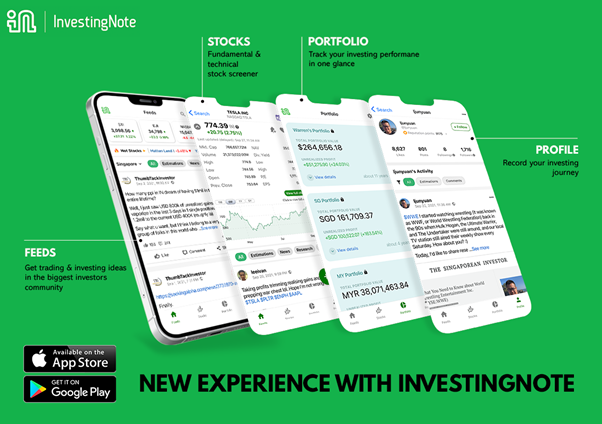

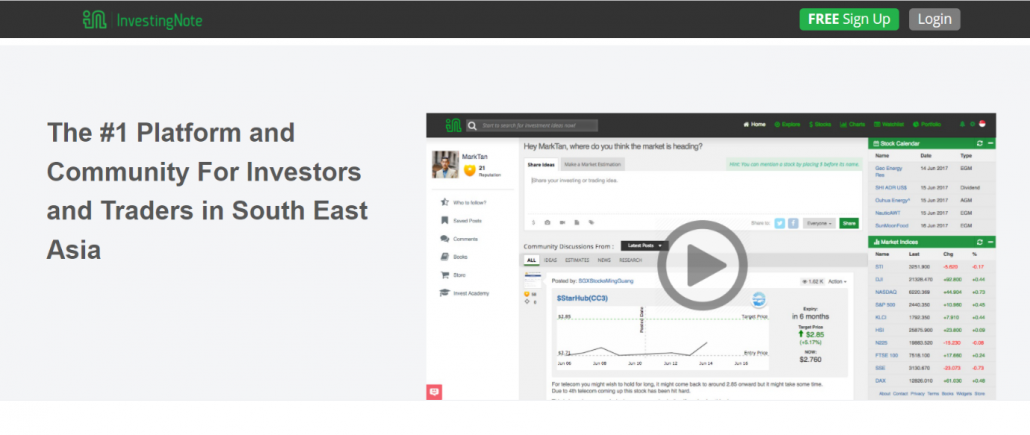

InvestingNote is Singapore’s first & largest community-driven platform where investors and traders from all levels connect and share ideas with one another. Through its platform, investors can identify trends, market movements and sentiments through crowdsource analysis that can make them better at investing.

In today’s article of “Redbrick Conversations with”, we speak with Mr. Shanison Lin, founder of InvestingNote. We chat about how InvestingNote started, his idea of active and constructive sharing where it allows new investors to leverage on other investors who are adept and more experienced in his community.

Q: Can you tell me more about yourself and how you got to where you are today?

Shanison: I came to Singapore on a scholarship program by NUS to study at the school of computing – I was a programmer before with a focus on financial applications. After graduating, I worked at ShareInvestor , which operates a platform that provides financial information to stock investors. The company was a subsidiary of Singapore Press Holdings (SPH) and I spent 4 years there as a tech lead.

I had a strong desire to start my own company, realising that it was a great opportunity for me to merge my knowledge from 4 years in the financial industry and my passion for creating a start-up in the field of technology. That marked the inception of the idea of InvestingNote.

InvestingNote focuses on investors and traders, which allowed them to focus more on sharing high quality investment ideas. We have a feature where users are not able to delete their posts after 30 minutes of posting, and any subsequent post edits can also be tracked. The aim is to ensure that information is more credible as part of our dedication to building financial communities.

Q: Would you consider yourself successful?

Shanison: I think it’s dependent on the individual and on how satisfied you are with your own life. Personally, I feel that happiness in your own life is significantly more important. To that, I would say that I am quite happy with my life here, despite its initial challenges.

I am very fortunate that we have had strong support from our investors and my team who are continuously bringing this company to the next level. My definition of success is being happy with what we have achieved, and to keep moving forward to make it better in the future.

Q: On a lighter note, what are some of the hobbies that you do in your free time?

Shanison: I enjoy reading books about entrepreneurship and the financial markets. On the weekends, I bring my kids to the library, and sometimes we will cycle at East Coast Park. I strongly encourage my kids to partake in sports and I will bring them out often so that in the future they would be more eager to go out and live active lifestyles as opposed to staying home all day.

Q: What is a regular workday like for you?

Shanison: Every day is a bit different for me. Every day at work, we have something called a Stand-Up meeting, where each team member is asked to share what challenges they had completed yesterday and what they are going to focus on today.

It is a popular practice in tech start-ups. I would host the meeting which does not get into too much detail, but after learning about their challenges, we would break out into smaller and more detailed meetings throughout the day.

Last year, we set up a team in Malaysia and we are trying hard to initiate the largest social network for stock markets in Malaysia. This entails having discussions for the different campaigns and challenges throughout the day. Also, a large part of my daily routine is trying to solve problems together with the team.

I view these Stand-Up meetings as a great way to build strong team connections and company cultures, especially during COVID period. Since we are working from home every day, the physical distance between team members is significant, and may cause a psychological disconnect. It was slow to implement early on, but the team understands the purpose of this and its benefits in bringing us closer together. It is also a great opportunity to feel more bonded to the team in Malaysia despite never having met them in person.

Q: How would your organisation maintain its appeal to your customers?

Shanison: We are building an online financial ecosystem within InvestingNote. We serve several participants of the financial market – retail investors, accredited investors, research analysts and fund managers etc. We also have financial institutions setting up their official account to distribute stock market information and research reports to engage retail investors.

This creates its own network effect that evolves by itself. Financial institutions benefit from increased outreach, leading to more trading account openings and market activity. In turn, retail investors benefit from the greater activity and input on our platform which help them in making informed financial decisions.

Once we attain this network effect, the system will be self-sustainable with some upgrades contributed by our end. Additionally, an expansion into other markets has also been part of our focus.

Q: What are some of the important values that InvestingNote prides itself in?

Shanison: At the core of InvestingNote, we wish to help investors make better investment decisions. It certainly is not easy to invest, especially when done alone. We hope to make investing fun while providing investors with the information to make more informed decisions which would hopefully lead to better outcomes.

There are many lessons that you can learn from trading, either through your own experience or through the life stories of others within the community. They extend beyond trading, and often include how they were able to achieve financial freedom, or how they were able to build a self-sustainable portfolio.

Q: Could you describe your current residence?

Shanison: I am living in a HDB at Moulmein–Kallang area. I like its central location which makes it very accessible. Most residential estates in Singapore are quite accessible in Singapore. It is quite easy for me to get to the CBD area, and sometimes I even cycle to my office which takes me about half an hour.

I find it a great way to exercise and I often spend the journey thinking about many things which gives me clarity throughout the workday. Once I reach my office, I can be highly focused with my work!

Q: What do you think of the real estate industry in Singapore?

Shanison: When people tell me about the real estate industry in Singapore, I tend to make mental comparisons to China to put things into perspective. A lot of my friends mention that property prices here are high and difficult to afford.

Considering the options that the Singapore Government offers like HDBs, you will realise that a BTO or resale flat costs about $1,000+ in monthly payments for a 30-year loan, with minimal cash outlay. This is very affordable for a married couple if you’re also eligible for the additional subsidies.

Singapore’s HDBs are quite affordable for families where both spouses are working, and that is something I feel very fortunate for.

Q: Now that you are in the finance industry, when it comes to financing your home, would you belong to the group that leverages all you can, or would you pay down as soon as you can?

Shanison: It depends on the current interest rates and your existing portfolio return. If your portfolio can consistently earn more than the interest rates you currently pay on your loan, then you should take on more leverage and place the excess funds in your portfolio.

However, if you are a bit more conservative and invest in fixed deposits, then you could consider using the excess money to pay down the loan, while still retaining cash reserve. I would not recommend using all your reserve just to pay down on the property loan.

Personally, I do invest but my wife is a bit more conservative, a good combination for our family. We take a moderate approach, not being too quick to pay down the loan but avoiding excessive leverage.

Q: If your friends are looking to purchase a home, what advice would you give to them?

Shanison: Choose a home that you can afford without making a drastic change to your lifestyle. It is alright if it is within your means, but it would not make sense if you were suffering just to pay for your monthly mortgage instalments. It would effectively mean that you cannot afford to take a break from work, and this would place tremendous stress on yourself and your family if you were suddenly unable to work for a period.

Q: Where is your favourite estate in Singapore and why?

Shanison: Probably central areas, where I have been staying for the last 10 years. If you ask me to move to somewhere in the East or the West, I will find it less accessible, and accessibility ranks high on my criteria list. More importantly, my house is just a 2-minute walk from the school which my kids attend. I think that is preferable to living somewhere where you would have to spend half an hour driving to or having to spend 15 minutes stuck in the traffic or in the rain.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!