What happens to HDB flats left unsold in previous launches? Do they sit empty? If you’re looking to ditch the years long BTO wait and secure your dream home faster, the HDB Sale of Balance Flats (SBF) might just be your key! In this article, we’ll be taking you through the process of how you can apply for one and how you can boost your chances of securing a SBF flat.

What is the Sale of Balance Flats (SBF) and why do they exist?

Imagine leftover delicious cookies from a baking spree – those are essentially SBF flats!

The Sale of Balance Flats (SBF) launches allow aspiring homeowners to apply for balance flats from previous BTO launches, surplus Selective En Bloc Redevelopment Scheme (SERS), replacement flats, and repurchased flats.

The flats launched will range from 2-room Flexi, 3-room, 4-room, 5-room, 3Gen flats and Executive Flats. This wide range of variety makes the SBF a popular option for many who are not willing to endure the lengthy wait associated with BTO options.

How often do Sale of Balance Flats (SBF) exercises occur?

In a significant shift, the Housing & Development Board (HDB) announced on January 8, 2024, that it will limit HDB Sale of Balance Flats (SBF) exercises to just once a year from 2024, with the next exercise happening in February. This marks a decrease from the previous two annual launches held in May and November.

Preparing for the upcoming Sale of Balance Flats (SBF) Exercise

Before diving into the SBF application pool, make sure you meet the eligibility criteria. These requirements, which differ for first-timers and second-timers, cover aspects like age, citizenship, income, and ownership of existing properties.

With the implementation of the new HDB Flat Eligibility (HFE) letter on 9 May 2023, applicants who wish to participate in the upcoming SBF exercise will need to first complete the Preliminary HFE check (i.e. Step 1) of the HFE letter application in the HDB Flat Portal before submitting a flat application.

The HFE letter will provide you with a holistic understanding of your housing and financing options before you embark on your home buying journey. It will inform you upfront of your eligibility to purchase a new flat, as well as the amount of CPF housing grants and HDB housing loan you are eligible for.

It takes about a month for the HFE application to be processed after HDB has received all the required information and documents, so do plan ahead if you’re intending to take part in the upcoming sales launch!

Applying for a HDB SBF Flat

Once your HFE letter has been granted, keep a lookout for the SBF sales launch.

Typically, HDB only releases information about the exercise during the launch itself with a short application window of around one week.

Flat applications can be done online via the HDB Flat Portal, and you will be able to find all the required information about the available flats there. You will be required to pay an administrative fee of $10 (inclusive of GST) for the application.

In order not to miss the sales launch, you can subscribe to the HDB eAlert which will alert you on the latest HDB announcements and upcoming sales launches.

How are the SBF Flats allocated?

At the end of the application period, HDB will conduct a computer ballot to shortlist all applicants, taking into consideration the different priority schemes, to determine each applicant’s queue positions to book a flat. Results for the HDB SBF application are usually announced in around 1.5 months and applicants will be notified via SMS and email when the results are released.

What happens after I’ve received a queue number?

If you’ve received a queue number, congratulations! You’re one step closer to owning a HDB flat. If your queue number falls within the number of flats available, HDB will notify you of your flat booking appointment about 2 weeks before the appointment date. During the appointment, you will need to place the option fee of $500 for a 2-room flexi flat, $1,000 for a 3-room flat or $2,000 for a 4-room flat or bigger.

At this stage, you will also want to get your finances in order for the purchase of the flat. For those looking to take up a bank loan or a loan from a Financial Institution (FI), this is when you should start requesting for a Letter of Offer (LO). You must obtain an LO after you book a flat, before you sign the Agreement for Lease.

Option fee paid, flat booked! What’s next?

With the option fee paid, you’ve officially secured your new flat!

You will be invited to sign the Agreement for Lease within 9 months after booking your new flat. Key collection will be nearer to when the flat is built.

If the flat you have booked is a completed flat, you can sign the Agreement for Lease and collect the keys to the flat within 9 months after booking the flat.

At the signing of the Agreement for Lease, you will have to pay the downpayment. The amount payable depends on how much your flat costs and whether you are taking an HDB housing loan, not taking any housing loan or taking a housing loan from a financial institution (FI).

When you sign the Agreement for Lease, you will also need to pay Stamp Duty as well as the legal fee(s) for the purchase of the flat from HDB.

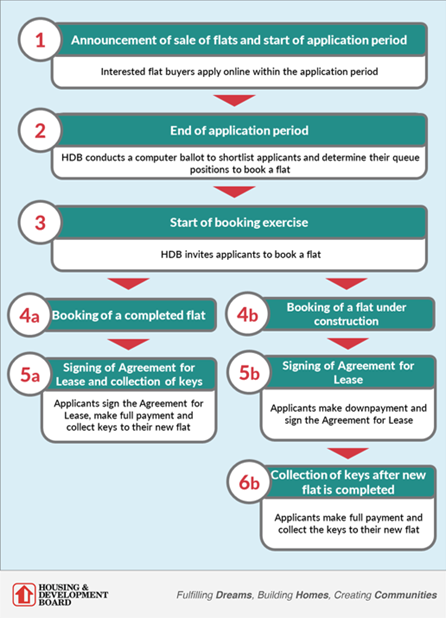

Here is a summary of the SBF process (infographic courtesy of HDB):

Here are some tips to increase your chances of getting an Sale of Balance Flats (SBF) flat!

Given that there is a limited supply of SBF flats that are released, and there is a very high demand for them, your chances are, unfortunately, quite slim. To increase your chances, applying for a BTO flat in a less popular estate may work better.

HDB also provides various priority schemes to eligible applicants, to increase their chances of getting a flat. Some of these schemes include:

1. Priority for First-Timers

First-timer applicants will enjoy higher priority when applying for an HDB flat. You will be able to enjoy a higher proportion of SBF flat supply, as well as an additional ballet chance compared to second-timer applicants. In addition, families with young children and young married couples may also qualify for priority as First-Timer (Parents & Married Couples), or FT(PMC).

2. Family and Parenthood Priority Scheme (FPPS)

Under this scheme, first-time married couples with children and young married couples will be able to benefit from a higher supply of flat allocation. Up to 60% of the public flat supply of SBF flats will be set aside for applicants who fall under the FPPS scheme.

3. Married Child Priority Scheme (MCPS)

The MCPS scheme helps a married child and parents to live with or close to each other for mutual care and support. Up to 30% of SBF flats are allocated to first-timer families, and 3% of SBF flats are for second-timer families.

Some eligibility conditions include: at least 1 of your parents (inclusive of widowed or divorced parents), or married child is a Singaporean Citizen or Permanent Resident. In addition, if you apply for this scheme, the flat has to be located in a project where the nearest block is within 4 km from a HDB flat or private property that your parents/married child lives in. The married child/parents’ names must also be included in your flat application.

Do note that if you apply for a flat under the MCPS scheme, the parents or married child who has helped you qualify must continue living with you, or within 4 km of your new flat throughout the Minimum Occupation Period of the new flat.

4. Third Child Priority Scheme (TCPS)

The TCPS scheme is helpful for families with more than 2 children and was introduced to encourage the formation of larger families. Up to 5% of SBF flats are allocated to applicants under this scheme. After you collect your keys to the new flat, the 3 children who have helped you qualify for the TCPS must live with you throughout the Minimum Occupation Period (MOP) of 5 years. In addition, they are not allowed to rent a HDB flat, apply or be included as occupiers in an application to buy a flat from HDB or the open market.

5. Senior Priority Scheme (SPS)

The SPS scheme gives seniors who wish to buy a 2-room Flexi flat priority to age in a familiar place or live near their parents/married child. At least 40% of the 2-room Flexi flats will be set aside for them. The flat should be within 4 km of their current or owner-occupied private property.

As we come to the end of this article, hopefully, you’ve gained more understanding about the Sale of Balance Flats scheme. While the majority of individuals typically prefer BTO as their primary and often sole option, SBF can still be a viable choice, especially when time constraints are a factor in the search for a home.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!