Until most recently, SOR and SIBOR rates were traditionally used to price mortgage loan rates here in Singapore. However, it was announced back in Aug 2019 that the Singapore Overnight Rate Average (SORA) will be the new benchmark SGD interest rate that would eventually replace SOR and SIBOR.

Following the gradual uncovering of a scandalous manipulation in the London Inter-Bank Offered Rate (LIBOR) which directly affects the Singapore Dollar Swap Offer Rates (SOR), it was apparent that there was a need to have a transaction-based benchmark that promotes greater transparency and offer greater stability to customers. Hence, the motivation for SORA also because it can be calculated independent of LIBOR, and thus reduces uncertainties when LIBOR ceases in 2021. SORA is a volume-weighted average rate of unsecured overnight interbank SGD transactions in Singapore and is in many ways like SIBOR, but with 2 keys differences: a) SORA is purely transaction-based, and b) it has no “term” component (unlike SIBOR: 1M SIBOR, 3M SIBOR etc).

Just this month of July, OCBC is the first bank to launch Singapore’s first-ever SORA pegged mortgage rate made available to prospective buyers of completed private properties with a loan sum of at least $1,000,000. In this article, we will be introducing to you the benefits of SORA and what you can expect moving forward!

Before we dive right in, let us take you through SIBOR, which was adopted as the primary mode of interest rate benchmarks. In simple terms, SIBOR reflects the price at which local banks in Singapore are willing to lend unsecured funds to each other. Yes, even banks themselves may need to take up loans from each other as they are only required to hold a portion of the money deposited with them as reserves! SIBOR then takes the average rate, which is then used in the computation of your monthly mortgage loan interest calculations. This is why home owners who take up private bank loans pay differing amounts of interests per month on their loan; the higher the SIBOR rates, the higher the interest payable each month on your mortgage.

At the beginning of the new year in 2021, banks will phase out SOR-related interest rate benchmarks and replace them with SORA. Those affected will include individuals who have loans previously pegged to SOR rates. Financial regulators and relevant authorities are in the process of paving the way for an easy transition into the use of SORA.

So what are the benefits of SORA and how does it differ from SIBOR?

Let us look at the recent offerings from OCBC for both their SIBOR and SORA pegged mortgage rates for a fair comparison.

| 3M SIBOR (current) | 90 day SORA | How you benefit? | |

| What it is | An interest rate benchmark pegged to 3-month SIBOR and reviewed every 3 months | An interest rate calculated on the past 90 working calendar days

*to note: Rates on Saturday, Sunday and Public Holidays will be computed based on the average rate from the previous working day *if SORA on a particular day is 0 or less than 0, the bank will apply a rate of 0 for computation |

It promotes greater robustness and transparency, with daily SORA rates made available on MAS. |

| How is the rate amount being determined? | Determined by the rate of Interbank Loan of unsecured funds, compiling the rates from 20 banks and ranking them, removing the upper and lower quartiles which would leave us with 10 banks, and their rates are averaged to give the day’s SIBOR | SORA is the average of all recorded transactions of Interbank loan involving unsecured funds brokered within the local arena between 9am-6.15pm. Interest rates for the first month are computed using the simple average daily SORA rates for the 89 days preceding the loan disbursement day | SORA is therefore not susceptible to manipulation and daily calculation of the simple average over a fixed 90-day period offers you a more stable interest rate |

| Loan Details | Flexibility of pre-paying up to 50% of the loan during the 2 year lock-in period

· Year 1: 3M SIBOR + 1.00% · Year 2: 3M SIBOR + 1.00% · Year 3: 3M SIBOR + 1.00% · Thereafter: 3M + 1.00%

|

Flexibility of pre-paying up to 50% of the loan during the 1 year lock-in period

· Year 1: 90D SORA + 1.28% · Year 2: 90D SORA + 1.28% Thereafter: Mortgage Board Rate + 0.88%. From the third year, pricing switches to the Bank’s Mortgage Board Rate (MBR) availed at 1.00% for this pricing package.

|

Offers you greater flexibility of pre-payment due to 1-year difference in lock-in period, plus banks will provide homeowners with the option of switching up for another pricing plan after the lock-in period at no charge |

From the above, it is important to note that SORA is more of a backward-looking rate that takes the simple average of its past 90 day transactions to derive its benchmark pricing and hence offers more stability as compared to SIBOR which is a forward-looking rate and is therefore exposed to market factors/conditions.

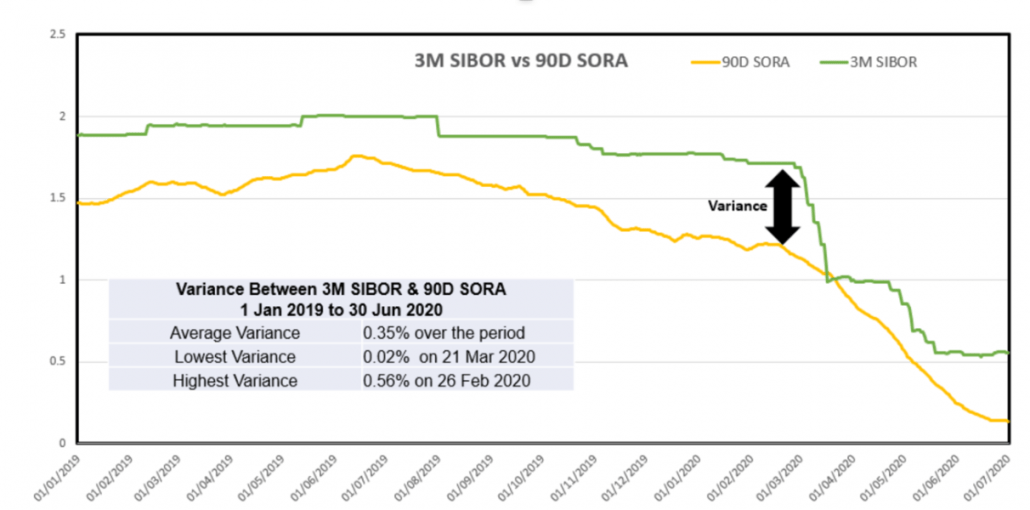

As SORA is still under pilot testing, it is yet to be determined if interest payables under the SORA-based loan schemes are cheaper than their SIBOR counterparts for its users as SORA is after all still an overnight rate that is prone to changes on a daily basis and appears to be more volatile. Hence, SIBOR pegged mortgage rates are still very much sought after. However, based on past market statistics, it is observed that SORA-pegged interest rates tend to be relatively lower than SIBOR-pegged rates as seen in the image provided by OCBC below:

While it remains uncertain on how things may pan out, Singapore should be lauded for its attempt to establish its own footing targeted at protecting the interests of Singaporean loan borrowers against external pressures such as the cited LIBOR scandal. For loan borrowers who may be uncomfortable with the switch to SORA, they may speak to their respective bank representatives who may be able to offer alternatives such as the existing fixed-rate loans, Fixed Deposit, Board rates or SIBOR rates. In the meantime, SIBOR rates are expected to remain subdued in the short term due to the high debt loads that that various central banks have taken on. Should you wish to refinance your home loan, feel free to speak to any of our mortgage advisors who would be more than willing to assist you!

As Singapore seeks steady and gradual recovery post-COVID 19 and Singaporeans hopeful for new changes post-election, more changes like SORA could be rolled out to meet the changing needs of the local climate against that of the larger economic arena out there. Nonetheless, let us all have faith and stand united as a nation as we emerge stronger from each hurdle!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!