In Asia, financial wealth can be held across real estate, investments to bank deposits. For those who do invest their savings, traditional investment options were simply not enough anymore, and robo-advisors was born.

At StashAway, its objective was to significantly improve the way people build their wealth. They had always focused on a great customer experience. Hence, in this week’s iteration of Redbrick Conversations with, we speak with Ms. Amanda Ong, Country Manager of StashAway and she shares her journey at StashAway, a digital wealth manager that intelligently navigates macroeconomic data and empower their clients to build long-term wealth.

Q. Can you tell us more about yourself, and how you got to where you are today?

Amanda: I have always been very interested in personal finance and investing. I came from a very traditional investment background and started my career with Citibank, where I was servicing the portfolios of institutional clients such as portfolio managers and fund managers. Then, I worked at a multifamily office where I did investment advisory for ultra-high net worth clients.

Q. What are some of the milestones you have reached on a personal level?

Amanda: I would say one of my major milestones would be my achievements at StashAway. When I first joined StashAway, I headed the client experience team, and we were a small team of four. At that point in time, the app has only been launched for a year and we were looking to launch in a couple of other countries.

Essentially, we were planning to scale and build up our client experience team. I was very much involved in the hiring process and built it to a team of 48 across 5 countries, as well as on the ground works such as setting up our client operations in line with local regulations. This process was incredibly fulfilling to me on a personal level. Aside from that, I would say handling our Singapore business – being able to help grow a company that is looking to make a difference in helping Singaporeans reach their financial goals sooner is very rewarding for me.

Q. What does success mean to you?

Amanda: In a broader context, the definition of success for me goes back to achieving financial freedom. In other words, having the option to stop working when I want to and retire at any age.

Q. What do you do in your free time?

Amanda: In my pockets of time now, I do appreciate spending time to work out, and simple things like going for walks. I also relish in new experiences such as exploring new cafes and restaurants.

Q. What is one interesting fact about yourself that people don’t usually know?

Amanda: I think many people in the industry do not know that I used to play golf competitively and represented Singapore in different international competitions. I also moved to the US when I was 14 to play in the junior tour over there.

Q. What is a regular workday like?

Amanda: I think my workday is mainly meetings, back-to-back meetings with internal stakeholders, external stakeholders and clients. In the evenings, I also do webinars for the companies as part of our financial wellness program. This is part of StashAway’s curriculum that provides free financial education for the employees in various companies and for the public, and we have weekly sessions.

During the evenings, I usually have a bit more time to sit down and do actual work such as going through emails, look through documents, and reviewing agreements. There is never a boring day.

Q. How does your organization maintain its appeal to consumers?

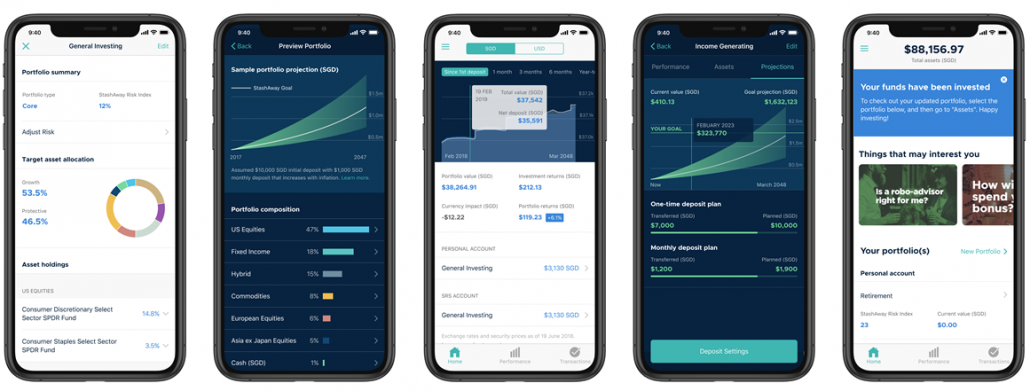

Amanda: One thing that we have always pride ourselves on is our ability to focus on user experience and continually improve on the application interface. This is something we spend a lot of time on – taking in client feedback, reiterate the product and improve it over time.

We have consistently updated the application every 2 weeks or so, which could be minor fixes, but they contribute to make it a better experience overall. At the end of the day, it’s also the fact that we always listen to our clients in terms of the investment products we offer.

We have just recently launched a new set of portfolios – thematic portfolios, that center on three different themes, which was prompted primarily due to client feedback since a lot of our clients wanted very specific thematic exposure.

We decided to launch these portfolios due to client feedback and demand. Similarly, we launched our StashAway Simple back in 2019, which is our cash management portfolio as well as our Singapore-focused income portfolio. The curation of both of these products were only possible because we took in the feedback of our clients.

Thus, I think our goal has always been to be the most client-centric wealth manager.

Q. What are some of the important values does StashAway prides itself with?

Amanda: Firstly, a key value StashAway maintains is our transparency to clients. We are very conscious about how we present the fees that clients pay, and also constantly making sure that our interests are completely aligned with our clients’.

For example, if you look at our management fee structure, it is a percentage of your Assets Under Management (AUM). We don’t take any trailer fees or any kickbacks from the underlying fund managers.

For us, it is a very conscious decision to make sure that if we do get any trailer fees, that these are completely passed back to our clients to better align our interests.

Source: StashAway

The second value StashAway holds dearly would be to ensure our organization is helping our clients. We are constantly trying to help our clients navigate the ups and downs of the market especially since we have seen quite volatile markets in recent years.

Hence, we do constantly check to ensure that we are constantly communicating with our clients. One major component of this is financial education. We are doing a lot of regular webinars and Ask Me Anything (Q&A) sessions. Ultimately, we want to make sure that it is easy for clients to speak to someone from StashAway. If they have any questions, especially when markets are volatile. I believe that being close to our clients is incredibly important.

In fact, for any client who contacts our client engagement team, we pick up the phone calls within an average of eight seconds, which is relatively quick compared to the banks, for example. We also have multiple channels for clients to contact us, ranging from WhatsApp to email. As a very digital platform, building trust with our clients is very important so we consciously think about how we can be as close to them as possible.

At the end of the day, it is about putting client experience first, and considering from the client’s perspective especially since they are putting their money with us. Our client experience team of 60 is also the largest team at StashAway, and we pride ourselves on being able to provide tailored responses to the client’s specific situation and portfolios and not merely cookie cutter answers.

Q. Could you describe your current property of residence?

Amanda: I currently stay in a condominium near the Redhill estate.

Q. What do you look out for when searching for a property?

Amanda: I think location is very important. Not just the proximity to nearby amenities such as grocery stores and cafes, but also the accessibility of the property. I don’t usually drive so I prefer properties that are very close to public transport. Lastly, I do like a place with a good view, so I will look out for that if possible.

Q. Do you believe in ‘leverage all I can’ or ‘pay down as soon as I can’ school of thought?

Amanda: First of all, I think it all depends on the numbers and the interest rates. If interest rates are very low, I might take on leverage, and invest the rest. But if rates are very high, then obviously I would want to pay it down as soon as possible – it goes back to one of the basic tenants of finance. The same way interest works for you, it also works against you.

Q. What kind of advice would you give to new homeowners and aspiring property investors?

Amanda: I think the most important thing would be to do your research. Actually, we have a webinar on this; One of our financial education courses is called renting versus buying. People often have the misconception that renting is essentially just throwing away money and buying is better as you get an asset.

It’s not necessarily true all the time, because it goes back to working out the numbers. In some instances, renting over the long term might make more sense.

For new homeowners, I recommend taking advice you have heard from others with a pinch of salt and do your research as well as financial calculations before you make the decision.

Q. Which is your favorite estate in Singapore and why?

Amanda: I don’t have any, but I quite like my current residence. On the Redhill side, there are the much older estates, and on the other side is Tanglin where things are trending and a lot more happening. It feels like the best of both worlds.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!