Purchasing a property is a big decision, as it is a household’s largest investment. It is especially so for Singaporeans, considering the exorbitant property prices due to our land scarcity. Hence, there has to be careful consideration before investing in property. One of the factors to be considered is the capitalization rate, or cap rate for short. What is a cap rate? Read on to find out what it means and how it affects your property investment decisions!

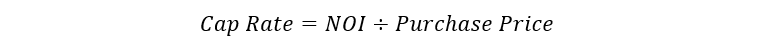

Capitalization Rate

A cap rate can be derived by taking the Net Operating Income (NOI) divided by the Purchase Price of the Property.

For those unfamiliar with NOI, it is the amount of income generated from the property, having deducted the vacancy voids, bad debt allowance, working expenses and debt service. This means it doesn’t factor the mortgage debt, and purely represents the property’s generated income.

The Purchase price is simply the amount paid for the acquisition of the property.

So, what does the cap rate indicate?

The cap rate will indicate the amount of risk involved in the investment, and the amount of expected returns from investment.

Given that all investors want to maximize their returns, simple reasoning will have one invest in a deal with the highest returns. However, it is not that straightforward, as risk have to be factored in as well. This balancing of the expected returns and the risks taken is known as the risk-return trade-off. Every investor has their own risk-return trade-off and therefore it is important to first identify yours before you make any investment.

Risk

To break it down, we shall start with how risk affects the cap rate.

A low investment risk means a low cap rate. Investors prefer property with low risk, as it means that there’s a lower chance of losing their capital investments. Hence, a low cap rate is a good sign to look out for when making any investment.

On the flipside, a high investment risk results in a high cap rate. Investors typically steer clear of such investments, although those with a high-risk strategy might decide to invest, in hope of higher returns. This leads us to our next point on returns affecting the cap rate.

Returns

Low expected returns indicate a low cap rate. Investors are willing to accept these low expected returns because of the lower risk that comes with it. Likewise, a high expected return will indicate a high cap rate. It is dangerous for an investor to base his investment decision in the hope of a high returns when the risk is also high. Thus, it is crucial to weigh the risk and the return carefully, both of which can be observed from the cap rate.

Factors affecting Risk

While we have briefly touched on the effects risk and return has on the cap rate, we have yet to identify the factors that affects such risk and returns.

1. Macro economics

If the general health of the economy is doing well and the purchasing power of households are high, there’s a greater likelihood that the demand for property is high. If this demand outweighs the supply, then the investment risk is low.

However, for an economy that is in recession, unemployment figures might increase and the household income falls. Demand for property in such a scenario will dip. Thus, there is greater risk involved.

2. Microeconomics

Property can be differentiated based on their location and their physical condition/amenities. Properties that are in a prime location with public transport networks or amenities nearby will definitely be in demand. Similarly, high demand will indicate low investment risk.

A property which is secluded or in poor physical state is not going to generate much interest. Demand will be low, hence, investment risk goes up.

3. Length of Tenure

Aside from economic factors, most buyers are also concerned about the property being owned in leasehold or freehold. The length of your tenure would determine how long you own the piece of real estate for. In the context of residential properties, HDB flats are fixed with a lease of 99 years while private properties have a mixture of leasehold and freehold.

Most homebuyers are willing to pay a premium for freehold properties as they hold their value better than 99-year leasehold properties over the long run. On the other hand, leasehold properties with 99-year tenure are usually cheaper and gives better yield than freehold properties. Hence, tenures play an important role in determining the return residential properties offer.

Limitations of Cap Rate

While the cap rate is helpful to determine the level of risks and expected returns for various investments, it is not indicative of the property prices. Since the cap rate is a ratio of NOI to purchase price, a low cap rate may indicate a relatively low net income from the property or relatively high purchase price. Typical of back-of-the-envelope calculations, cap rate lacks consideration of cash flows over time and usually only solely focuses on the returns for the year of purchase. Therefore, investors should not rely solely on cap rates as it lacks accuracy for long-term investment decisions.

Conclusion

On the whole, a cap rate is an important indicator of the risk and returns of any investment. Thus, investors must consider their own risk-return preferences before making any property purchase. Additionally, there are other factors affecting the risk level of property investment aside from the cap rate, and it is crucial to assess these factors as well. Therefore, cap rates are helpful for investors to identify the type of properties he should purchase quickly, but in-depth financial analysis are necessary to make sound financial decisions.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!