Whether you’re a newly wedded couple who isn’t keen to wait for your BTO, a retiree couple or a single individual looking for your first home, the HDB resale market has a variety of housing options to offer you. Purchasing properties involves complex paperwork and some hidden costs. So, here’s a complete guide for your HDB resale journey.

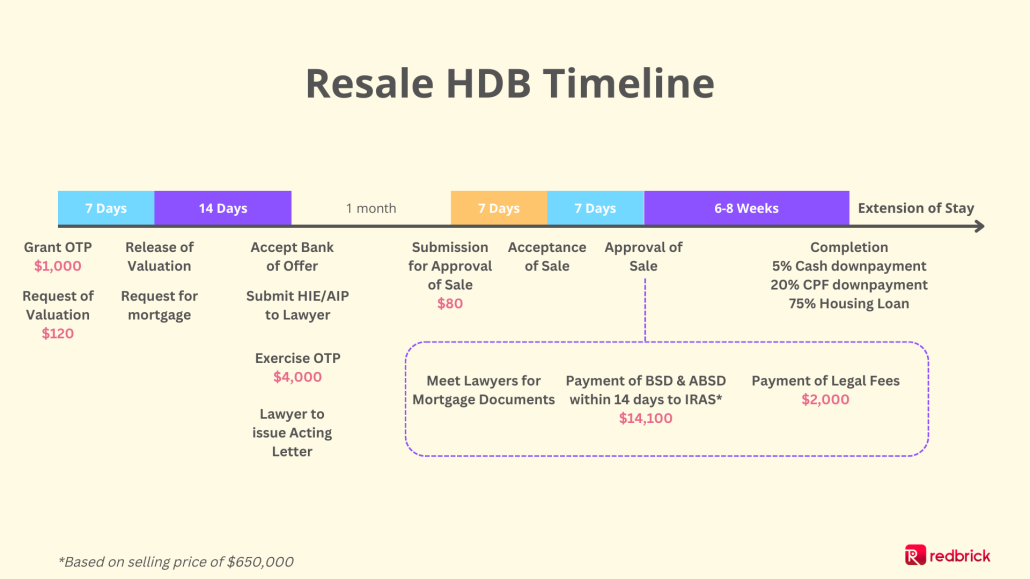

1. Understanding the timeline

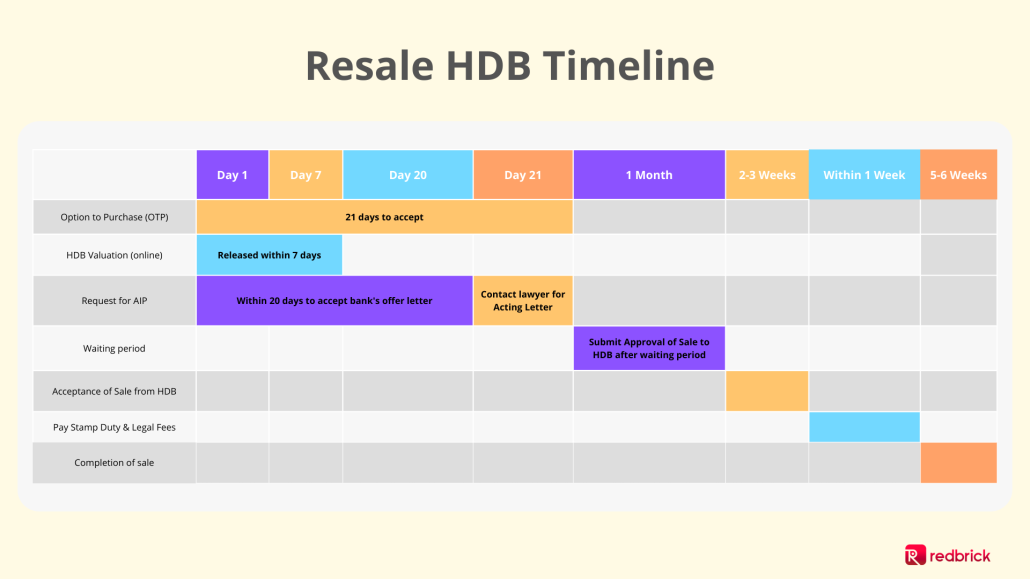

Here’s a quick rundown of the key periods to purchase your resale HDB.

As shown, it should take roughly a month for the conveyancing of title from the seller. Thereafter, it will take another 2-3 months for HDB to approve the sale. Legal processes should be completed within another 2 months after which. Given the short period to decide on purchasing the resale HDB from the grant of Option to Purchase (OTP) from the seller, it is critical that you prepare the relevant documents beforehand prior to requesting for the OTP. You should also be prepared to wait for another 6 months from requesting for the OTP. It could take a longer time to legally own the property and have alternative accommodation available.

2. Before Home Searching

With thousands of HDB resale flats available, there are endless options for your next home purchase. To better narrow down the list of potential homes, it would help to check your eligibility to purchase. You can also check on the loan quantum that you are eligible for.

Here are the key criteria for resale flat eligibility, per the recent cooling measures in September 2022:

- At least 1 occupant must be a Singaporean Citizen (SC) or Singapore Permanent Resident (SPR). If there are no SCs in the household, all SPR owners and essential owners must have had SPR status for 3 years

- Married Couples and Engaged couples are eligibility to purchase all types of flats except 3-Gen flats.

- Homeowners and essential occupiers must not have any ownership interests in any local or overseas private residential property or have disposed of them in the last 15 months. This does not apply to seniors aged 55 and above if they are downgrading to a 4-room or smaller resale flat.

- There is no income ceiling on resale flat eligibility, but income ceiling applies to CPF housing grants, excluding Proximity Housing Grant and HDB Housing Loan

Additionally, home loans for resale HDB flats can be roughly categorized into HDB Loans and loans from private financial institutions.

a) HDB Loans: Housing Loan Eligibility (HLE) application

If you place emphasis on stability in cashflows, you may wish to consider taking up a loan from HDB. The interest rates for HDB loans are 0.1% above Central Provision Fund (CPF) Ordinary Account (OA) interest rates. In comparison, fixed loans offered by private banks often only apply to the first 2-3 years. HDB loans are also preferred by younger couples that have less cash in the bank, as homebuyers only have to pay 20% down payment either by cash or CPF.

To determine the loan quantum, you are eligible for, banks will conduct a stress test on your current financial situation. Based on current guidelines, this means that your Mortgage Servicing Ratio (MSR) must be below 30% of your income and Total Debt Servicing Ratio (TDSR) has to be below 55% of your income. MSR refers to the ratio of mortgage instalments for all properties to your gross income, while TDSR restricts your total monthly instalments across all debts to be below 55% of your total income.

These calculations will be based on interest rates at 4% p.a., as per the recently revised guidelines.

For instance, Mr. and Mrs. Singh currently have a car loan which they have to repay at $1,000 monthly. On top of that, Mr. Singh has to pay for his monthly installment of $500 on his higher education loan. Given their total income is $15,000 per month, their TDSR is $8,250. This means that based on TDSR, the highest monthly installment that they are eligible for is $3,750.

However, when MSR is accounted for, they can only take up to $3,300 installment for all properties at most. other words, Mr. and Mrs. Singh must ensure they have sufficient funds on hand to be able to pay for the property upfront.

As there are numerous considerations behind the loan quantum you are eligible for, obtaining a Housing Loan Eligibility (HLE) is the most straightforward way to determine how much you can borrow from HDB. It would include details such as duration of repayment, monthly installments required and the interest rates. HLE is also critical as it is required for you to obtain an Option to Purchase (OTP) from the resale buyer before submitting a resale application. It is also notable that homebuyers who owned a private property in the past 30 months are not eligible for the HDB housing loan.

b) Bank Loans: Approval In Principle (AIP)

By getting an Approval In Principle (AIP), it signals that the bank is willing to lend you the quantum over the next 30 days. It is a unilateral agreement from the bank’s end and you are not obligated to borrow from the bank. Aside from assessing your financial health based on TDSR and MSR, banks also consider your age. Unlike HDB loans, private bank loans require a higher down payment with LTV capped at 75%. Aside from comparing interest rates, the key to finding the suitable bank loan would be to consider the monthly installments and loan tenure.

3. Budgeting

a) Understanding CPF usage & accrued interest

For most Singaporeans buying their first home, we will use our savings from CPF OA. With over 37% of gross income being contributed to our CPF monthly for those in their 20s and 30s, most of us would have sufficient CPF savings for down payment. You should also check whether your monthly CPF contributions can cover your required installments, otherwise be prepared to top up with cash.

What you may not know is that using CPF isn’t free. Upon reselling your flat, you will need to return the principal sum drawn from CPF as well as accrued interest. Assuming you had used $100,000 during the initial payment for your $800,000 HDB and you have arranged for CPF deduction of $500 for monthly payments.

After 10 years, when you are selling your property at $1,000,000, you have to repay $$196,455 to CPF. That’s an accrued interest of $36,455 for 10 years.

In other words, your cash proceeds from reselling your HDB might be lower than expected after repaying your outstanding mortgage and CPF. Such guidelines are to ensure that homebuyers will have sufficient funds in their CPF for their retirement sum in the future.

b) Other Hidden Fees

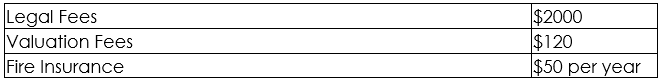

There are also other fees that are payable before purchasing your flat. These include legal fees such as title search fee to check the validity of the title you will be purchasing, valuation fees of the property, as well as HDB Registration fees.

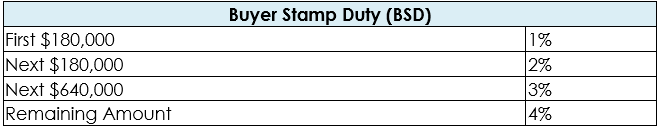

Additionally, be prepared to pay Buyer Stamp Duty (BSD) based on the purchase price of your property. Since it is a progressive tax, higher tax rates are applicable for higher purchase prices. For instance, buyers of an $800,000 resale flat would have to pay BSD of $18,600.

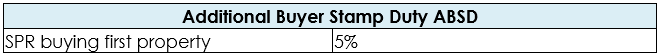

For PRs, there is an additional 5% Additional Buyer Stamp Duty (ABSD) applicable. This means another $40,000 ABSD for the resale flat at $800,000.

c) Total upfront cost for HDB Loan

Another consideration is the Loan To Value (LTV) ratio for HDB loans. This refers to the loan quantum as a proportion of the valuation of the property you wish to purchase. Current guidelines restrict LTV to 80%, which means you can borrow up to $400,000 for a $500,000 resale HDB flat. The remaining 20% would have to be paid as down payment and can be paid via CPF or Cash.

d) Total upfront cost for Bank Loan

In comparison to HDB Loans, Bank Loans would require a higher upfront cost at 25% – 5% to be paid in cash and the remaining 20% can be paid by CPF or cash. This is due to the LTV limit of 75% for banks. As mentioned earlier in this article, you may not be able to borrow the full sum of 75% if you have taken up other loans previously. This means that you should be prepared to fork out a higher upfront cost either by cash or CPF.

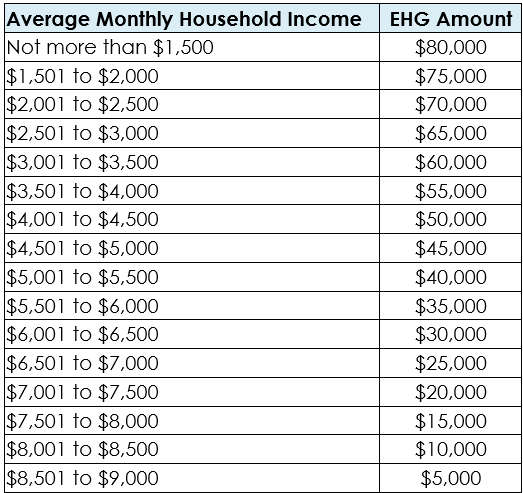

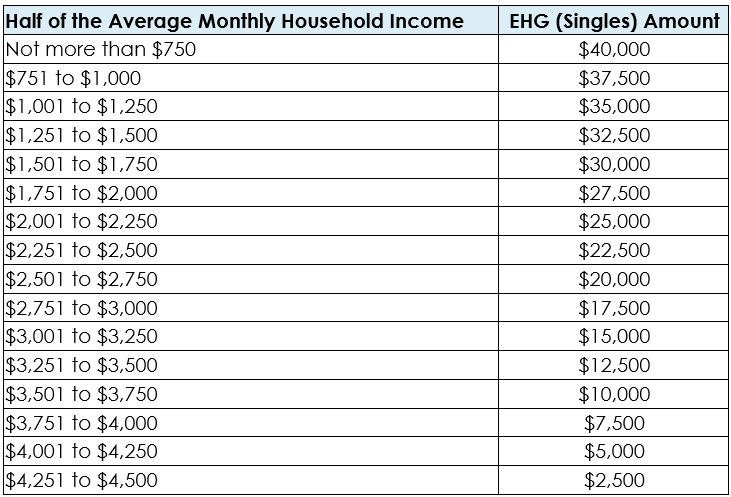

e) Grants eligible

Lastly, consider which grants you would be eligible for, as they would be able to reduce the payable amount on your flat purchasing price. The income ceilings that are applicable on CPF based on your household status, including Enhanced CPF Housing Grant which offers generous subsidies. as well as whether you are eligible for a proximity housing grant, which offers a $30,000 subsidy to live with your parents or child and $20,000 to live within 4km of your parents or child.

Grant amount for first-timer households (Family)

Grant amount for couples comprising a first- timer and second-timer households

4. Temporary Extension of Stay

Sometimes, the seller of the flat might still be searching for a new place to stay. They might request for a temporary extension of stay in the property after resale completion. In other words, after committing to the Option of Purchase (OTP) or signing the Sales & Purchase Agreement (S&P), sellers might negotiate to move out of their flat at a later date. This period cannot extend beyond 3 months after resale completion.

During this period, the buyer would be the owner of the flat at the time of the extension and is liable for the following:

- administrative fee of $20 to HDB to request for the extension of stay

- Service & Conveyancing Charges without rebates

- Property Tax at non-occupier rates, which are significantly higher than owner-occupied rates.

It is advisable for property buyers to negotiate with the sellers beforehand and have a written document determining who would pay for these fees prior to agreeing on the extension of stay. This also means seeking official approval from HDB instead of having private agreements, which might cause other issues if the relationship sours.

Minimum Occupancy Period (MOP)

Before you agree to the seller’s request for a Temporary Extension of Stay, you should also consider whether this would affect your plans to resell the flat in the future. Based on prevailing guidelines, MOP is calculated from the day after extension ends or is terminated, instead of key collection. This also means that your bank loans might start running 2 months prior to your actual move-in date.

Conclusion

In closing, there are multiple stages to take note of before purchasing your resale HDB. The timeline above is a sample of how a typical sale could be made, but buyers who are downgrading from a private property might require other arrangements prior to fulfilling the newly imposed 15-month wait-out period. Older buyers may also wish to carefully consider their finances as banks typically offer lower loan amounts for older borrowers. Regardless, if you’re considering purchasing a resale HDB and would like to have some personalized advice, reach out to our expert mortgage advisors for a complimentary consultation session.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!