Unicorn believes that in 2022, the market would probably take 1 step back first before it takes 3 steps forward – and the first “half” will be marked by lots of rain while the second will probably bring more sunshine.

Inflation had turned out to be the game changer, which was what Unicorn Financial Solutions had been sharing since last January when Unicorn suggested that inflation might not be as “transitory” as Fed said it was.

Of course – inflation isn’t what the stock market is afraid of – but the increase of interest rates and the liquidity drying up. This is also what is shaking up the stock market, especially growth stocks.

FIRST “HALF”

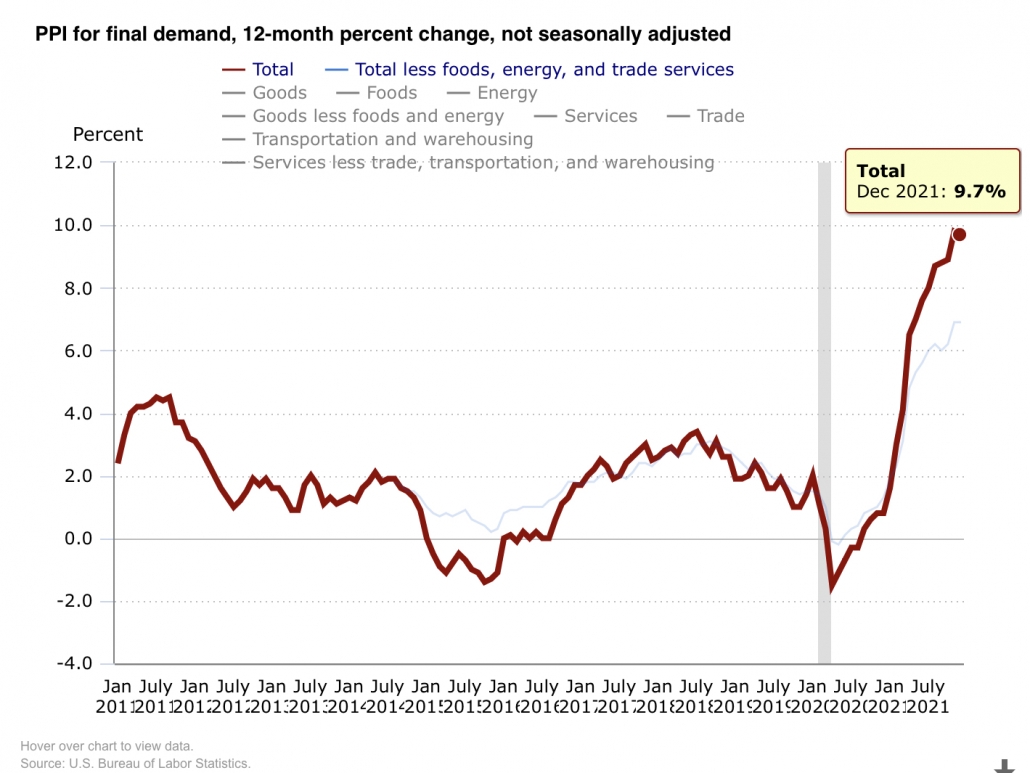

The US inflation rate had steadily increased to hit 7% in the last month of 2021, and it was the highest in almost 40 years1. This was pushed up by the Producer Price Index (PPI), which

hit 9.8% last November2, and represents the input costs to producers. In December, the PPI remained high at 9.7%.

And as inflation hits the roof, the Fed got to work. In order to tamp down inflation, the Fed signalled 3 rate hikes this year. While the market is gloomy with the “promise” of rate hikes, it is likely to be quite volatile, with growth stocks taking the biggest hits. NASDAQ, representing some of the growth stocks, is already down more than 16% and might take some time more to find its ground.

SECOND “HALF”

Unicorn think that while the first “half” is dull and grey, the second “half” would be bright and sunny as the growth stocks will probably stage a comeback as the Fed eases on their actions

when inflation calms down.

Announcing 3 rate hikes this year also marked a change in the rhetoric from re-nominated Fed Chair Jerome Powell as he had earlier mentioned that there would be no rate hikes till

2024.

In fact, this also signalled how ready he IS to pivot on policies once they no longer serve their purposes.

He could probably have been instructed by the US President Joe Biden to do what he can in order to lower inflation (by saying Fed will increase interest rates) to keep voters happy.

Eventually, he might not have to raise rates as many times if the inflation had already dampened due to what he SAID of the actions that Fed might carry out.

Unicorn also think that the Fed Chair’s words might be more bark than bite as the Fed did not buy that much corporate nor junk bonds eventually when they first announced in March

2020 that they will carry out QE Infinity in order to support the economy in COVID times.

ACTION TO TAKE

1. Top up your investments

Besides growth stocks, another area that is relatively attractive is China after a 30% drop. As China emerges from a regulatory storm that affected their stock prices, Unicorn still believes in the value of the Chinese companies for their fundamentals are intact. President Xi Jinping, who is entering a unprecedented third term as China’s President, also looks to having a strong economy and healthy stock market as a reflection of his leadership. Unicorn also think that it’s an opportunity to pick up good buys currently in the first “half” especially with regular monthly investments as the market gets more volatile.

2. Buy in as and when you have a surplus

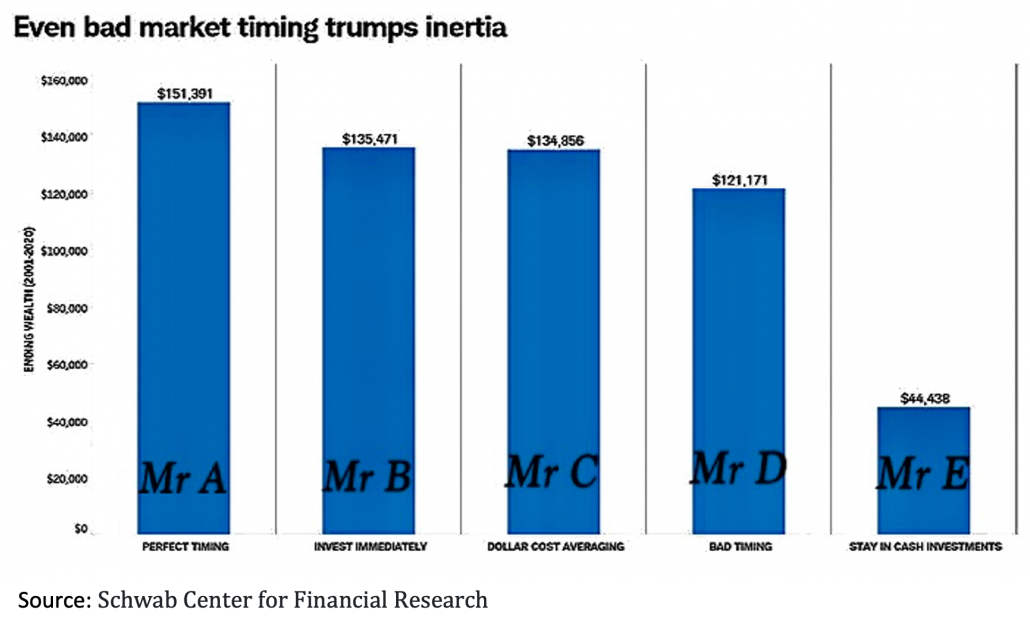

Trying to time the market becomes an opportunity cost because “timing the market perfectly is nearly impossible, the best strategy for most of us is not to try to market-time

at all. Instead, make a plan and invest as soon as possible4”.

Important Notice

The information herein is published by Unicorn Financial Solutions Pte. Limited. (“Unicorn”) and is for information only. This publication is intended for Unicorn and its clients or prospective clients to whom it has been delivered and may not be reproduced or transmitted to any other person without the prior permission of Unicorn. The information and opinions contained in this publication has been obtained from sources believed to be reliable but Unicorn does not make any representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose. Opinions and estimates are subject to change without notice. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. Unicorn accepts no liability whatsoever for any direct indirect or consequential losses or damages arising from or in connection with the use or reliance of this publication or its contents. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. Unicorn does not accept liability for any errors or omissions in the contents of this publication, which may arise as a result of electronic transmission. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Unicorn Financial Solutions Pte. Limited Reg. No.: 200501540R

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!