Private properties make up approximately 26.7% of Singapore’s residential market. These are privately owned properties that may be landed or non-landed properties. More details on landed properties can be found here.

In this article, we will focus more on the non-landed private properties in Singapore. These include apartments, condominiums, executive condominiums, etc. Apartments and condominiums take about 20.4% of Singapore’s total residential land. Shophouses and other take about 0.9%. The remaining 5.4% are landed properties in Singapore.

As such, we will first look at what are apartments, condominiums, executive condominiums, Singapore Improvement Trust (SIT) flats, Housing and Urban Development Company (HUDC) units, cluster housing and town houses.

Apartments

Apartments are a block of units that are mainly for residential purposes that may or may not come with shared facilities like swimming pools. These have a minimum plot size of 600 to 800 square metres – with the exception of certain areas (Joo Chiat, Kovan and Telok Kurau) that have a minimum plot size of 1,000 square metres. Some may still be walk-up apartments as the buildings are really old.

Condominiums

Condominiums, on the other hand, are usually guarded by a security guardhouse with shared facilities, and they are also usually high-rise living (unless its height has been restricted by the government).These have a minimum plot size of 4,000 square metres. Condominiums are also coined as one of the “5Cs” that Singaporeans aim to attain.

Executive condominiums

Executive condominiums are a hybrid between the Housing and Development Board (HDB) and the private sector. These homes are first sold under HDB by a private developer who had developed the residential blocks. At the same time, these executive condominiums will become privately owned after a period of 5 years.

Singapore Improvement Trust

SIT flats are heritage housing, the most popular being in Tiong Bahru. These are low-rise walk-up apartments that have been developed by the British. In addition, these have been privatised with a short lease term left.

Housing and Urban Development Company

HUDC units are also a hybrid between private and public housing. HUDC flats were built in the 1970s and the 1980s as another housing option for middle-income families but these have been phased out of development by HDB in 1987 due to a fall in demand. There were a total of 18 HUDC estates with a total of 7,731 residential units and 23 shop units.

These flats have been privatised as early as 1 November 1996 (Gillman Heights Condominium) to the latest on 17 March 2017 (Braddell View). In between, 11 of these developments have undergone en bloc sales and some have already been developed. Meanwhile, others are in the midst of putting up these estates for collective sales.

What should we look out for when purchasing a non-landed private property?

First, we should consider whether we are looking at living in the unit or purchasing it for investment purposes. After which, we should look at the type of property that we want (and are able to afford). Next, we should look at the property and also its surrounding amenities.

When we are looking at a new place to live in, we should be more stringent in our requirements. After all, it will be our new living environment for the next few years. Some considerations that we can look at are: accessibility, amenities and also neighbourhood. When looking at accessibility, we should not just look at the nearest MRT station but also roads leading to our homes. We all have days that we may not take public transport and hop into an Uber, Grab or taxi to get to places that we need to be at, just because. As such, looking at accessibility to major roads and expressways are important – whether or not you own a car.

In addition, we would also want to consider the surrounding amenities around the unit. These include police stations, fire stations, clinics or hospitals; on top of our usual shopping centre, hawker centre and supermarket or wet market. Having a police station, fire station and hospital can help in emergency situations that we do not expect or want to happen but things do happen, so this is just a precautionary measure.

At the same time, besides looking at transport, there are other things that we need when living such as food, one of our basic necessities. This could be cooked or raw food as we have days that we may not want to cook or for those who are unable to cook. At the same time, since most are looking at living a healthier lifestyle, cooking our own food may be better for our health.

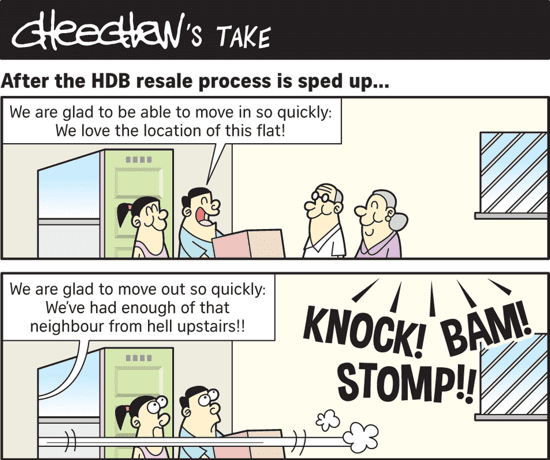

Moreover, with some neighbours who may be nasty to existing neighbours (the above is just a caricature of a situation), we should also be aware of the neighbourhood that we may be moving into. We should take note of this when we are looking to purchase a resale unit – public or private.

Other than wanting to purchase a new house, we should also be aware of some regulations that may affect us. This includes that the legal age to purchase a unit (21 years old), taxes such as stamp duties and property taxes, and leasehold or freehold property.

Some taxes that affect us when purchasing a new property would be the Buyer’s Stamp Duty and Additional Buyer’s Stamp Duty – part of the government’s measures to cool the heated property market in 2013. These have to be paid within 14 days after signing the sales and purchase agreement if signed in Singapore or 30 days after receiving the document in Singapore if the document is signed overseas.

Property taxes on the other hand will affect us when we own the house. These are calculated based on the annual value of the property, and tax rates are calculated based on whether the property is owner-occupied not. These taxes are paid in advance each year and are payable to Inland Revenue Authority of Singapore (IRAS) – who determines the annual value of the property.

Leasehold and freehold tenures of a property will affect not just your decisions when purchasing but also how long you will be able to hold the property for. Freehold properties are often properties that you can own for perpetuity and are private properties in Singapore. These freehold properties are also rare in the market as the government no longer issues freehold tenures. On the other hand, leasehold properties can be private or public properties. It is more common for a 99-year leasehold to be sold and at the end of the lease, the ownership of the property reverts to the government.

All in all, when purchasing a property, we should always make our own decisions and always take a look at the property (as pictures may be deceiving at times). Thus, the above mentioned are not a comprehensive list of things that we should look out for when purchasing a property but are rather some things that we can consider before getting property – private or public.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!