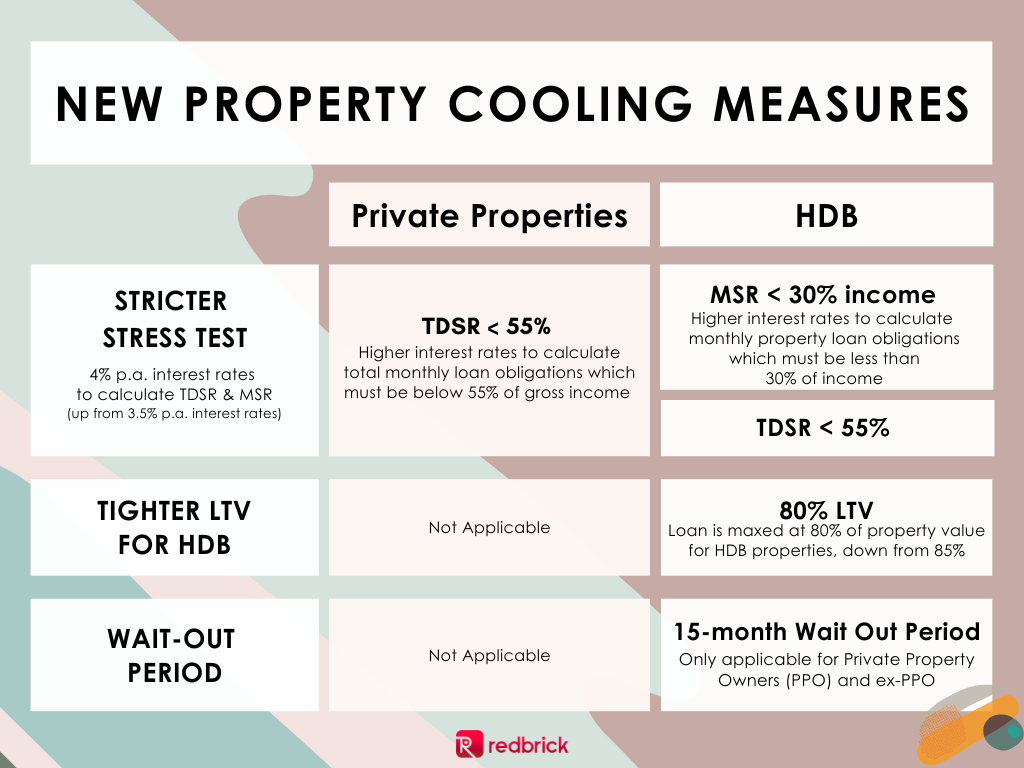

If you are thinking of downgrading from your condominium to a HDB, think again. New property cooling measures including tighter stress test for home loans and a wait-out period of 15 months were rolled out recently.

The rise in interest rates amid optimistic buyer sentiment has raised concerns about the sustainability in mortgage debt burdens, and has prompted government intervention in the form of new property cooling measures to curb high transaction prices and prevent overinflation in the property market.

1. Tighter Loan Limits and Stricter Stress Test

With interest rates expected to continue its upward trend, MAS has stepped in pre-emptively to tighten loan quantum limits. This is implemented through the change in the stress test interest rates for both the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR). This will only apply to properties with Option to Purchase (OTP) or S&P Agreement granted from 30 September onwards.

| Type of loan | Medium-term interest rate |

| Residential property purchase loans and mortgage equity withdrawal loans | The higher of a 4% per annum (p.a.) floor (up from 3.5% p.a.) or the thereafter interest rate. |

| Non-residential property purchase loans and mortgage equity withdrawal loans | The higher of a 5% p.a. floor (up from 4.5%p.a.)or the thereafter interest rate. |

In other words, a 4% interest rate will now be used to compute TDSR and MSR, which in turn affect one’s loan eligibility. TDSR states that a borrower’s monthly loan obligations for all loans (not just residential loans) cannot exceed 55% of their gross monthly income, and applies to property loans from private financial institutions for both HDB and private properties.

On the other hand, MSR only applies to HDB purchases and requires the monthly property loan repayments to be below 30% of a borrower’s gross income. According to this new stress test, one can expect a reduction in loan quantum of about 5% – 7%, on various loan tenures, for both HDB and private properties. It is also important to note that should interest rates increase beyond 4%, the higher interest rate would be applied as the stress test instead.

2. More restrictions for resale HDB Property

Lower Loan-To-Value (LTV)

LTV has been lowered from 85% to 80% for new HDB applications and resale applications made on or after 30 September 2022. While this signals an increase in cash and/or CPF outlay, this is expected to have little impact on affordability as first-time and lower-income homebuyers will still receive generous grants amounting to S$80,000 for Build-To-Order (BTO) flats or up to S$160,000 when buying a resale flat. Furthermore, flat buyers can also use CPF savings for the purchase.

Tighter eligibility for HDB Loans at 3% interest rates

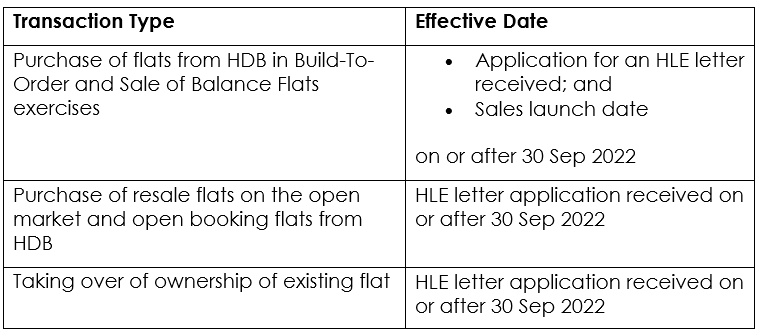

Additionally, housing loans granted by HDB would have an interest rate floor of 3% to calculate the eligible loan amount. This means that new applications for HDB Loan Eligibility (HLE) will need to meet the requirements interest rates at 3% or 0.1% above the prevailing Ordinary Account (OA) interest rate, whichever is higher.

However, this will not affect the actual HDB Concessionary interest rates priced at 0.1% above the prevailing CPF OA interest rate (currently at 2.50%), which will remain at 2.6% p.a. until 31st December 2022, as CPF reviews its interest rates quarterly. Such measures are in line with the higher TDSR and MSR which are aimed at encouraging homebuyers to be more prudent with their financials in the long-term.

The interest rate floor will apply to these properties:

3. Wait-out period for Private Property Owners (PPOs) to purchase HDB Resale flat

Prior to the implementation of the new property cooling measures, Private residential Property Owners (PPOs) were able to purchase resale HDBs without any wait-out periods, as long as they dispose their private property within a period of 6 months from their HDB purchase. However, PPOs looking to purchase a BTO must dispose their private properties and wait out a period of 30 months before being able to make an application to HDB.

From 30th September 2002 onwards, PPOs and ex-PPOs must comply with the new wait-out period of 15 months before they are able to purchase a resale HDB. Only seniors aged 55 years and above, who are moving from a private property to resale flats that are 4-room or smaller, will be exempted from this wait out period.

While this is a temporary measure open to future review, with the intention of moderating demand in the HDB market, it may create undesirable impacts for buyers who are genuinely looking to downgrade from their private properties for financial reasons such as a family emergency or change in personal financial situations.

Why has more tightening measures been introduced?

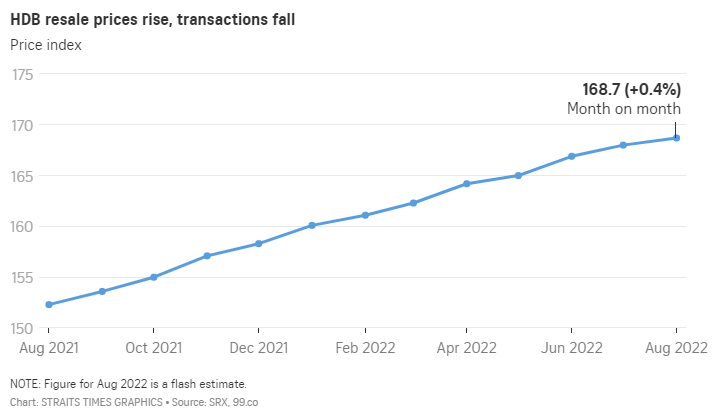

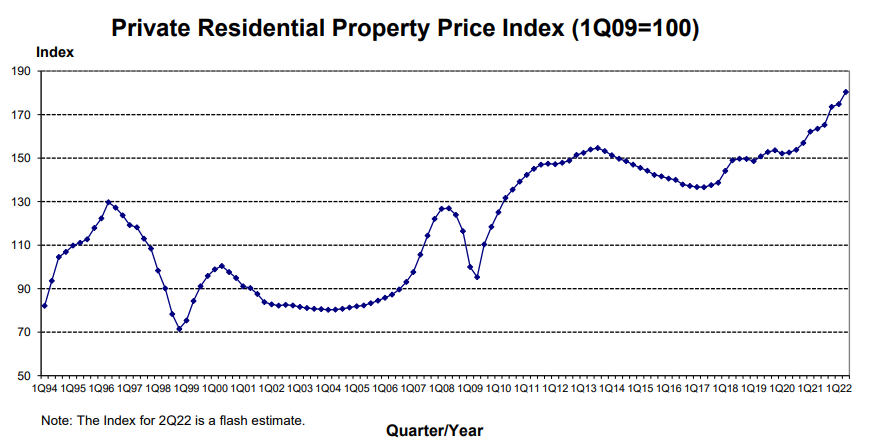

Property prices have been rising rapidly since 2020 despite the pandemic due to buyer optimism, and interest rates have been continually rising. Interest rates in Singapore are expected to continue rising given the recent rise in US interest rates to curb with stubborn inflation and a tight labour market. With higher interest rates, mortgage affordability is likely to be affected particularly for individuals with little buffers for their monthly cash flows

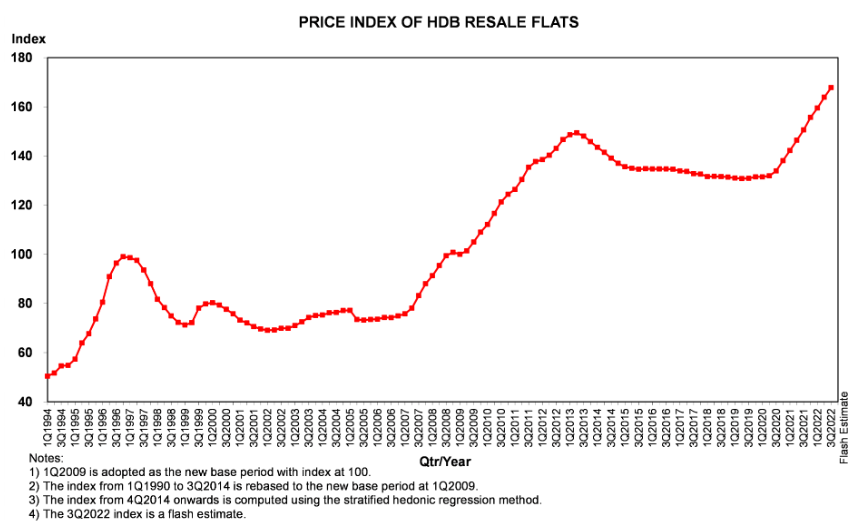

While rising HDB Resale prices is not a new phenomenon, such steep increases have not been observed since 2007. This has been concerning as the buyer fervour has been deemed to be without economic basis, and the threat of a housing bubble has loomed over Singapore. In efforts to cool the market, a slew of measures was introduced in December last year. However, there has been little impact on the rising prices as buyers remain confident in Singapore’s market.

As shown, HDB Resale Prices has risen by 2.8% in 2Q2022 which is faster than the 2.4% in 1Q2022. Given that resale prices continue rising despite the introduction of property cooling measures in December 2021, such the downward revision of the TDSR from 60% to 55%, this highlights the general increase in demand for public housing as observed from the sharp rise in HDB Resale Price Index by over 5% at end 2Q2022.

Aside from having larger apartment sizes than new BTO flats, resale flats have also attracted buyers due to the relatively short waiting time. Homebuyers, especially those who are unaffected by the excessive pricing and have ample liquidity, are also generally willing to fork out exorbitant prices for desirable locational attributes, such as proximity to MRT stations or to the CBD. With stricter stress tests to limit loan quantum, buyers who are purchasing near their loan limit previously will now have to put in further consideration when purchasing more expensive flats. As a result, sellers may have a lower expectation on their sale price.

One potential reason for rising prices in the private property market could be the rise in geopolitical instability in the region, that has led to many investors shifting their capital to Singapore. Amid Beijing’s technological crackdown and economic turmoil in Hong Kong, many investors have chosen to shift their focus to Singapore, which is a relatively politically stable.

Additionally, there has been a rise in Multinational Companies setting up their regional headquarters and Research & Development (R&D) centres in Singapore, particularly from the biomedical and manufacturing industries. With big-value investments from companies like Pfizer in Singapore, such shifts are likely to have generated demand for residential properties to home their foreign expats.

Rental demand is likely to have also risen, further contributing to the demand for local and foreign investors to purchase private properties.

Property Cooling Measures: What’s Next?

The property cooling measures are two-pronged in order to cool the market and ensure sustainability in the growing prices. Firstly, it is positioned to help homeowners better cope with the rising interest cost by applying a higher stress test that will lead to lower loan quantums, thereby having more manageable debt burdens. Secondly, the introduction of wait-out period for PPOs also aids in moderating demand.

As a result, there is likely to be higher demand for 4-room and smaller resale HDBs as couples above 55 years old looking to downgrade from private property turn towards these markets. This is likely as many elderly couples no longer need that much space as their children have moved out, which then allows them to unlock equity from their property.

Furthermore, PPOs who wish to purchase HDB will need to find alternative accommodation for 15 months which could lead to further rise in rental market prices, as the demand already outweighs supply in the current rental market. The new measures have also left some private property sellers in a predicament, as some were forced to sell their property due to divorce procedures, or the need to unlock capital. While they can put in an appeal to HDB, these cases are reviewed on a case-by-case basis, which might be risky.

The remaining alternative would be for them to stick to the private property market and downgrade to smaller private property to unlock capital. In turn, prices for smaller private properties might increase, depending on a multitude of factors. As the new regulations shifts market sentiments, the impact of these policies will be felt by both buyers and sellers in coming months and we look forward to analysing the implications in the future.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!