Essential Occupier – a term that constantly pops up on HDB’s website when you search for grants and schemes. But, what is it? Read on to learn more about the HDB essential occupier, as well as the pros and cons of structuring your home purchase under this arrangement .

Who are essential occupiers?

An essential occupier refers to a family member who forms a family nucleus with the owner, and qualifies under a HDB scheme for a HDB flat purchase. This is different from being an owner or co-owner of the flat. An essential occupier does not have any legal right or a share in the apartment.

A proper family nucleus can include:

- If married: you, your spouse, and your children

- If single: you and your parents

- If widowed, divorced, or separated: you and your children under your custody

- Orphaned siblings

- Fiancé and fiancée

And no, living in a HDB flat does NOT make you an essential occupier. Another thing to take note of: If you are listed as an essential occupier, you must continue to live in the HDB flat until the minimum occupation period is up.

How long is the minimum occupation period (MOP)?

5 years. This minimum occupation period is calculated from the date you collect your flat keys. However, this does not include, if any, the period you do not occupy the flat. This means that if you collected your keys in January 2017 but did not physically live in the flat for 2 years from 2020-2021, your 5 years MOP would only end in 2023, and not 2021!

When is it necessary to have an essential occupier?

If the flat owner is ineligible to purchase his/her own HDB flat, or fulfill grant or scheme requirements, an essential occupier is necessary. This could be due to restrictions such as age or divorce.

If you are not eligible to buy a HDB flat under the Singles Scheme as you are widowed, separated, or divorced, and your children are below the age of 35, they can form a family nucleus with you.

So, should I include my spouse as an essential occupier or a co-owner?

Generally, many couples choose to include both couples’ names under a Joint Tenancy. However, some other couples choose to have their HDB apartments to be only under the name of 1 spouse. This could be the case if there is only a sole breadwinner in the family nucleus. As one spouse does not benefit from the Central Provision Fund (CPF) contributions to service the mortgage, some couples prefer listing only the spouse that receives the CPF contribution as the sole owner.

Moving on to the pros and cons of having a HDB essential occupier

1. Additional Buyers Stamp Duty (ABSD)

If you and your spouse are planning to purchase multiple properties, this is a huge benefit for you. If you only listed 1 spouse as the sole owner, the other spouse could purchase a private property without paying ABSD on that property. Do take note that the 5-year MOP still has to be met!

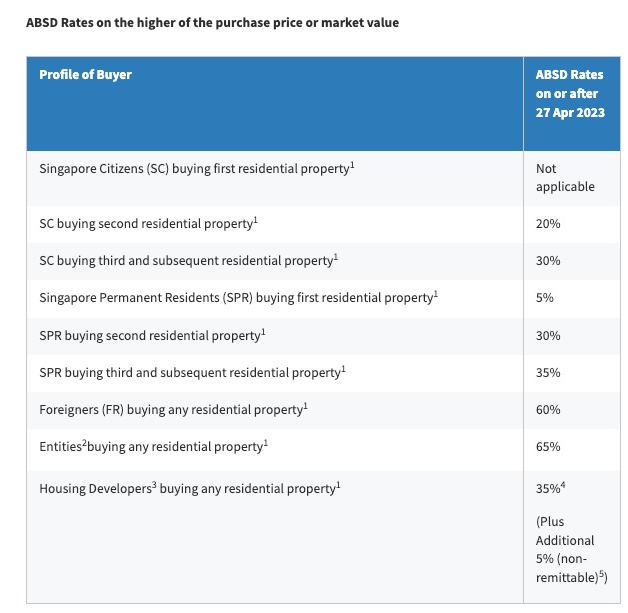

The ABSD rates are as follows:

*ABSD is charged on the higher of the purchase price or market value.

ABSD can be costly. So this is a large reason why many couples prefer listing 1 spouse as an essential occupier instead of a co-owner.

Of course, there are cons of listing an individual as an essential occupier too.

1. Usage of CPF

If you are listed as an essential occupier, you cannot use your CPF to fund the property and repay the mortgage. This can cause a huge blow to your finances in cases of loss of job or financial difficulties.

2. More difficult to secure a high loan amount

The bank is unlikely to grant you a large loan amount. As the loan amount is determined by the income of the owners of the property. The mortgage servicing ratio is capped at 30% of the borrower’s monthly income. Coupled with the fact that only the owner’s income is considered, this may be a huge disadvantage. If your income is not too high, it would mean that the banks will not lend you as much. You may have to fork out a larger downpayment amount, which may be a challenge for some.

What are the different manner of property holdings available for me if I do not want to use this scheme?

1. Tenancy in Common

Under the tenancy-in-common scheme, co-owners hold a separate and definite share in the property.

A tenancy-in-common is a form of property ownership where each co-owner holds a separate and definite share in the property. However, all co-owners are entitled to the enjoyment of the whole property regardless of their share in the property. Upon one party’s demise, ownership will be distributed as per his/her will. Or, according to the provisions stated in the Intestate Succession Act.

Here’s an example to make things simple:

Mr. Tan and Mrs. Tan purchased a HDB property. With 70% being under Mr. Tan, while the remaining 30% under Mrs. Tan’s name. If Mr. Tan passes away, 70% will be transferred to his beneficiary. Whereas the 30% will remain as Mrs. Tan’s share in the property.

2. Joint Tenancy

Joint Tenancy is a form of property ownership, where all co-owners have an equal interest in the property. Under this scheme, the amount that each individual owner contributed to the purchase of the property is not taken into consideration. Under the right of survivorship, when one co-owner passes on, the share of the property will fully be transferred to the other co-owner(s), regardless of what was stated in the deceased individual’s will.

Here’s an example to depict this manner of holding.

Mr. Tan and Mrs. Tan purchased a HDB flat together. Mr. Tan paid 70%, while Mrs. Tan paid 30% for it. However, they chose to purchase it under a Joint Tenancy agreement. Under this agreement, they would hold 100% of the property together , instead of 70% and 30%, individually.

Whether you purchase with an essential occupier, or joint tenancy or tenancy-in-common, all manners of holding have its pros and cons. So, make sure you weigh them before making a decision. Always do research on which would be the better choice for you!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!