With the rise in property taxes in efforts to cool the market, more young Singaporeans turn to listing their spouse as an essential occupier instead of co-owning their HDB flat.

Who is a HDB Essential Occupier?

According to HDB, an essential occupier refers to a family member who is part of a family nucleus, which is necessary to qualify for HDB. This is different from being an owner or co-owner of the flat, as essential occupiers do not have a share of the apartment or any legal right in it.

While it has been common for couples to co-own their HDB flat under Joint Tenancy, in which the couple owns the flat together as a whole, but some have chosen otherwise.

To do so, they choose to have their HDB apartment to be only owned by one spouse, and to list the other spouse as the essential occupier. In particular, some couples may have the husband as the breadwinner while the wife as a homemaker. Since the wife does not have a full-time job that contributes to her Central Provision Fund (CPF) to service the mortgage, the couple may choose to only list the husband as the essential owner.

What are the benefits of HDB essential occupier scheme?

1. Their next residential property purchase under spouse’s name is not subjected to ABSD

By listing a single owner and the other spouse as the essential occupier, the couple can purchase a condominium after the essential occupier fulfils the 5 years MOP. He/She will be regarded as 1st time buyer.

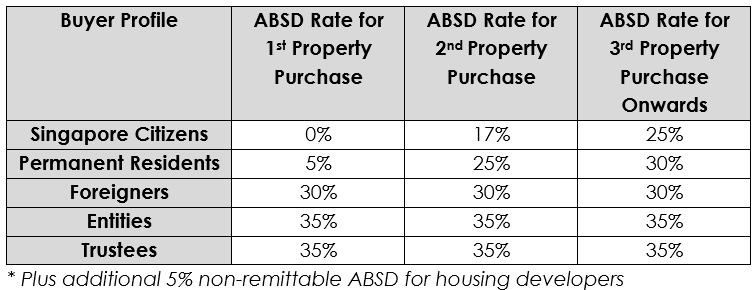

Although essential occupiers also have to wait for the Minimum Occupancy Period (MOP) of 5 years to pass, they are not seen as owners in the eyes of the law. Let’s have re-cap on the current ABSD table.

As of December 2022, the ABSD rates for the different buyer profiles are as follow:

2. Higher loan quantum for second property

While the current HDB may have a lower loan quantum due to the MSR, the loan quantum for the couple’s second property may be higher. Since the essential owner is not a borrower for the current HDB flat, he/she would not have any housing loans, and can therefore be granted a higher loan quantum by the bank for the couple’s second property.

For private properties, a second property loan by private banks can only be up to Loan To Value (LTV) ratio of 45% but a first property loan can go up to LTV of 75%.

What are the disadvantages?

However, there are quite a number of disadvantages that comes with this:

1. HDB Essential occupier’s CPF cannot be utilized for the property

In the case of the single owner losing his job, or are meeting some financial difficulties, the essential owner may not be able to help to repay the mortgage. In these uncertain economic times amidst the Covid-19 pandemic, such situations could be taxing on the couple’s finances.

2. Financial capability if young people wish to do this at purchase (Single income to take on MSR ratio)

Banks offer different loans based on the number of owners. By having a Single Owner, it would mean that the Mortgage Service Ratio (MSR) would be solely determined by the income of the owner. For HDB flats, the MSR cannot exceed 30% of one’s income which would only be imposed on the single owner.

On the other hand, a couple who co-owns the apartment is likely to get a better loan deal, since the MSR of 30% would be determined by the income of the 2 owners.

3. In the event of death, intestate succession kicks in without a will

Under Joint Tenancy, in which the couple would own the apartment together as a whole, if one spouse passes, the Right of Survivorship would automatically confer the ownership of the apartment to the surviving spouse.

For instance, Mr and Mrs Tan own a flat under Joint Tenancy. Upon the passing of Mr Tan, Mrs Tan will become the sole owner of the flat regardless of whether Mr Tan has a will.

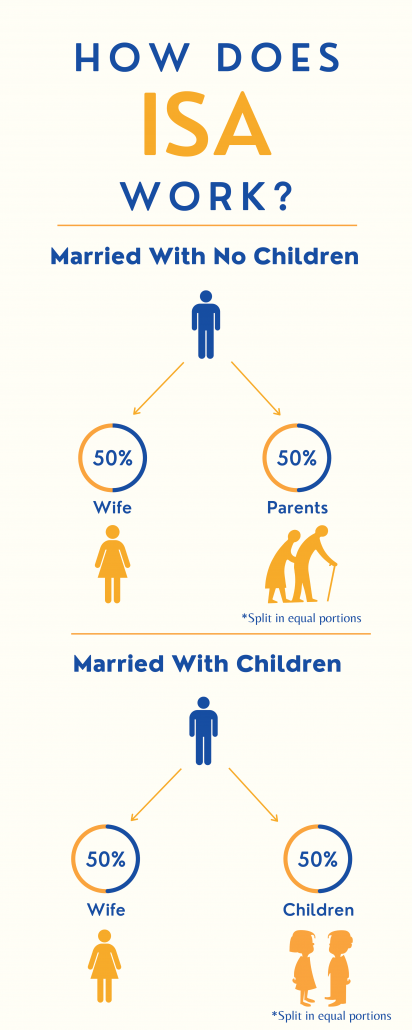

On the other hand, listing your spouse as the essential occupier will not give them such legal rights. If the spouse who legally owns the flat passes on without a will, the Intestate Succession Act (ISA) would kick in.

In this case, your assets would be liquidated and split accordingly to the ISA regulations. Essentially, your HDB flat would be sold and your family would receive the proceeds of the sale in the proportion shown in the infographic below.

Summary

While listing your spouse as essential occupier instead of owning it jointly may have its advantages, other considerations such as long-term financial status may deter you from choosing this alternative. Which camp do you belong to?

Regardless of which alternative you prefer, it would be wiser to speak to our mortgage advisors about your long-term goals before making a decision.

After all, a property could be the most expensive item you would purchase in your lifetime and not all considerations can be watered down to simply tax savings.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!