My friends have been teaching me to how to cycle for many years, but I only picked it up in my twenties. The advice they gave was truly simple. “Look straight and just pedal!” Yet, I always fumbled because I was more concerned about the obstacles that I do not want to bang into. I was not looking at where I needed to go. In a similar way, investing is also quite simple in theory, but most of us fumble because it is easy to turn our focus away from what is most important.

Value Investing

Ever heard of the term ‘value investing’? Perhaps more than ever, the current bumpy markets warrant us to refocus and examine what value investing is in greater depth. Quoting Charlie Munger, “all intelligent investing is value investing”. If anyone wishes to invest and wishes to do so successfully, he should, according to Munger, be a value investor.

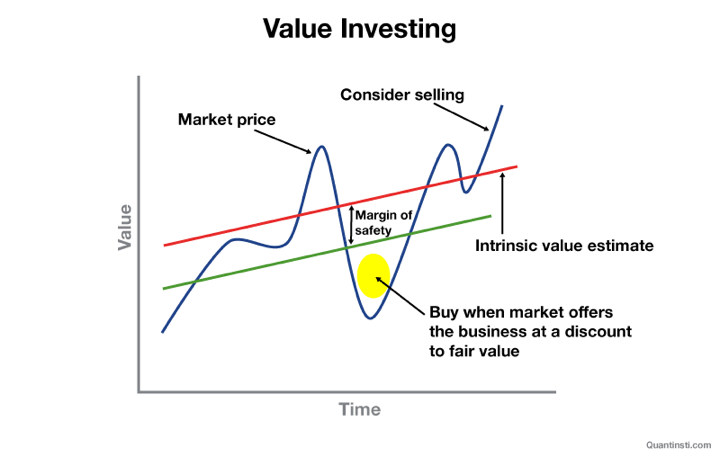

So what is value investing? Benjamin Graham, the father of value investing, taught this concept of buying stocks at prices well below their intrinsic value (with what he calls a margin of safety). Warren Buffett further developed this concept and advocated buying wonderful companies (companies of great value) at fair prices. To Buffett, a stock is first and foremost a business. There is a lot more to consider than simply looking at the stock’s price on the stock exchange. Of top priority to Buffett is how the business is being managed, as compared to how people speculate on the stock prices.

For example, if someone wishes to invest in an F&B establishment, he should be concerned about all the factors pertaining to the business’ value. He would likely make a trip to the restaurant, sample the food, experience the service and evaluate whether the business is making money. At the most fundamental level, he would want to read the financial statements to assess the profitability and financial health. If he sees the restaurant having raving Google reviews, snaking queues round the clock, and overflowing cash in the cash register, he would be emboldened to invest more into the business. This would clearly be a business of great value.

Supposed you managed to buy this restaurant, would you suddenly be worried if a stranger walked in asking to buy it at a significantly lower price than what you paid? If you are confident you have bought a great business, you are free to ignore the stranger. There is no reason for you to take the low price he quotes more seriously than your own assessment of the worth your business. However, in reality, many “investors” take the everyday price quotations from strangers in the stock markets as the gospel truth of the worth of their businesses. Letting it sway them to extreme emotions of exuberance and desperation. What a sadistic way to sabotage ourselves unnecessarily, don’t you think?

Conclusion

Investing in the current market conditions would certainly feel more bumpy and dangerous given the way the economy is headed and how the stock market has been fluctuating. It is like cycling down a long windy and bumpy slope. But just like how cycling down a steep slope gives you an additional push, investing in valuable companies at such market prices can give your investments a boost.

A seasoned cyclist knows that he needs some awareness of where the obstacles and boundaries are, but at the end of the day, he would focus on the path he wants to go and just pedal. Likewise, investors should give some consideration to prices, but a greater focus has to be on the value. As you continue to invest diligently during this period of lower prices, rather than ‘losing money’, you are essentially storing wealth for yourself as a value investor.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!