The purchase of a home is a significant adult milestone. Purchasing a house is a large-ticket item and its imperative that plan your finances well. This is to ensure that you are purchasing within your budget so that your financial commitments are sustainable and flexible to meet with your changing needs.

Most home buyers will take on a home loan to fund their property. Besides loan eligibility and cash / CPF down payments required, it is also important to consider the monthly mortgage payments as these payments take up a significant part of one’s monthly cash flow for many years to come. Despite its importance, many people, especially first-time buyers, are unsure of how to calculate their mortgage payments.

Clive Chng is an associate director at Redbrick Mortgage Advisory. He is interested in property financing and developing strong client relationships. He understands how difficult it can be to make decisions without the proper information and advice. There are rules such as Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR), that can complicate the preparation. Let Clive help you overcome these obstacles.

Understanding The Important Parameters Involved Before Using The Mortgage Calculator In Singapore

Let’s first understand the important parameters before moving into the calculations.

1. Loan tenure

Loan tenures for purchases are capped at age 65, or 30 years (Private property) or 25 years (HDB), whichever is lower. If there are joint owners of varying ages, an Income Weighted Average Age (IWAA) is calculated to determine the “combined” age of all owners. That said, there is also an option to get a longer loan tenure at the start, by reducing the loan amount taken on the mortgage.

2. Loan Quantum

When it comes to loan quantum, we’d have to dive deeper into factors such as loan eligibility, bank valuations and personal preference. The maximum Loan To Valuation (LTV) or loan amount one can take is always a factor of a borrower’s income and commitments, capped at a maximum of 75%.

To determine loan eligibility, MAS states that a buyer has to adhere to MSR and TDSR guidelines to ensure that he/she is not over leveraged. Part of the requirements also specify that the borrower’s income is stressed test against an interest rate of 4.00%, specified by MAS, to cater to potential rising interest costs.

At present, as we are in a high interest rate environment, it is important to note that the stress test benchmark rate will increase should interest rates go beyond a certain level. Although the current Stress Test interest rate specified by MAS sits at 4.00%, because mortgage interest rates have already breached the 4.00% level, the banks have since increased their stress test interest rate to between 4.25% to 4.50%

Valuations also matter when it comes to determining the loan amount one can get. For HDB purchases, valuations are determined by HDB, and for private properties, the valuations are determined by the bank that you are obtaining a mortgage from. It is important to note that the banks will only grant you a maximum of 75% loan on the lower of the purchase price or valuation price. Hence, it is important to know what the property is worth, before making a commitment to buy.

Lastly, one may decide to use more CPF for the down payment to take a lesser loan amount, while others will want to preserve their CPF in the Ordinary Account (OA) or Special Account (SA) so that it earns a virtually risk-free return of 2.50% or above, and in doing so also creates a buffer for rainy days (CPF can be used to pay for the monthly mortgage payments).

It is not mandatory to take on the maximum loan of 75% if one does not choose to. Yet, careful consideration has to be taken when deciding on the amount of loan to take up, especially for buyers of HDB flats, because once you have decided to take on a lesser loan, the decision is irreversible; there is no way to release equity from the HDB apart from selling it in the open market. For private properties, owners can still consider taking out an Equity Term Loan on the property to release residual equity. However, you will realise that you’d have to jump through several hurdles to obtain that equity, and the banks would now charge you an interest on the equity released.

3. Interest Rates

The amount of mortgage you would have to pay monthly largely depends on the loan package that you choose, as well as the types of rates chosen. Banks often have a mixture of different loan packages with fixed rates or floating rates.

Fixed-rate mortgages mean that the interest rate is fixed for the first few years of the mortgage only. After which, your interest rates will transition into a floating rate for the remaining tenure. The interest rate for the remaining years is usually pegged to the common benchmark rates such as SORA (Singapore Overnight Rate Average) coupled with a higher spread. Hence, it is common to look into refinancing when your mortgage is nearing the end of the lock-in period.

On the other hand, floating-rate mortgages have interest rates tied to a particular reference rate plus a spread (bank’s profit margin) added to it. The more common reference rates are SORA, Fixed Deposit, and Board rates. If the reference rate changes, your monthly payments will also change accordingly. As the borrower assumes a higher risk / volatility, floating rates are generally priced lower than fixed rates.

It is common for the banks to offer lower spreads in the first few years of the mortgage (typically within the lock in period) and higher spreads thereafter. Hence, it is encouraged that you review the interest rates close to the end of the lock in period, and refinance to a more competitive package should the opportunity arise.

Calculating Your Monthly Mortgage Instalments

Now that you have understood the important parameters for your mortgage, you can input the values into an online mortgage calculator in Singapore, to get a gauge on the monthly mortgage instalments. It is also encouraged to simulate higher interest rates, should you decide to take on a floating / variable interest rate to cater for any potential increases in interest rates.

Should I Be Concerned About the Mortgage Servicing Ratio (MSR)?

Earlier, we had discussed that MSR and TDSR would determine a borrower’s loan eligibility when making a purchase. Let’s dive deeper to find out more about how it affects you.

The mortgage servicing ratio (MSR) specifies the portion of a borrower’s gross monthly income that goes towards the repayment of the mortgage and is only applicable when purchasing a HDB flat, or an executive condominium (EC) where the minimum occupation period (MOP) has not yet been fulfilled.

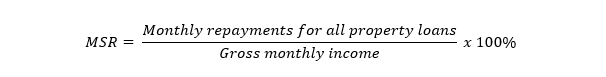

To calculate MSR, use the formula as shown below:

MSR is capped at 30% of a borrower’s gross monthly income. What this means is that the monthly mortgage payments on the HDB cannot exceed 30% of a borrower’s monthly income. MSR helps to prevent borrowers from over leveraging, so it is alright if you realize that you are borrowing the maximum amount your income allows you to.

Can I Still Apply For A Mortgage If My Total Debt Servicing Ratio (TDSR) Exceeds 55%?

The Total Debt Servicing Ratio (TDSR) refers to the proportion of a borrower’s gross monthly income that can go towards repaying all their monthly debt obligations. Monthly debt obligations include car loans, personal loans, renovation loans, student loans or any other debts usually taken from a financial institution and reflected in one’s credit report.

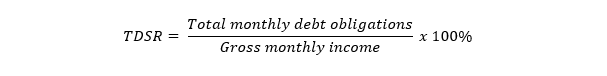

You can use this calculator to easily calculate your TDSR. Alternatively, the formula for calculating TDSR is as follows:

With effect from 16 December 2021, the TDSR is set at a maximum of 55% by the Monetary Authority of Singapore (MAS). In short, your monthly commitments (inclusive of the mortgage you intend to get) cannot exceed 55% of your monthly gross income. Hence, the larger the commitments you have, the lesser income that can be used toward the mortgage, and that translates to a lower loan eligibility.

Unlike MSR, that only applies to property loans taken for HDB flats or ECs, the TDSR loan is relevant to loans taken up for all property types. Yes, HDB or EC purchases have to conform to both MSR and TDSR.

Summary

It is often easy to gain access to an online mortgage calculator in Singapore. Yet, it is imperative to have a good understanding of how MSR and TDSR will affect your borrowing ability. It is also important to know how loan tenure and interest rates affect your monthly mortgage payments.

At present, online calculators are still unable to cater to credit policy-based results. Always do your own homework and thorough research before making a purchase. For avoidance of doubt, speak with a professional mortgage advisor for more insights. Always seek professional advice on the best way to move forward.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!