As negative as it seems, fear is not necessarily a bad thing. Consider how, for example, the fear of being knocked down may help us cross the road carefully. However, if the fear prevents us from crossing the road at all, then it is not so healthy.

How does fear impact investing?

Stanley Druckenmiller, known for producing an average return of 30% per year for many years for his hedge fund, once lost $3 billion during the dot-com bubble with a single phone call. He had steered clear of speculative stocks for a very long time, only to cave in at the very tail end of the bubble. As accomplished as he was in investing, he was not spared from bad investment choices resulting from fear.

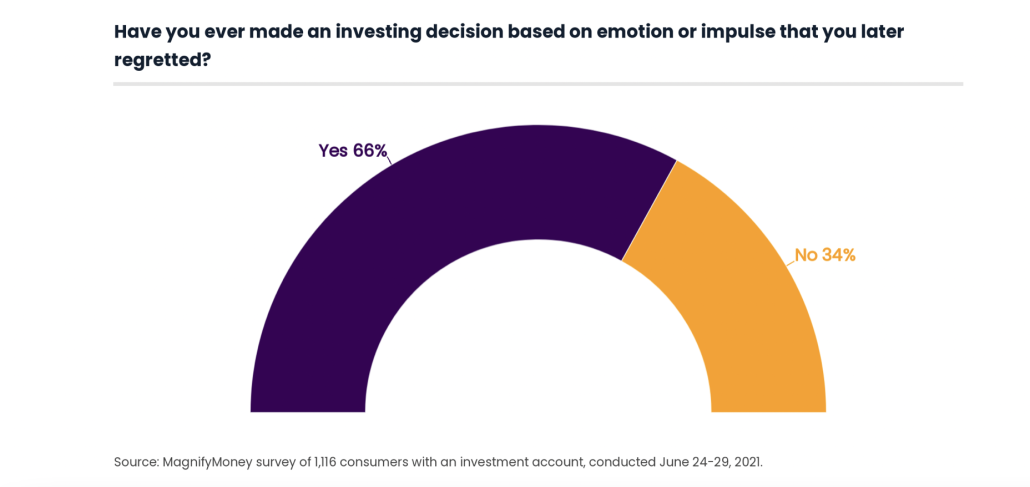

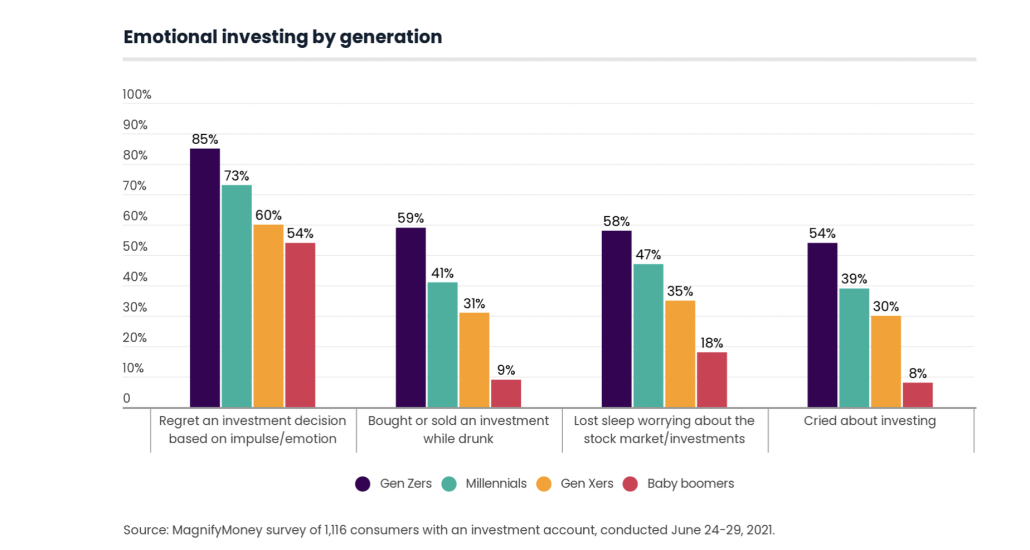

A recent survey conducted by MagnifyMoney reported that 66% of investors made an emotionally charged decision they later regretted, with a high percentage being Gen Zers. 58% of the surveyed agreed that their portfolios would perform better if emotions were left out of the equation, but that is easier said than done.

How do we overcome fear and invest successfully?

According to Investment Guru Warren Buffett, when interviewed during a period of wild market fluctuations, he told investors: “Don’t watch the market closely”. His intention was to prevent investors from being fearful about the fluctuations and end up buying or selling on impulse. An easy way to invest ‘without watching the market closely’ would be to create a system, using a strategy like dollar cost averaging (DCA). Think about how effortless it is, for example, to brush our teeth. This is because it has become our daily habit – most people can brush their teeth on autopilot. Thus, among many other benefits, DCA can help investors invest in a systematic and emotionally managed way. It is effective because the investor keeps investing without any pressure to constantly analyse price movements.

Dollar cost averaging will also calm the nerves of the investor. How so? Have you ever looked down from the top of a long escalator and felt dizzy? Or felt overwhelmed while burning the midnight oil for a major exam? Compare that to descending via a series of shorter escalators or studying more consistently for regular quizzes. Any big and daunting issue in life often feels more manageable when it is broken down to smaller bits. The stress involved in investing a percentage of your income on a monthly basis most certainly differs from investing a sizeable portion of your total assets at one go. This is what DCA can do for you and your emotions. (For the strategic advantage of DCA in capturing good investment opportunities, see our previous article).

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!