If the recent August Build To Order (BTO) launch including Queenstown and Hougang has left your senses tingling, you have probably considered getting your own property. Being one of the largest financial commitments you would make, it is only reasonable for you to stop and ponder – how can I pay for my house? We have always heard about Singaporeans using their CPF savings to pay for their new house– but which aspects can it cover, and how much cash do you need?

What is CPF?

Central Provision Fund (CPF) is a mandatory savings scheme for all Singaporeans and PRs that doubles as a social security scheme. Aside from addressing healthcare and homeownership, it also helps individuals set aside enough for retirement.

How does CPF Work?

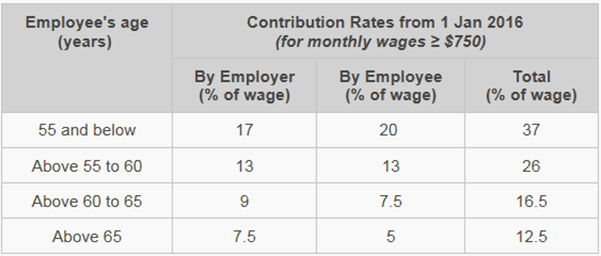

For Singaporeans in their 20s, roughly 20% of their income goes to their CPF. Additionally, your employer has to contribute an additional 17% of your income to your CPF. If you are earning $3,000 a month, your total CPF contribution would be 37%, which is around $1,110! That’s a pretty significant figure of your earnings that is in the system.

But where does your CPF money go?

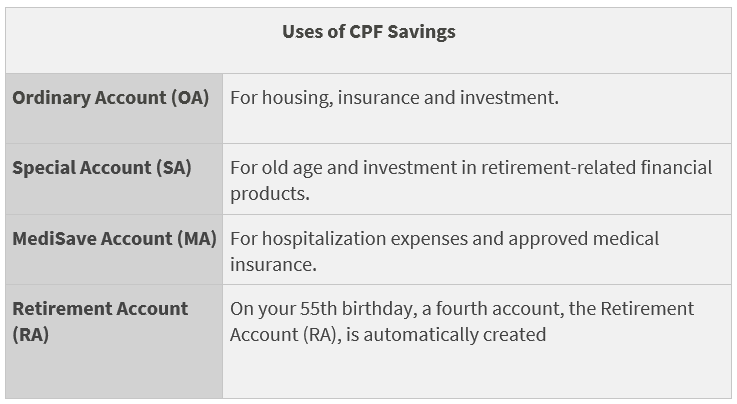

Well, your CPF contributions would be split into 3 accounts namely Ordinary Account (OA), Special Account (SA), and MediSave Account (MA). Each account has its own purpose, and the contribution rates change according to your age range. OA also offers a 2.5% interest rate, which is far above what is offered by savings accounts in private banks.

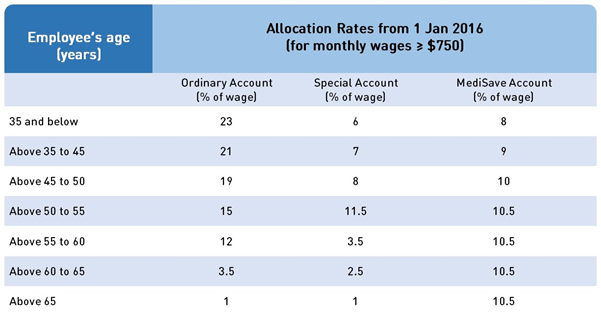

Given that you are more likely to buy your own residential property in your younger working years, a higher percentage of the allocation rate will go into OA, as reflected in the table below. As you age, the allocation rate weighs heavier into MA.

Loan Structures Offered

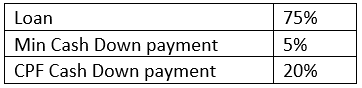

If you are eligible for an LTV of 75%, the loan structure is as follows:

This means that up to 75% of your property can be financed by a mortgage. For the remaining 25%, 5% must be paid by cash. The balance can be paid by CPF.

When it comes to paying mortgages, only the monies in your OA can be used to pay for your down payment and mortgage installments. As for your SA and MA, their purpose is to provide for your retirement needs and medical expenses respectively. Thus, you cannot tap on the other accounts to finance your property purchase.

As mentioned above, the minimum cash down payment of 5% must be paid in cash. This 5% refers to the amount relevant to Option To Purchase (OTP) – 1% Option Fee and 4% Exercise Fee. After all, OTP must be paid by cash – wouldn’t it be an administrative mess if sellers start applying to CPF to receive OTP fees?

Additionally, there might be Cash Over Valuation (COV) for resale flats and private housing. This refers to the difference between the valued price of the property and the transacted price. COV must be paid in cash. Generally, the balance can be paid using CPF.

Having said that, CPF still has a withdrawal limit to ensure that buyers do not use up too much of their CPF on housing and have enough for their retirement. The Withdrawal Limit (WL) is 120% of the Valuation Limit (VL), which refers to the lower of the purchase price or the value of the property at the time of purchase. Upon reaching the Withdrawal Limit, no further withdrawal of CPF by any other owner would be allowed. In other words, any outstanding housing loan exceeding 120% of the VL must be serviced by cash.

Although that may sound daunting, it is not a concern for BTO buyers. After all, the public housing flats are usually sold below the Valuation Limit and Withdrawal Limit to remain affordable. Hence, it is usually not a condition for those looking to finance their first home loan using CPF.

Can you use CPF to pay Buyer Stamp Duty?

Most properties can have their Buyer Stamp Duty (BSD) paid through CPF, including all HDB and Building Under Construction (BUC) Private Properties. For HDB, they can communicate with CPF to get access to your accounts. On the other hand, CPF can lodge a caveat on the Mortgage In Escrow which is essentially a temporary title deed for BUC.

However, in some cases, you may need to pay cash first. This pertains to private resale properties. This is because the title deed is still under the name of the current owner, and CPF cannot lodge a caveat on the title deed that does not have your name on it. Therefore, you would have to pay cash for the BSD first and claim back the monies after the title deed transfer is complete.

The Downside

There are 2 main drawbacks to using CPF for your house repayment.

Firstly, upon the sale of your house, you will need to repay CPF the amount withdrawn and the accrued interest. This means that upon selling your house, the proceeds of the sale will be dispersed in this order:

- Outstanding housing loan

- CPF principal amount withdrawn + accrued interest

- Cash proceeds

Essentially, aside from repaying your housing loan, you will also need to refund the monies withdrawn from your CPF OA to pay for your installments. In addition, you will also need to return the 2.5% interest that the principal sum would have accrued if you did not withdraw it. The balance thereafter would be cash proceeds for you to keep.

The second drawback is losing opportunity costs. Essentially, you are missing out on the low-risk interest rate of 2.5% your CPF OA offers. Unlike the marginal interest rate offered by private banks, CPF OA has a 2.5% interest rate per annum, which could snowball into a hefty amount over the course of 20 years. Withdrawing the money to pay for your mortgage means that you are missing out on the opportunity to maximize your returns.

There are many benefits of using CPF for your mortgage installments, especially for borrowers with tighter cash flows. However, it also comes with some costs – including opportunity costs and having to repay the CPF amount with accrued interest upon the sale of the property. For those looking to minimize the opportunity costs, an intelligent alternative would be to repay your installments in cash and CPF. This allows for part of your monies in CPF OA to continue earning decent interest rates while not taking too much of your cash.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!