Ray Dalio, founder of the Bridgewater Associates, the largest hedge fund in the world, must be heaving a sigh of relief as he said he’d chose gold over Bitcoin if he had a gun to his head. Gold had been losing out to cryptocurrencies in the recent years as a store of value or inflation hedge, but with the recent crash, cryptocurrencies might have just lost their lustre to gold.

What is TerraUSD?

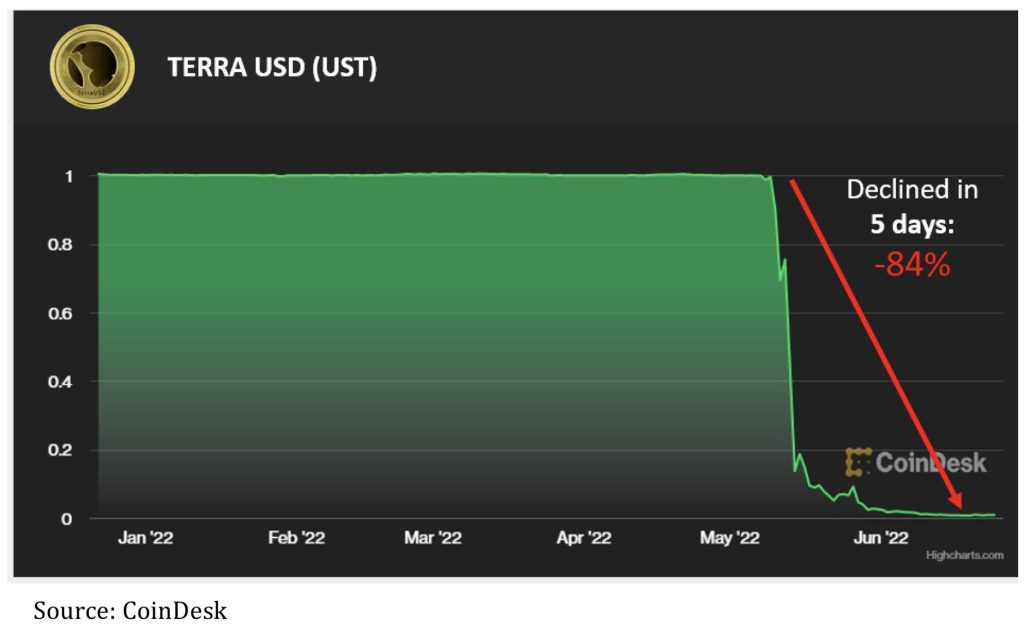

Due to the volatile nature of cryptocurrencies, stablecoins were designed to be pegged to fiat money or commodities. Posited as a stablecoin, TerraUSD (UST) was launched in 2020, with a computer algorithm being used to peg itself to the US dollar. It is not backed by actual US dollar-denominated assets1. When the algorithm failed, it resulted in UST declining by 84% in value within 5 short days.

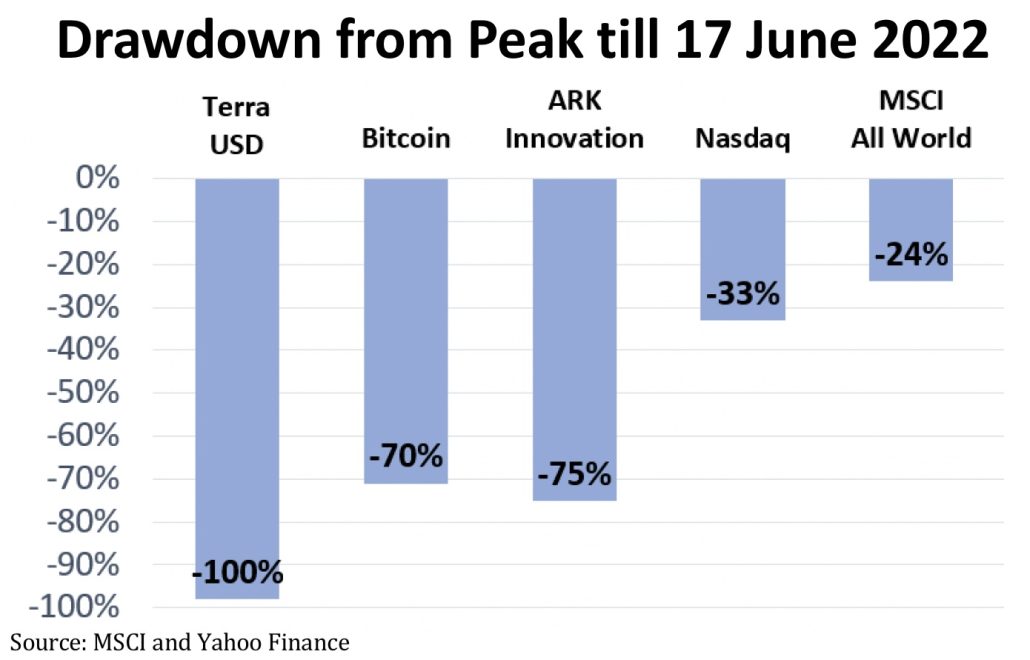

The crash created a ripple effect among other cryptocurrencies. Bitcoin and Ethereum fell by 70% from their peaks. The sharp declines meant that investors who had put their hard-earned money into these cryptocurrencies are likely to be experiencing severe financial winters now.

What lessons can be derive from this episode?

Of course, cryptocurrencies aren’t the only assets undergoing market corrections. Many equity indices (e.g. the MSCI All World Index and the Nasdaq) and funds (e.g. the ARK Innovation ETF) also underwent significant corrections. Their declines serve as a reminder that the ample liquidity of the past 12 years of loose US monetary policies had contributed to the widespread speculation in assets with no fundamental value nor proven store of value. With inflation now forcing a change of policies, these wild asset bubbles are deflating.

The crash is a stark reminder that as attractive as some of these very volatile asset classes could be at a certain point of time, a more robust strategy is needed to ensure long-term financial success. Two key components of this strategy are having a portfolio approach and a meticulous selection of securities.

1. Portfolio Approach

As different asset classes perform well in different economic seasons, the portfolio approach includes diverse asset classes. The weightage of each asset class would be determined by macroeconomic fundamentals. The portfolio approach would increase the resilience of the portfolio and avoid major shocks due to an over-reliance on any one asset class.

Unicorn Financial Solutions’ portfolio is actively managed with the current allocation: 40% Equities, 20% Gold and 40% Cash. Unicorn Financial Solutions believe that this allocation gives us the resilience to take on the current volatility that’s brought upon us by the uncertainties and fragility of the global economy, which is reflected in the current discounts in the market too. Having sufficient cash reserves ensures Unicorn Financial Solutions can take advantage of discounts when such opportunities arise. However, we also believe that these discounts will probably disappear in time when relative certainty returns.

2. Securities Selection

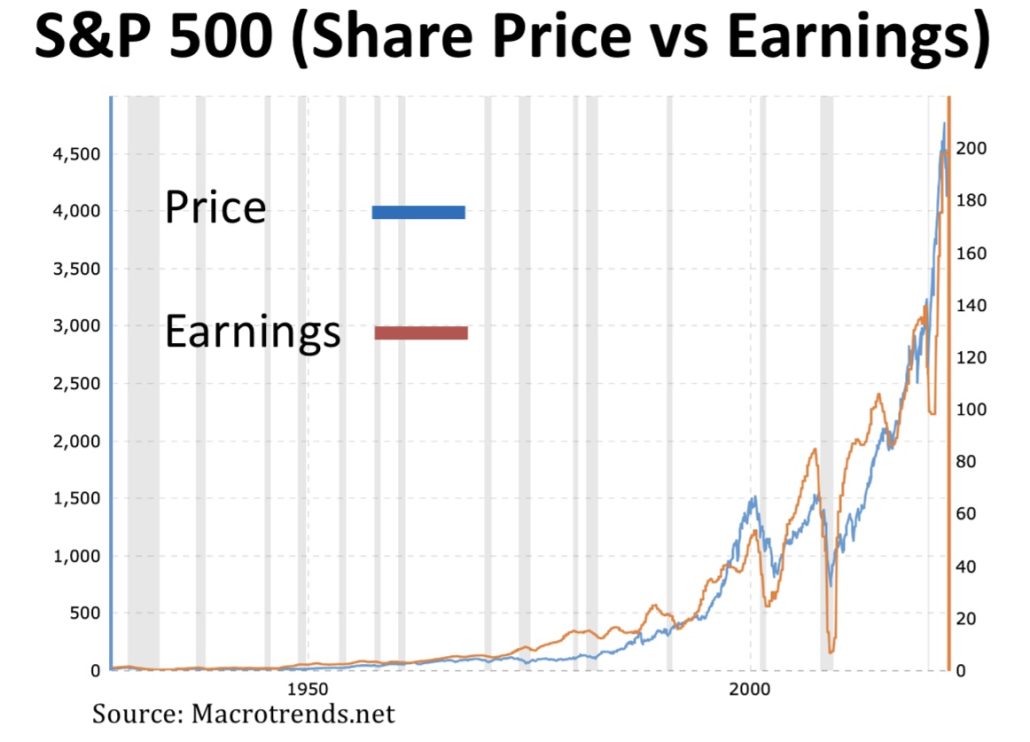

While the portfolio approach focuses on macroeconomic fundamentals, securities selection focuses on the fundamentals of individual stocks, such as the company’s operating earnings. Essentially, it is about choosing companies that are highly profitable, or have a strong track record. Unicorn Financial Solutions avoid loss-making companies with no clear path to profitability.

A comparison of the stock price versus the earnings of the S&P 500 companies over the last 100 years in the above chart illustrates the high correlation between the long-term stock value and the operating earnings of the companies. See more details here.

There are also many types of companies that you could choose to buy, and this might be a good time to re-assess your portfolio. There are 3 classes of investments that are experiencing dips in their share prices currently.

1. “Terminally ill” investments are usually heavily indebted and loss-making companies which need a constant injection of capital. These companies may not survive this crisis, like many of the poster-boy dot-com companies during the dot-com boom. They had enjoyed their time in the sun, but expanded too quickly and their costs outran their revenue and capital injections. Examples include Pets.com, eToys.com, and boo.com. You may like to liquidate them as soon as possible.

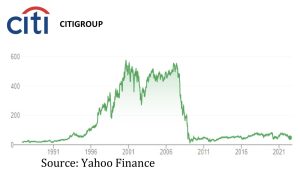

2. “Critically ill” investments are those in ICU and may not regain previous financial health even though they are in recovery. These investments include those with no fundamental value as well as companies that were bumped up by the pandemic. An example of a company in this class would be Citigroup, which suffered a major decline in share price during the last financial crisis, and might most probably never recover. Its share price today is more than 90% shy of its peak. Funds in this class of investments might be better off in the next class of investments.

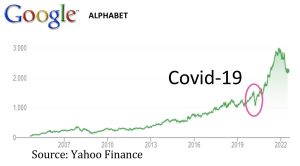

3. “Mildly ill” investments are highly profitable companies with a clear path of growth, as well as commodities backed by a strong secular demand or are a proven store of value. Thus their share prices might have dipped currently, but they recover shortly after the crisis. An example would be Google – where COVID-19 (in 2020) had proven to be just a minor blip to their operating earnings, and its share price is discounted right now. Get more details here. If you are wondering whether your current portfolio is sufficiently robust or would like to accumulate more companies like Alphabet in your portfolio, do look for your Unicorn Financial Consultant who would be able to craft a personalised plan and investment strategy for you.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!