A growing concern amongst Singaporeans is the fear of displacement in their own country. Singapore is well on her trajectory to becoming one of the world’s most booming economy with growth schemes such as the Tech.Pass targeted at foreign tech companies, which would indirectly allude to the fact that more expats and foreign talents are to be expected in the years to come.

For years, the Singaporean government has threaded a fine balance between extending its open arms to the global talent pool and managing the needs and confidence of its own people. With housing being a top priority concern for the local population amidst its title as being the city with the world’s second most expensive homes, rules and regulations encircling the real estate market is one that Singaporeans are keeping an eye out for, one which could affect the outcome of the General Elections held every 5 years.

So, what are some of the regulation surrounding foreign ownership?

Homes that are not available for purchase (Restricted Properties)

Restricted properties refer to the categories that are restricted only for local ownership, regardless how deep the pockets of an interested foreign buyer. For the record, foreign buyer is anyone who is not a Singaporean citizen, including foreigners and Singapore Permanent Residents. Yes, there are case-by-case exceptions such as Dyson who owns a Good Class Bungalow along Cluny Road, but generally it is a no-no. The list of restricted properties are as follows (not exhaustive):

- HDB (BTO, DBSS and Executive Condominiums before MOP)

- Landed Properties (Good Class Bungalows, Bungalows, Terrace, Semi-Detached)

- Townhouse or Cluster House (Strata landed houses which are not within approved Condominium Development under the Planning Act)

- Shophouse for residential use

- Vacant Residential land (i.e land that has no structure built on it)

- Places of Worship

Prior approval must be sought from the Singapore Land Authority (SLA), under the Land Dealings Approval Unit (LDAU) which manages all foreign person ownerships in Singapore. The LDAU is responsible for assessing the foreign ownership based on several factors such as education levels, income levels and their contributions to society. Only upon approval will ownership be granted, not accounting for the onslaught of tremendous amounts of tax payable thereafter. The list of restricted properties form a large portion of the Singapore housing market, which ensures that the interest of Singaporeans are by and large protected and taken into serious consideration.

Homes that foreign persons can purchase without needing approval (Non-restricted properties)

Not all hope is lost for those who truly want to make Singapore their home. There are still options available (although limited), for those interested in purchasing a property here. They include the following:

- Condominium Unit

- Strata landed house in an approved condominium development

- Executive Condominiums and HDB resale flats that have reached the 5 year MOP

- Taking up a lease in a landed residential property for a term not exceeding 7 years (including renewal option)

- Shophouse for commercial use only

- Industrial and Commercial Properties

- Hotels (Hotels Act)

Most of us have friends from Malaysia who have decided to take up permanent residency across the border, here in Singapore in search of better opportunities. They are allowed to purchase from any of the properties above without needing to seek approval from the LDAU! From the list, there is also a clear distinction in the land use type. Industrial and commercial based properties do not require approvals for the simple reason to incentivize foreign entities coming in to take root and grow their enterprises locally, which stimulates the economy while providing local employment opportunities.

There is one last exception under the list of unrestricted properties that foreign buyers can consider – Sentosa Cove. In this resort island, foreigners are not required to obtain any prior approval before purchasing a luxury landed apartment.

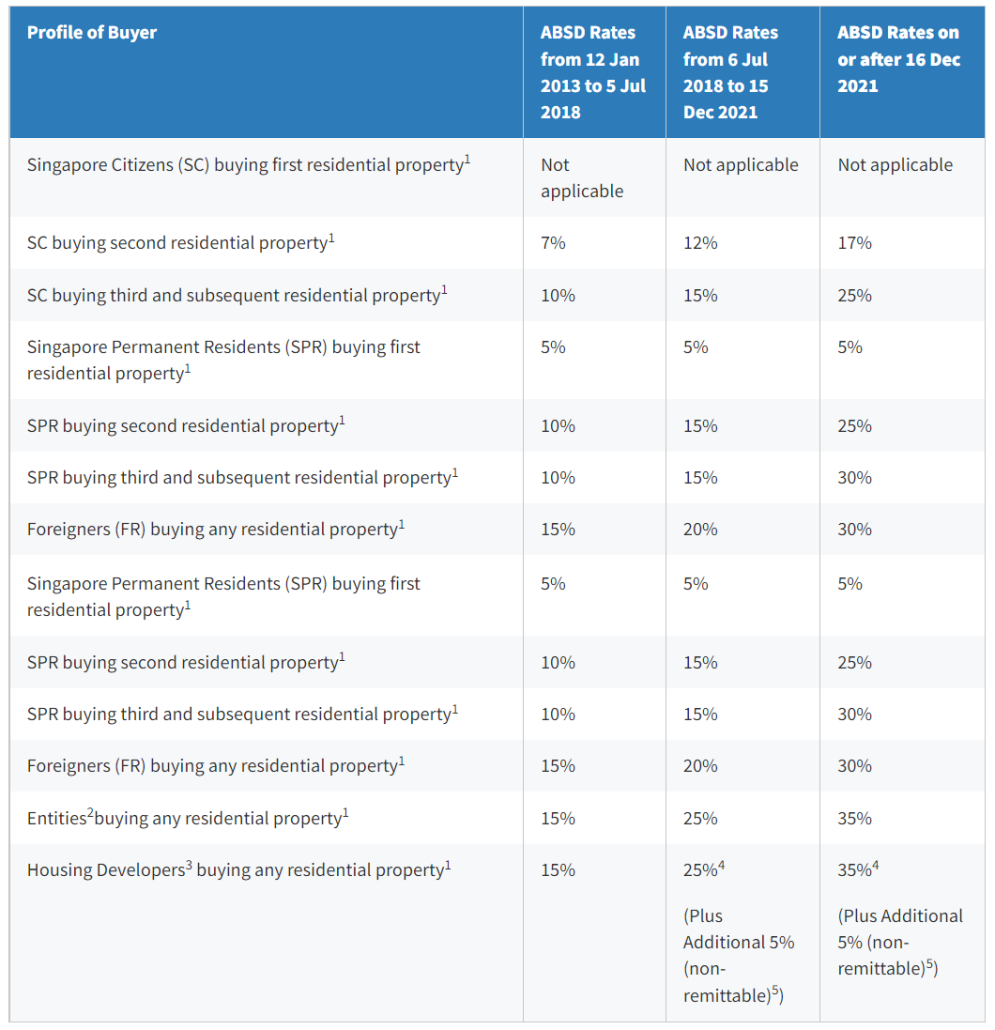

Apart from putting red tapes on a select group of properties and land ownership, another means of deterring foreign ownership is through taxation. Examples include the Additional Buyer’s Stamp Duty (ABSD) which depends on the residency profile of the buyer.

Source: IRAS

Did you know that there is a particular group of foreigners that can seek remissions on the ABSD payable when purchasing more than 1 property? Yes, and these individuals come from 5 countries, namely: Iceland, Norway, Liechtenstein, Switzerland and the USA (citizens only). This special concession comes as a result of Singapore’s existing Free Trade Agreements (FTA).

We hope that this article has provided you enlightenment on what goes behind the scenes of the real estate sector regarding foreign ownership. While prices of homes are most likely going to increase, it is in tandem with inflation and growing demand, but one can be rest assured that Singaporeans will have and will likely always maintain a significant consideration in the eyes of the government.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!