In this article, we will dive into the details of loans. While many of our readers may already be familiar with home loans, this article addresses a broader scope to provide you with a wider understanding of the usage of debt beyond paying for your home.

There are two main types of loans – secured loans and unsecured loans.

Secured loans

A secured loan is similar to a housing mortgage where the asset (your house) is pledged to the lender as collateral. In a situation where the borrower defaults on their loan obligations and fails to repay the lender, these assets can be repossessed and liquidated on the open market to recover the cost of the loan.

On the other hand, if the value of the collateralised asset falls below the loan amount, the borrower may have the option to reduce his outstanding loan balance by repaying a portion of the loan, or by collateralising more assets.

As seen in the 2008 financial crisis, debt products known as Collateralised Debt Obligations (CDO) were in theory backed by the value of homes. In a nutshell, the exception in this situation was that they were highly leveraged in an environment where credit was easily available.

Unsecured loans

For the lender, the risk profile of an unsecured loan is much higher, since the loans are not backed by assets as collateral. As such, interest rates on unsecured loans are relatively higher. Some examples include personal credit cards, bank overdrafts and lines of credit.

These two broad categories can be further distilled into term loans and revolving loans

Term Loans

This is the type of loan that most people think of when you mention “loan”. These are typically found in housing loans and student loans. They usually apply to loans for larger sums of money and as such, are repaid over a period of multiple years with a fixed loan tenure. Since the loan tenure is considerably long, the interest rates charged are lower than revolving loans and may utilize a fixed or floating rate.

However, most term loans do not offer the flexibility of repaying the outstanding loan balance early. This differs across loan packages and greater flexibility usually comes at the expense of a higher interest rate. Furthermore, after the loan has been fully paid up, you will need to contract for a new loan if you wish to access more funds.

Revolving loan

A revolving loan, or a revolver is often seen in the form of personal lines of credit and credit cards. It simply allows you to use a stipulated amount of money known as a credit limit. Once this credit has been repaid, you are free to access the full amount again. Essentially, a revolver enables you to access sums of cash in the short term before they become immediately available.

As mentioned earlier, this added flexibility results in interest rates that are relatively higher than those charged on term loans and come in the form of fixed or variable rates. Unlike terms loans, revolving loans are an ongoing contract with your credit provider, and repaying your monthly credit simply refreshes your line of credit, leaving you free from fixed instalment payments.

The cost of borrowing

When taking a loan, it is not uncommon to firstly think about the interest rate charged on a loan. Lenders understand this and tend to advertise attractive interest rates to grab your attention. However, the additional costs hidden behind processing fees, legal costs and penalties do add up to the overall cost of your loan and are not often given enough attention as it should.

We will first begin by explaining the differences between a flat rate loan and a monthly rest rate.

Flat Rate Loans

In a flat rate loan, the interest payable on your loan is calculated based on the initial loan amount. This means that your fixed monthly payments will contribute the same exact amount to interest payments and to repaying the loan principal.

Over a longer period, this may result in significantly higher interest payments. Even though you could hypothetically stretch out the loan tenure, since the interest charged on your loan is based on the principal rather than the outstanding balance, this amount can be quite significant.

Monthly Rest Rate

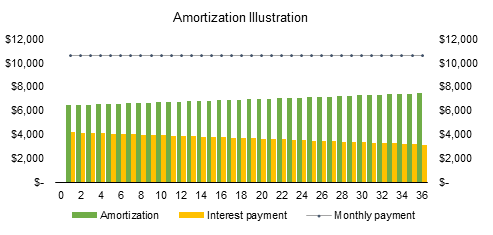

Unlike the flat rate loan, the interest payable is calculated based on the outstanding loan balance at that given month. Such an arrangement is most often seen in home loans. As the loan is amortised, the outstanding loan balance reduces which leads to a lower interest payment as the months go by. However, since the borrower services the loan with a fixed amount every month, the proportion of this sum which contributes to paying off the loan increases over time.

Types of Interest Rates Charged

Interest rates usually come in one of the two forms – fixed rate or floating rate.

A fixed rate relates to a fixed interest charged by the bank or lender. However, unlike one would imagine the name implies, a fixed rate loan does not charge a fixed rate for an indefinite period. Instead, the fixed interest rate applies only for a given lock-in period, which usually lasts 2-3 years before reverting to a floating rate.

A floating rate refers to an interest rate which is pegged to an interest rate benchmark such as the Singapore Interbank Offering Rate (SIBOR) or more recently, the Singapore Overnight Rate Average (SORA). The bank or borrower would then add their own “spread” on top of this rate, and typically offer the product as a 1-month or 3-month SORA loan. The time period relates to how frequent the refresh period occurs, corresponding to the compounding period of the historical SORA rate.

Do read our other article here on how to determine which loan would work best for you in any given economic environment

Effective Interest Rate

The Effective Interest Rate (EIR) reflects the true cost of our loan. In contrast, the advertised interest rate only gives us an idea of the nominal interest rate on loan. Calculating your EIR allows you to determine the interest rate of your loan if the compounded interest was payable annually at the end of each year.

Based on this principle, it can be expected that 1 repayment of $12,000 at the end of the year results in a lower EIR than 12 repayments of $1000 every month. We can also expect that the EIR of a flat rate loan would be higher than the nominal interest rate since the interest payments across the entire tenure of the loan is based on the principal. Alternatively, the monthly rest loan charges an interest based on the outstanding loan balance at the end of each month, and its EIR would be close to the nominal rate.

Using the EIR gives us a better basis of comparison when comparing against loans by providing a more standardised figure. However, loans can vary greatly within the market, and even from a cost perspective, there are multiple factors to consider.

Other Costs

Listed below are some additional fees to take into consideration when seeking a loan:

- Processing fees – A fee charged for processing your loan application and to conduct the necessary credit checks

- Excess charges – For drawing more than the stipulated overdraft limit

- Late payment charges – Penalties for untimely repayment of loans

- Default charges – Charges imposed where the borrower is unable to make payment

- Early repayment charge – Imposed for paying part or the entire outstanding loan balance prior to the end of the loan tenure

It is worth mentioning that processing fees should be accounted for when calculating the EIR, since it is considered a fixed cost in the context of a loan.

Determining a loan tenure

So, you are almost done and ready to sign off on that loan contract, now you have to decide a tenure! A general rule of thumb is that a shorter loan tenure exposes you less to interest. However, this must be balanced with your ability to service the loan throughout the tenure and if you have plans to take on any subsequent loans.

We recommend requesting a repayment schedule for the loan in question to aid you in proper budgeting throughout the loan tenure.

The world of loans is complicated, and for the uninitiated, “debt” can often strike fear in our hearts. We hope that with today’s article, you are now more well-equipped to take on the jungle of financial jargon. In any case, our highly experienced brokers at Redbrick Mortgage Advisory are more than willing to guide you on your journey, just reach out!

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!