The chain of events that followed the 2007/08 financial crisis has taught us the importance of strong financial positioning which underpins the ability to firstly survive, and for those who were more informed, the importance of looking ahead to create opportunities for themselves. The devastating effects of COVID-19 in early 2020 presented a unique situation within the real estate market for investors who had the patience, holding back on property purchases during interest rate hikes while the protracted US-China trade war waged on through 2019, seemingly without an end in sight.

Many of us looked at what stood in front of us – impending job losses, a changing work environment and frequent updates on daily and weekly cases. On the other hand, new launches were getting snatched up as soon as they were released on the market. Why? For the economy to survive, people needed to spend rather than save, and the interest rates were cut in the name of quantitative easing, making housing loans significantly more attractive than they were a year ago.

Then came the cooling measures in December 2021. So, what do we do now?

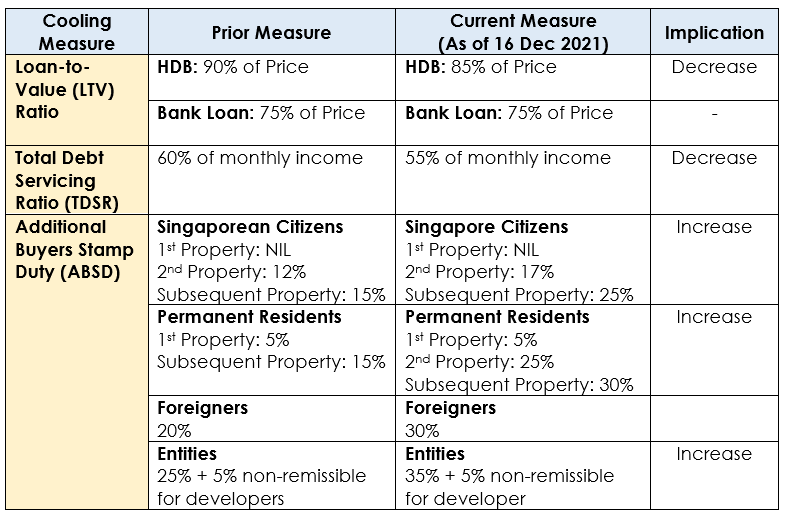

Summary of Recent Cooling Measures

Across the board, we see that these existing measures have firmed up. In certain situations, these measures may have a collectively large implication on your decision to purchase a second property for investment purposes. Understanding such nuances will therefore allow you to identify opportunities, rather than jumping on deals to overcome your fear of missing out.

1. New Launch Properties

When purchasing a resale unit, the ABSD is applied on the higher of either the property valuation or the purchase price.

It is important to note the distinction between the valuation of the property and its price. The key difference is that the price, or asking price, is the amount that a buyer pays in a property transaction, regardless of the property’s valuation.

Consider a seller who owns a property valued at $1.0m receiving multiple bids on his property. Due to this popularity, he manages to sell the unit at an asking price of $1.5m. The ABSD now applies to the higher of the two – the asking price of $1.5m.

These updated cooling measures would mean that if this property is the buyer’s second property (assuming he/she is a Singapore Citizen), he would have to now pay a 17% ABSD as compared to the prior 12%. In this scenario, it translates to a $75,000 increase in stamp duties, effectively 7.5% of the property’s valuation.

Purchasing new launches allow us to circumvent this problem, since they are sold at their valuation price when bought directly from the developer. Furthermore, purchasing new launches allow you to deduct this ABSD from your CPF.

In essence, purchasing new launches, or units with minimal price disparity between valuation and asking price would enable you to minimise the cash outflow towards the ABSD.

2. Purchase smaller units of lower quantum

In general, rental prices in the Outside of Central Region (OCR) have risen faster than Core Central Region (CCR). Within the OCR, we can find units of a lower quantum, which are more rental-friendly and also experience a greater level of desirability due to the ever-expanding transportation networks in Singapore. It is therefore not uncommon to find private residential units presenting themselves as attractive rental properties under $1.0m.

Two driving forces may support your decision to purchase an additional property for rental purposes. Firstly, COVID-19 has extended the waiting time for married couples to receive their keys to their BTO flats. Those eager to seek alternative living arrangements for a duration of 2-5 years may choose to rent while waiting for their next opportunity. They would therefore seek rental apartments within a budget that would be comparable to their expected mortgage on a BTO.

Secondly, the stark increase in ABSD for foreigners may create an added barrier to property ownership in Singapore. This would therefore encourage them to find alternatives within the rental market.

Since the quantum of these smaller units between 500-700 sqft within the OCR are generally lower, the marginal gross ABSD paid on these units are still reasonably within the budget of Singaporeans already looking to purchase properties for investment purposes.

3. Older developments that present attractive en-bloc opportunities

Developers in Singapore are currently facing a depleting land bank. Alongside this, their operations have been significantly affected by the impact of COVID-19. On one hand, we have observed that large developers retain the capacity to heavily out-bid their competition on Government Land Sales (GLS) sites.

Alternatively, the remaining developers may react similarly to homeowners purchasing smaller units in our previous point and are likely to pursue acquisitions of older and smaller condominiums, presenting owners with an en-bloc opportunity.

Older and smaller properties do have their advantages in an en-bloc situation. The higher ABSD of 35% applied to developers is partially remissible if they manage to sell all units within five years. A smaller plot typically relates to a smaller project, which makes this opportunity more attractive in the eyes of a developer.

As the owner, you may also be able to command a premium considering the smaller number of units in the existing development. In other words, the pie can be sliced less thinly. With the intensification and renewal of decentralised neighbourhoods, this phenomenon is not uncommon, but we advise that speculation of profitability should be carefully measured in tandem with proper financing in place in case en-bloc attempts fail.

4. CCR properties

Pursuant to the significant increase in ABSD for foreigners, the high quantum associated with CCR properties will result in a significantly higher ABSD. Quality developments, increased accessibility and a lower quantum as seen in new OCR projects are factors that bridge the gap between properties in these two regions.

It may be reasonable to conclude that apart from the prestige of living within the CCR, OCR properties present their own suite of benefits. Then again, prestige is less tangible than the convenience and amenities provided by the property and its surroundings. COVID-19 has shown us that workplaces can be decentralised, and that the nature of shopping malls have changed in the wake of e-commerce.

However, while OCR and RCR properties present significant rental opportunities, lower demand for CCR properties due to the recent cooling measures may leave a gap in the market for you to fill as a means of long-term capital appreciation. Feel welcome to speak to our mortgage advisors regarding long-term financing in light of your other real estate goals!

5. Dual key properties

Dual key properties are single properties that have been designed to be split into two separate sub-units. Effectively, you pay the ABSD on one additional property, while being presented with the ability to rent the two units out separately. If you purchase a dual key property as your second property, you have the benefit of a third rental property without having to pay the ABSD of a third property.

In comparison to smaller units (500-700 sqft) in the OCR, dual key units are usually priced higher, and therefore have not experienced the same popularity. However, it allows one to maximise the ABSD paid on their second property. Since such units are more available in older properties, such a strategy may enable you to position yourself for a possible en-bloc a few years down the road.

As usual, despite the significant impact that the ABSD plays on your property investment decisions, the largest impact comes from your available budget and how your home equity can be stretched within your appropriate levels of risk. Reach out to us at Redbrick Mortgage Advisory to chat about how you can maximise the current interest rate climate as part of your long-term real estate strategy!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!