What you need to know before financing overseas properties

Financing overseas properties can be a complicated process, so it is essential to approach it with caution. It is thus important to know the various factors and considerations involved. Including the local property market, mortgage options, laws and regulations, and financial planning. This article will help you form decisions and secure a mortgage that is tailored to your specific needs and goals.

1. Financing a property in Australia

The real estate market in Australia is backed by its good standard of living and desirable lifestyle. As well as its strong currency, attracting many investors from all around the world.

Here are some property laws and regulations to take note of if you are approved for an investment property.

– It must be a new property or vacant land

– The investment property cannot be an established dwelling

– You are required to live in the establishment dwelling and sell it once you no longer live there

So essentially, if you own the property, you’re only permitted to sell it to locals should you decide to dispose of the property in the future. This is just one tactic the government employs to regulate property prices and demand within the resale market.

Purchasing new vs established buildings

It’s much easier for foreign investors to buy new buildings or vacant land than it is to buy an established property. You would have to apply through FIRB, but there is much less scrutiny if you buy:

– New Buildings: Generally, no conditions attached

– Vacant Land: You need to complete construction of the dwelling within 4 years

On the other hand, for established buildings (not new), foreign investors will only receive approval in these situations:

– Buying a home to live in as a temporary resident: You have to sell it once you leave, unless you become a permanent resident or citizen

– Buying an established dwelling to demolish it and develop more: You can apply to purchase an existing dwelling if you’re planning to demolish and build new housing. However, you must build and supply new additional new housing, i.e., replace 1 house with 3 townhouses.

Financing overseas properties in Australia: Fees and Charges

The application fee set out by the FIRB depends on the value of the property you plan on buying. If you’re purchasing a property under $1m, your fee will be approximately $6,000, while a property priced at $3m will demand a fee of about $38,000.

In addition, the Foreign Citizen Stamp Duty is a 8% surcharge in NSW that goes on top of your usual stamp duty (i.e.. transfer duty). Each state has its individual stamp duty amount, so be sure to check this.

Aside from these, the process of applying for a home loan is similar to that of locals.

Buying Property as a Temporary Resident

You need approval from the FIRB if you hold a temporary visa, as you are still classified as a foreigner when it comes to buying property. But you do not need FIRB approval if you have a joint tenant agreement with an Australian spouse.

If you are a temporary resident from New Zealand, you are given the same rights as Australian home buyers, making it easier for you to purchase property. However, you may need to pay foreign citizen stamp duty if you buy Australian property while outside the country.

Taking a Loan

Most Australian lenders have strict rules when granting a loan to foreigners, such as:

– Imposing higher interest rates

– Larger Deposits of around 30-40%

– Restrictions on paying with foreign income

– Obtaining approval from the FIRB

However, there are plenty other internationally recognized banks that operate in Australia that offer home loans as well.

2. Financing a property in Malaysia

Properties in Malaysia are well sought after due to its close proximity to Singapore. Its growing economy, low prices, and similarities in culture make it an attractive investment.

Property laws and regulations to be aware of:

– Foreigners can own any type of property except for

i) Properties valued less than RM1m

ii) Low and medium-cost residential units as defined by the state authority

iii) Properties standing on Malay Reserved Land

iv) Properties distributed to Bumiputera interest in any property development project

Having said that, foreigners can easily own a bungalow, terrace house, condominium, flat, landed property, studio unit, commercial property, industrial property, agricultural land (except Malay Reserved Land) and industrial land (except Malay Reserved Land).

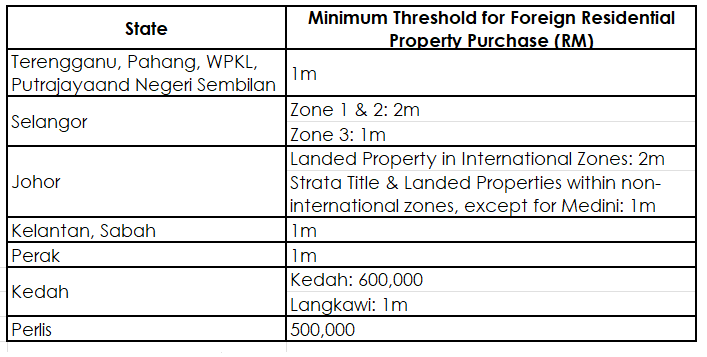

– Generally, a minimum of RM1m is applied to all kinds of property in every state, but this can be amended by state authorities.

Malaysia My Second Home (MM2H) Programme

Tailored to foreigners who wish to live in Malaysia for a long time with a 10-year visa, it is a popular option for many who plans on retiring in Malaysia. Before putting in an application, foreigners below the age of 50 are required to prepare a minimum of RM500,000 in their Savings/Current Account / Fixed Deposit, whereas individuals above 50 years old have to have at least RM350,000.

Despite the high requirement, one clear advantage of the MM2H programme is that foreigners can access property with a lower value.

What to take note of when financing property in Malaysia:

– Foreigners can qualify for home loans, but access to mortgages very much depends on one’s financial standing, the purpose of purchase and the type of property.

i) The Margin of Finance (MOF) can reach 80% for MM2H holders, and 70% for non-MM2H holders.

ii) However, if your spouse is a Malaysian citizen, they can enjoy a MOF of as high as 90%

– Obtaining a home loan through MM2H is a less complex process as you would be holding a visa, reducing the risk for banks. But if you are not under the MM2H programme, your success in accessing a loan will vary depending on whether you borrow from a local or foreign bank. You may need other forms of assets (i.e.. savings, stocks) to be used as collateral.

Financing overseas properties in Malaysia: Fees and Charges

Some closing costs have to be considered when purchasing property.

Stamp Duty

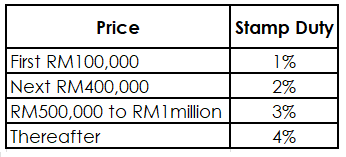

This will include a RM10 stamp duty on the Sale and Purchase Agreements (SPA), a 0.5% tax on your loan agreement, as well as a Memorandum of Transfer (MOT) or Deed of Assignment (DOA), calculated on a tier system.

Legal Fees

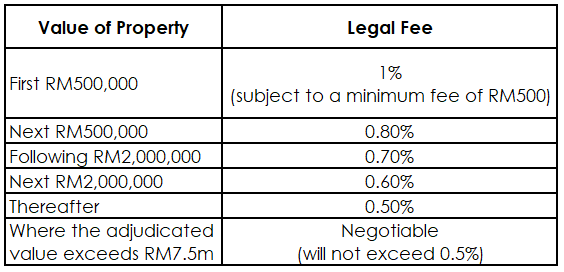

The legal fees for preparation of the Sale and Purchase Agreement are calculated as a percentage of property purchase price.

Real Property Gains Tax (RPGT)

RPGT will be charged on the profit gleaned from future property disposal. Should foreigners sell the property within 5 years of ownership, a 30% of the chargeable gain will be charged. If property is sold after the 5th year, only 10% will be charged.

3. Financing a property in United Kingdom (UK)

United Kingdom is renowned for its reputable education and prestigious universities. But did you know that besides its strong currency, a large majority of the UK market is underpinned by foreign investment? Thanks to the UK market’s relative affordability and rental yields, investing in UK property has become extremely popular amongst those that want to maximise the value of their money.

Financing overseas properties in UK: Fees and Charges

Buying property in the UK, however, is not all that simple. The total cost may increase by more than 10% due to additional expenses.

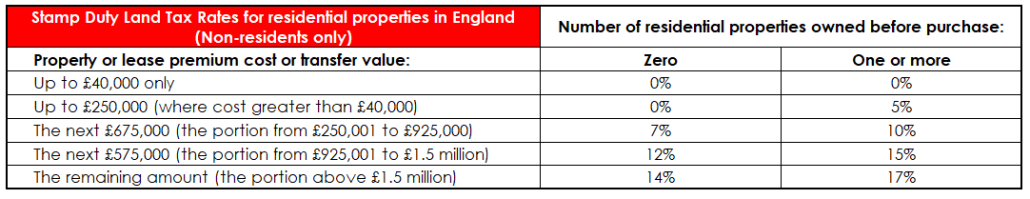

– Stamp Duty: All Real Estate purchases over £40,000 are subject stamp duty charges, ranging from 5% to 17%.

– Deposit: If you obtain a UK mortgage to purchase a home, your deposit will be from 20% or more of the property’s price.

– Mortgage expenses: There are several costs involved with taking out a mortgage to purchase a home, including arrangement fees, booking fees, and valuation fees.

– Legal Fees: You will have to hire a solicitor or conveyancer to work on your behalf, regardless of whether or not you’ve obtained a mortgage.

– Land Registry Fees: Land registry fees must be paid to transfer the property’s legal deeds to the new owner, you.

While there are no additional charges levied on foreign buyers, you will still have to pay for the costs of property transactions. This includes legal fees and any costs incurred by your lawyer (i.e.. fees for report and registration). On top of that, your mortgage will also involve administrative costs, interest, and taxes non-resident UK property owners are subject to.

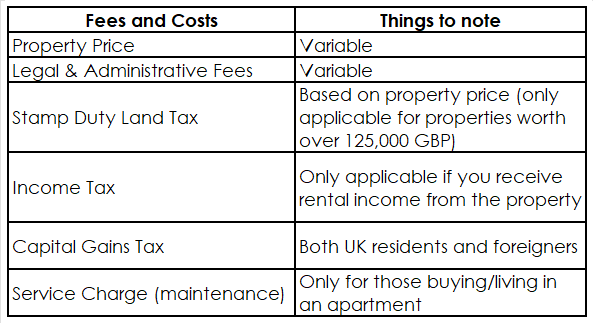

Here is a breakdown of the costs you would be incurring when buying UK property.

Steps on buying property in the UK:

1. Hire a lawyer

Before you enter a binding contract with the seller, you should hire a lawyer so that they can do their due diligence. This is to ensure that the property deal is legitimate, and look through your contract to protect your interests.

2. Exchange of Contract

Between 2-4 weeks from the agreement, both parties are to enter into the transaction. Before the exchange of contract, there isn’t any binding of agreement and any party can walk away from the deal.

3. Complete the paperwork

During this step, your lawyer will handle the paperwork and alert you of any sums of money to be paid by the requisite deadlines. A resale property transaction can take a few weeks to reach the completion stage. After which, the home will be yours officially!

Do take note that if you were to take a loan from a Singapore bank, you will be subject to the Total Debt Servicing Ratio (TDSR). This restricts your total debt repayments to not more than 55% of your gross monthly income.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!