One of the most common mistakes is the lack of understanding on how you can maximise the usage of your CPF accounts to repay your home loans. We want to share an insight on how you can have a comfortable retirement plan while maximising your CPF savings to repay your home loan.

With his expertise as a mortgage banker and relationship manager specializing in wealth management in two major foreign banks, Colin Lim has helped homeowners finance more than SGD$1 billion worth of properties. Colin is an associate director at Redbrick Mortgage Advisory and will reveal why CPF is your best friend in retirement planning.

How does CPF work?

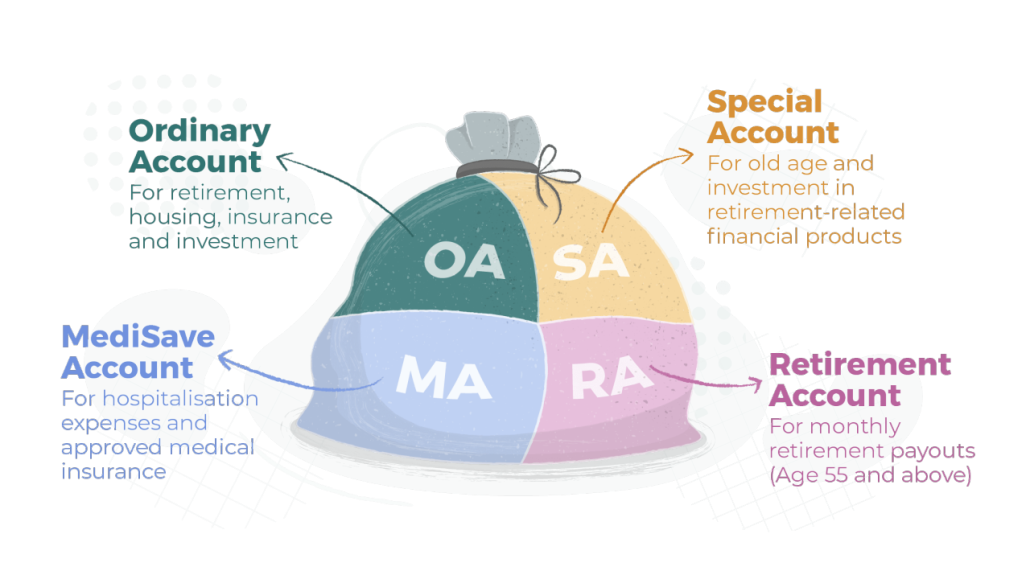

While most Singaporeans have actively contributed to their CPF accounts, not many of us know exactly what it entails. Simply put, CPF acts as a social security net and a savings account for you to repay your mortgage loan. It has 4 accounts, and each has its respective roles – Ordinary Account (OA), Special Account (SA) and Medical Account (MA). The fourth account, Retirement Account (RA) will be set up once you turn 55 years old.

The account that most of us are familiar with is the Ordinary Account (OA), which can be used to repay mortgage loans. What most of us don’t know is upon selling your apartment, monies used (or ‘borrowed’) from your OA will need to be repaid, not just the principal sum but also the accrued interest.

How much CPF savings do I need to retire comfortably?

Based on CPF’s calculations, you would require to set aside roughly $411,000 by age 55 if you wish to receive monthly pay-out of $3,000 during your golden years. While this might seem like a rather huge sum, a study by an insurance company has found that there is generally a gap in savings for retirement, and many start saving too late. If you are expecting to only rely on CPF Life for your retirement years, preparing for $3,000 monthly would not be too much of a stretch.

Now, we have the bigger question.

How can we achieve $260,000 in our Ordinary Account (OA) and Special Account (SA)?

Let’s take an average Singaporean fresh graduate as an example. Alice, aged 23, has the typical starting pay of $4,000. According to The Straits Times, there is an increment of 3.4% in income in 2021. If Alice has a similar increment in income, she would have racked up $100,000 in her OA and $30,000 in her SA by the time she turns 30. Alice gets married and purchases her matrimonial home, where she and her spouse empties their OA to foot the down payment.

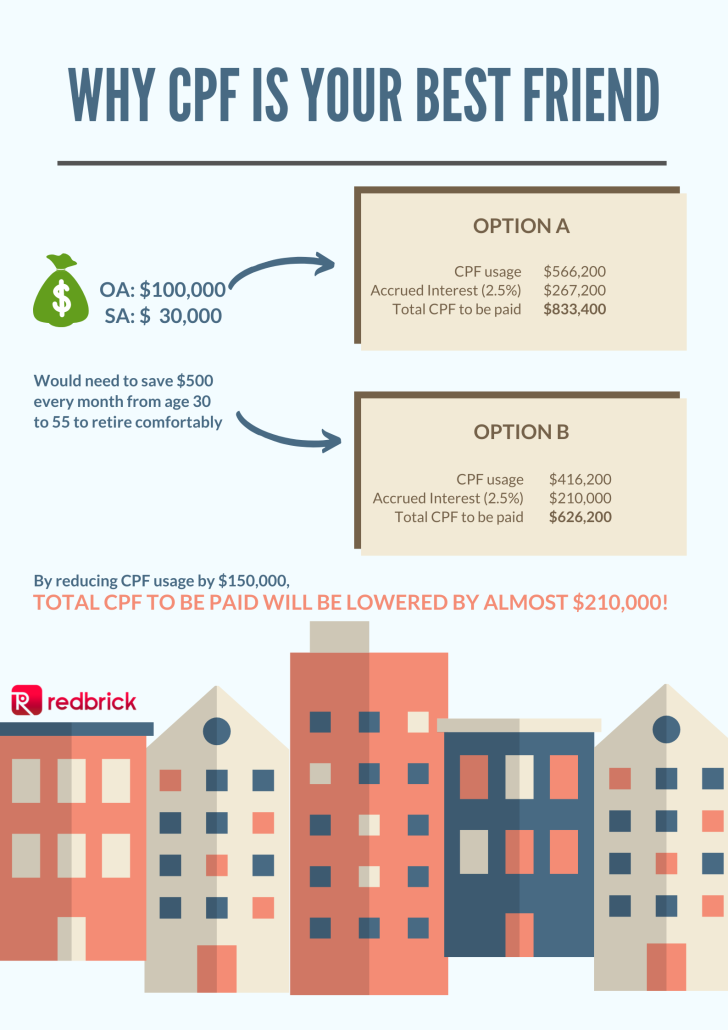

Subsequently, the couple attended a webinar on the importance of saving up for retirement. Feeling inspired, Alice and her husband decided to save up with the goal of $260,000 each, a general figure that would allow for a comfortable retirement for most Singaporeans. Based on calculations, she needs to save about $500 every month from age 30 to 55 in order to enjoy $260,000 of savings for her retirement.

Is it possible for Alice to save up this figure in a more effortless way?

In short, the answer is yes, and this depends on the couple’s decision on how they would like to finance their monthly mortgage.

For a typical home purchase at $500,000, the couple would need to pay monthly instalments of $1,554 (or $777 each), assuming the couple applied for a loan from a private bank instead of a HDB loan. Now, Alice can choose whether she wishes to pay her monthly instalments solely from her CPF or with a mixture of cash and CPF.

| Purchase price | $500,000 |

| LTV (75%) | $375,000 |

| Tenure | 25 years |

| Average Home Loan Interest Rate | 1.8% per annum |

| Monthly Instalments (can be paid by CPF or cash) | $1,554 in total, or $777 each |

Option A: Pay using only CPF

Based on our earlier assumptions, Alice would be earning about $5,000 a month. To simplify our calculations, her husband would have a similar income profile. Given the current CPF allocation rates, Alice’s monthly CPF contributions would suffice to repay her monthly mortgage payments. However, her CPF-OA would be empty as she would have paid $100,000 upfront for the down payment. She would not be able to save much over the next 25 years as majority of her OA contributions would be used to repay her instalments.

With the total CPF principal sum at $566,200 by the end of the 25-year tenure, the accrued interest will also snowball to roughly $267,200. This means that upon selling their HDB flat, Alice and her husband will need to repay over $833,400 (or $416,700 each) to CPF board after paying off their existing mortgage. Assuming that Alice sold a 5-room flat in Queenstown after repaying her loan, we can assume it was sold. The selling price is the median resale price of $935,000 according to Q4 2021 HDB resale statistics. This would mean the couple would enjoy $101,600 in cash proceeds after repaying their accrued interest, which is grossly insufficient for them to upgrade to a condominium at age 55 as the loan quantum offered would be much lower.

Option B: Pay using CPF and Cash

Now, what if Alice chooses to pay $500 cash for her installment instead?

This would mean that Alice would only need to repay $626,200, as she would have only incurred a principal of $416,200 by the end of the tenure and thereby a lower interest sum would have incurred. Based on this scenario, Alice and her spouse can save $250 monthly in each of their OA account. While it may seem insignificant, interest savings of $250 at 2.5% p.a. would also mean that the CPF monies to be repaid upon selling the property will also be lowered by almost $210,000!

Not only that, by saving $500 per month in OA, each of them will also have an additional $220,000 of savings in their OA after 25 years.

While the market offers numerous opportunities for investment and wealth accumulation, high returns are often accompanied with high risk. CPF-OA offers an (almost) guaranteed interest gain of 2.5% that is risk-free. Often, we forget about the best friend who has always been by our side, which is the CPF Board. By considering different financial options, saving up for retirement might be easier than expected!

If you have any inquiries about your unique situation, feel free to chat with us. Our mortgage advisors will review your current situation, property goals and help you maximize your retirement savings.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!