To combat rising inflation, there is an increasing group of investors looking at purchasing properties in trust for their children. It is evident that property prices have been accelerating over the years and many parents are considering securing a future home for their child. But what does it really mean to purchase a property in trust?

In Singapore, the legal age to own a private property is 21 years old. Hence, when parents purchase a property in trust for their child (who is below 21 years old), the parents will be the legal owners of it and the child will be the beneficial owner. Upon turning 21 years old, the legal title of the property will be passed to the child as the trust will be terminated. Thereafter, the child will assume full responsibility for all property taxes and related liabilities of the property as he/she fully owns the property legally. Additionally, the child will not be eligible to purchase a HDB as he/she already owns a private property.

In other cases, parents can also allow the child to inherit the property at a later time such as at a specific age or a specific occasion such as upon university graduation. It may also include certain conditions attached that need to be fulfilled before the child is eligible for inheritance such as to get married by a certain age. All these terms and conditions need to be specified in the trust deed.

Beyond providing a strong financial asset to your child, if an irrevocable trust has been set up for more than five years, the real estate will be protected from unfortunate events such as bankruptcy. Personal creditors of the parents will not be entitled to claim the trust property to pay off any debts owed to them. Hence, protection of the property asset is secured.

Government introducing Additional Buyer Stamp Duty (Trust) for property in trust

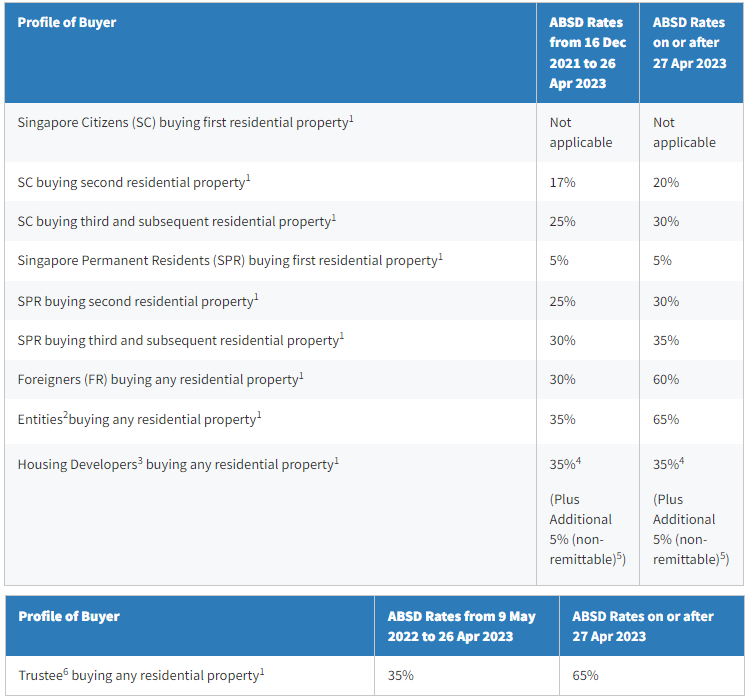

With effect from 27 Apr 2023, the government has increased the Additional Buyer Stamp Duty (Trust) to 65%. Before that, home owners are required to pay 35% for Additional Buyer Stamp Duty (ABSD) when purchasing properties in trust.

ABSD (Trust) will apply for any conveyance, assignment or transfer on sale of residential property into a living trust, regardless of whether there are identifiable beneficial owners of the property.

Remission of Additional Buyer Stamp Duty (Trust)

Remission of ABSD (Trust) may be granted if the application fulfills all the remission conditions under the Stamp Duties (Trust for Identifiable Individual Beneficiary) (Remission of ABSD) Rules 2022. If remission of ABSD (Trust) is granted, partial or all of the ABSD (Trust) of 65% will be refunded, depending on the situation.

Remission of ABSD (Trust) refunded

= ABSD (Trust) paid MINUS The ABSD payable based on the highest profile of the beneficial owners of the residential property in the transaction*

*The ABSD payable based can refer to the latest ABSD Rates table below

Remission Conditions

- The residential property is held on trust for identifiable individual beneficiaries only

- ABSD (Trust) of 65% has been paid

- Application for Remission of ABSD (Trust) is made within 6 months after the date of execution of the instrument

Additional Buyer Stamp Duty (ABSD) Rates

Scenario 1: Parent purchasing a property in trust for the child who is a Singapore Citizen and below 21 years old. It is the child’s first residential property. The child is the sole beneficial owner of the trust property and there are no other conditions in the trust to amend, revoke the child’s beneficial ownership in that property. Hence, the child is an identifiable individual beneficiary.

In Scenario 1, upon fulfilling all the remission conditions, the full ABSD (Trust) of 65% will be refunded. This is because as the trust property is the first residential property owned by the minor child, there will be no ABSD payable.

Scenario 2: Parent purchasing a property in trust for the child who is a Singapore Citizen and below 21 years old. It is the child’s first residential property. The child is the sole beneficial owner of the trust property. Additionally, the trust states that the child is entitled to inherit the trust property if he graduates from university.

In Scenario 2, no remission will be granted. This is because as the child’s interest in the property is contingent on his graduation from university, he is not an identifiable individual beneficiary. One of the remission conditions is that the residential property is held on trust for identifiable individual beneficiaries only. Hence, the remission condition will not be fulfilled.

The application for Remission of ABSD (Trust) can be done via the e-Stamping Portal and most applications will be processed within 2 months upon successful submission of all required documents. Once approved, the refund of ABSD will be made within a month.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!