Many people view borrowing as debt, but leverage can actually be used as a tool for increasing wealth, such as real estate investments. That’s because borrowing money for an appreciating asset like real estate is most likely going to increase your net worth. With 13 years of experience working in banking and finance, Andrew Adriaan has won numerous awards and is known in the field for his expertise in managing mortgage portfolios. In this article, Andrew shares about using power of leverage, myths of borrowing and how leverage could be the secret weapon you have yet to unleash.

Borrowing is not always a debt

Growing up, you might have been taught that borrowing is bad. Like most Asians, most of us are afraid to borrow. We link borrowing with negative examples like buying items that depreciate and utilizing services that we can only enjoy for a brief moment. We’ve all heard of people who purchase expensive goods and enjoy lavish lifestyles by taking unsecured loans or by borrowing on credit cards, which often, if not managed properly, may result in bad debt.

Very often, it may seem intuitive to associate such unhealthy habits to taking housing loans. However, loans or real estate investments, if used correctly, could help you to achieve your financial goals. Simply put, leveraging is the act of strategically borrowing to increase your investment in a way that benefits your financial position. While borrowing simply for enjoyment purposes, would simply be debt.

Buying time with borrowed money

How many of us have missed an opportunity to invest in a particular asset simply because we did not manage to gather the funds in time? As best said by H. Jackson Brown, Jr., “Nothing is more expensive than a missed opportunity.” The cost of missing life-changing opportunities could be painful to bear, but you could avoid the issue by tapping into other resources.

One viable option is by taking a loan which essentially exchanges money for time – in other words, in return for grasping your opportunities in time, you would need to repay interest on your loan. Consider whether your loan could allow you to make timely investments that could generate a higher return in exchange with the cost of interest payments.

If you are not convinced yet, here’s an example.

Comparing today’s prices to 2020’s prices, in general, property is valued at 30% to 35% more, with a few exceptions in certain developments/areas. If you had been contemplating buying a property then, you might have missed the golden opportunity to instantly make at least 30% profit.

To illustrate this point, let me share an example. In 2020, Tom and Dick saw an opportunity to invest in real estate. Tom had the courage and purchased a 2-bedroom unit at $1 million, by applying a maximum loan of 75% and a minimum down payment of 25%. Dick, however, decided it was more conservative to save up and pay a 40% down payment as he did not believe in taking on too much loan.

3 years later, Dick is finally able to afford the $1 million apartment with his 40% down payment plan. However, he can only afford to buy a 1-bedroom apartment instead of a 2-bedroom apartment. This is because the same 2-bedroom apartment costs $1,300,000 today. Tom, on the other hand, has made a profit of $300,000 on paper value.

Thus, leverage can be a tool for you to better grab your investment opportunities at the right timing.

Borrowing Is Not A Risk, It’s A Security!

While most of you might see paying off your mortgage before turning 50 as a win, I see it as a disadvantage. You may choose to pay off the low-interest loans with your hard-earned savings.

After all, facing the daunting threat of being laid off and in debt is undeniable. That threat is a motivator to encourage you to use extra cash in hand to pay off your loans as quickly as possible. You may also opt for the shortest loan duration possible as you do not want to be a slave to your mortgage and to retire debt-free. When you are only considering your current state of finances (as a high-salaried employee), you may think that it is alright to pay higher monthly instalments. You may believe this is the best way to manage your finances or real estate investments, and that this is akin to being prudent with your money.

Ironically, you are actually putting yourself possibly at even greater risk, as you are slowing down on building your reserves or over-committing yourself to higher monthly instalments.

For instance, if you had chosen to commit to a shorter loan tenure and taken up monthly instalments of $5,000, you would have a much harder time repaying your mortgage as compared to a longer loan tenure with lower monthly instalments of $3,000. And if you finally choose to extend your loan tenure, only because you are facing a difficult time, such as unemployment or in need of a better cash flow, it may be too late, The bank will need to reassess your profile and is unlikely to offer you the loan tenure you need, given that you are in not-too-good financial situation.

This would mean that you would need to dig into your savings, but most of your savings would have depleted in your pursuit to repay the mortgage as quickly as possible.

At this stage, some may feel disheartened, and may turn to unsecured loans or personal loans which would incur much higher interest due for a smaller sum of money. Others may even turn to borrowing from family and friends, or from illegal moneylenders. In reality, individuals could have avoided this stress with better financial education and planning.

One of the many ways is to put yourself in a more favourable financial situation – by having a longer loan tenure and lower monthly instalments. While you may be paying slightly more interest on the loan, this improves your monthly cash flows, allowing you to be in a healthier financial situation and less vulnerable to sudden shocks or emergencies in your life.

The Secret Behind How The Rich Gets Richer

Aside from being born with a silver spoon, the other tried-and-tested way to get rich is by having healthy leverages and ensuring that the returns are higher than the cost of borrowing. If you invest your loan into an effective use and make a proper assessment, you can unlock a variety of opportunities with the money from your loan. Unless you have an everlasting supply of cash, leveraging on the loans allows you to diversify your portfolio more, reducing your risk.

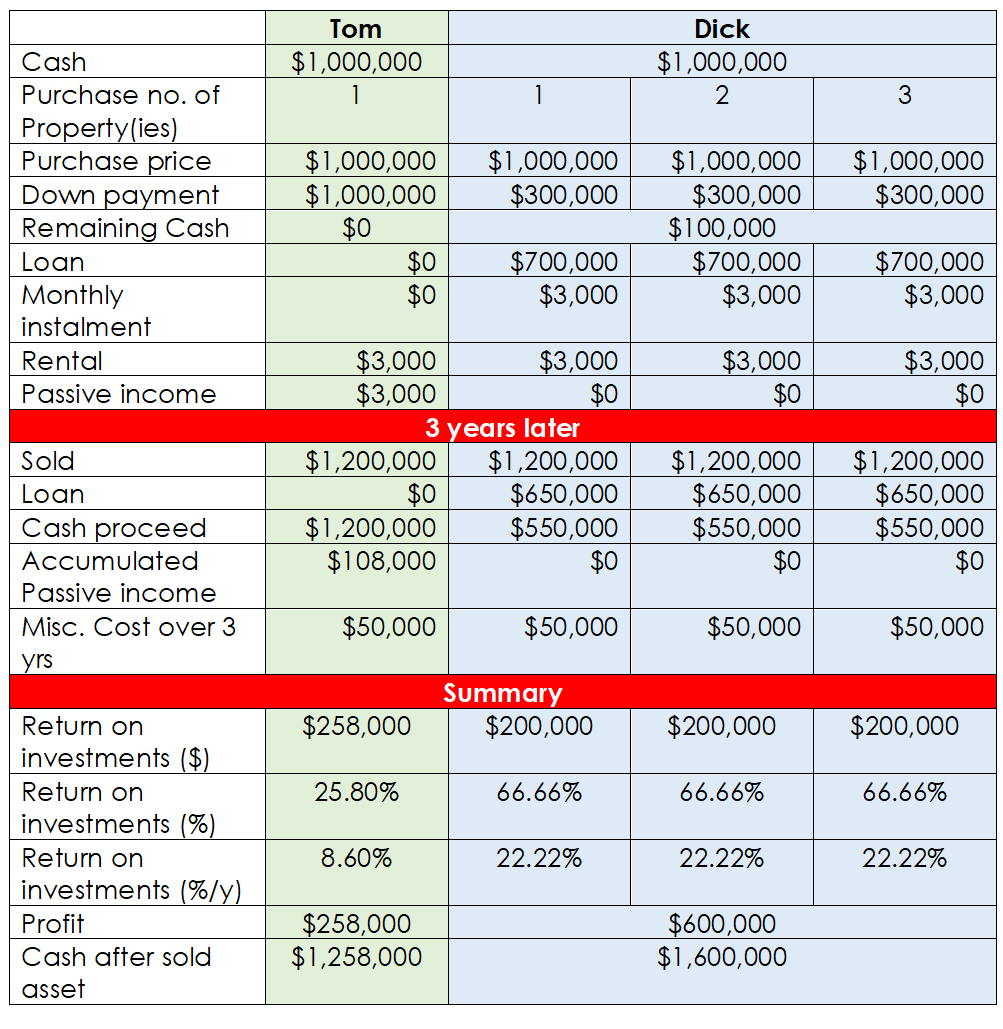

For example, Tom and Dick each have $1 million dollars. Being debt-averse, Tom prefers to take no loan at all and thinks that in this way, he gets the whole rental income as his passive income. He purchases a property worth 1 million and enjoys a monthly rental of $3,000.

On the other hand, Dick decides to leverage by borrowing 70% for each property. Putting regulatory restrictions and stamp duties aside, Dick manages to buy 3 properties with the same $1 million dollars by using leverage. After paying his monthly loan instalments, he has no passive income monthly.

Three years later, they decided to sell all their properties at $1,200,000 per property. The table below describes the outcome of their real estate investments.

In closing, I would encourage everyone to consider using leverage as a tool to maximize their real estate investments or financial opportunities to be in a better financial position. A loan can be your best friend when you are aware of its potential and able to use it wisely to grow your wealth or when it helps to achieve what is necessary. If you are still unsure whether leverage is a suitable tool for your unique situation, feel free to contact Redbrick Mortgage Advisory for a complimentary consultation to review your financial standing.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!