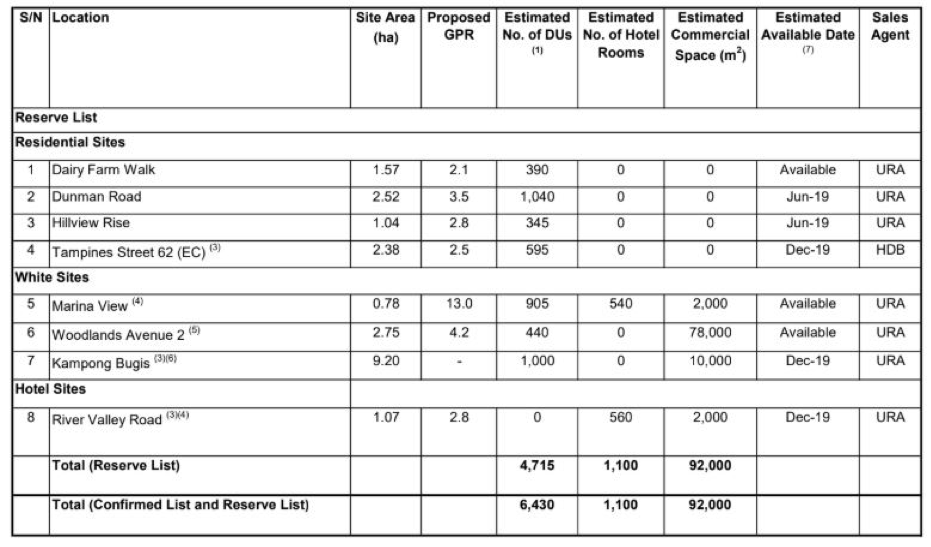

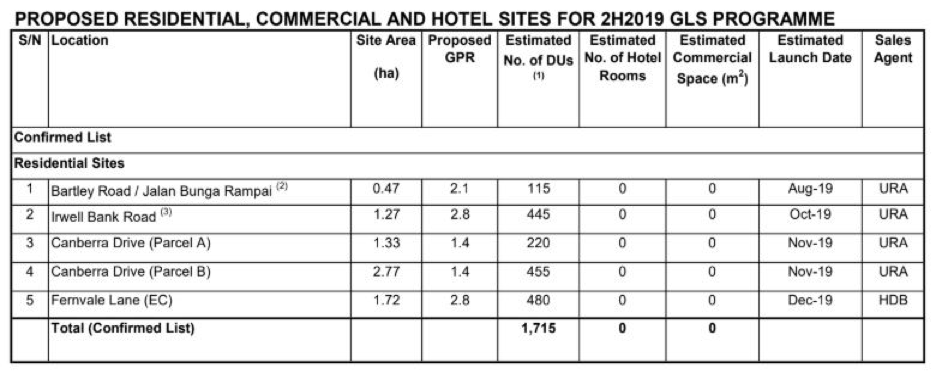

In the recent Release of Second Half 2019 Government Land Sales (GLS) Programme, the Ministry of National Development (MND) released 5 confirmed list sites and another 8 sites on the reserved list. These total up to about 6,430 private residential units, 92,000 sqm gross floor area (GFA) of commercial/retail areas, and 1,100 hotel rooms.

There are about 1,715 units from the 5 confirmed list sites amounting to 310 units, a 15% deficit compared to the 2,025 units from confirmed list sites in the GLS scheme 1H2019. In total, there have been 2,875 private residential units confirmed for the whole of 2019, which translates to the lowest number since 2014, after the total debt servicing ratio (TDSR) was imposed. This number ranged from 3,095 to 4,355 units in the past half a decade.

This comes as a result of the large oversupply of around 44,000 private housing units in the pipeline, consisting of around 39,000 unsold units from the GLS scheme and collective sales, and an additional 5,000 units from sites that are still pending planning approval. There are also 24,000 existing private housing units that are still currently vacant.

Here are the proposed confirmed and reserve sites for the GLS Programme in the 2nd half of 2019.

Source: MND

These are some of the expectations we can have in relation to the GLS Programme, from the changes that the new release of the GLS Programme has detailed:

-

Stabilised property cycle

Firstly, with the introduction of a tightening in the supply pipeline of private residential properties, we can expect a stabilised property cycle in the near future. The property cooling measures which were amended last year has pushed the demand for private residential properties down, which has resulted in a decrease in prices for these properties. With the current cut of supply, we can expect that the prices for these properties will stabilise as a result, without huge fluctuations in the near future.

As a result of this, the local property cycle will likely be stabilised, which means that you should probably wait till the prices are low again if you are intending to invest in private residential properties!

-

An increased focus on white sites

Apart from the main focus on stabilising the private property market, MND has also announced its increased focus on white sites. The reserve list has 4 private residential sites which include 1 EC site, 3 white sites and 1 hotel site. These sites have the potential to yield about 4,715 private residential units, 92,000 sqm GFA of commercial space, and 1,100 hotel rooms.

Among these sites, there are some future plans for the white site at Kampong Bugis, which is at the mouth of the Kallang River and boasts 1.1km of water frontage. According to the Urban Redevelopment Authority (URA), there are plans for this site to house a waterfront residential precinct which will be picturesque, car-lite, sustainable and which focuses on building a community in a mixed-use area. This area has the potential to yield 4,000 private homes and another 50,000 sqm of other uses which include retail, offices, community, sports and recreational.

The increased focus on white sites is a sign that more and more developments will be starting to incorporate mixed-use elements within them, and more new developments will be gazetted as a mixed-use one instead of a pure use development. The shift towards mixed-use developments also shows the direction that URA is intending for Singapore’s future – to integrate lifestyle elements into residential sites, and to transform Singapore into a car-lite environment by focusing on more green spaces in the city.

-

Smaller site developments for developers

Apart from an increased focus in white sites, the recent GLS Programme also introduced smaller sites for sale. The original parcel of land at Canberra has been split into two portions, Parcel A and Parcel B, with Parcel A being regular rectangular-sized and having a site area of 1.33 hectares, and Parcel B being irregular-sized and having a bigger site area of 2.77 hectares. This split of the original land parcel is most likely to be more attractive to developers, as the original land parcel could have cost more than $5 billion, which likely would have been shunned away even by the big developers.

Channelling focus to smaller site developments instead of huge ones also means that this is a chance for developers who are new to the market to start out. Projects are likely to be slightly cheaper than the ones built by big-name developers, and there could some new ideas in the making. Even though the Canberra site is split into 2, there will still likely be fair interest in both sites, because of the upcoming Canberra MRT Station which will be built as an infill station on the North-South Line.

GLS Programme & its effect on the property market

The GLS Programme is released every half a year, with information of several confirmed and reserved sites being released to the public. With this, developers and the general public will then decide on their course of action in that half of the year, with regards to the local property market.

The recent cut back of private residential supply will likely stabilise the prices of the property market, which are greatly affected by the changes in the supply and demand of the properties. With the information from the GLS release, you can then decide your investment endeavours in the near future, and plan for the opportune time to invest!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!