Being filial to one’s parents has always been an extremely important value in our Singaporean society, and we would definitely want to take care of our parents in their silver years. One way to show piety and get paid for it would be to live near your parents; the Proximity Housing Grant (PHG) is offered to Singaporeans who purchase resale flats near their parents.

Of course, children who do not live near their parents are by no means less filial than those who do, but staying near parents does have its benefits. For example, parents can easily turn to their children for help during (touchwood) sickness or emergencies because they are close by. Additionally, visiting is a lot more convenient, and can happen more often (getting to eat mom’s home-cooked food regularly is definitely a plus).

So, what is the Proximity Housing Grant (PHG)?

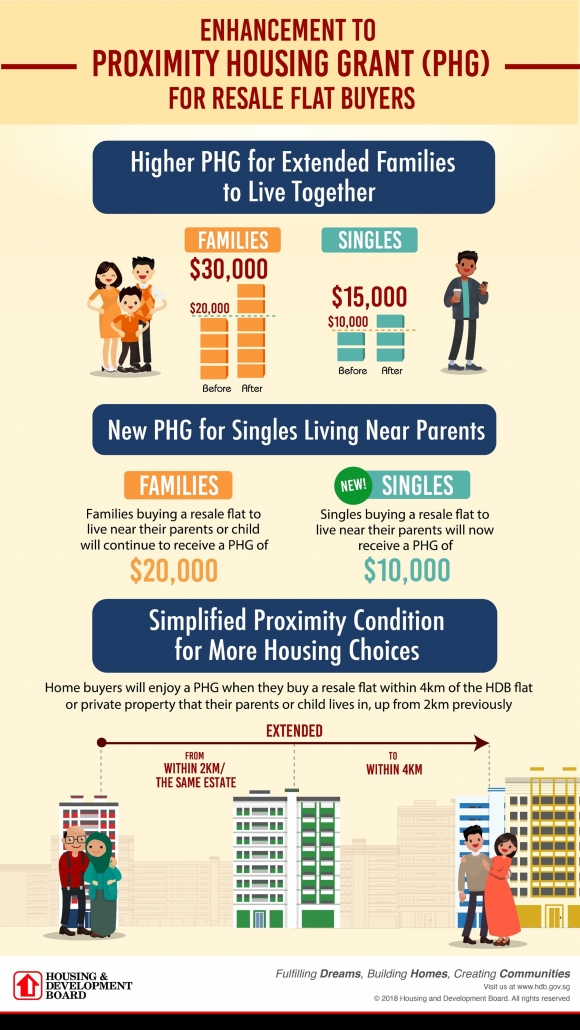

Married couples or singles who live near their parents are entitled to a $20,000 or $10,000 grant respectively, and married couples or singles who live with their parents in a newly purchased resale flat are entitled to a $30,000 or $15,000 grant, respectively. Near is defined as within a 4km radius, which was upgraded from the previous 2km radius. The Proximity Housing Grant (PHG) also applies to parents who buy a resale HDB flat to live near or with their children, provided the child is married or at least 35 years old if single.

Important things to note about the Proximity Housing Grant (PHG)

The Proximity Housing Grant (PHG) is a positive thing for Singaporeans and is important in the face of our aging society. However, there are some restrictions that you need to be aware of the PHG.

1. Homebuyers obtaining BTO units are not eligible for Proximity Housing Grant (PHG)

The PHG is only for resale HDB units and does not apply to Build-To-Order (BTO) units. This is because BTOs are already subsidized flats, whereas resale flats bought without Central Provident Fund (CPF) grants are considered non-subsidized flats.

2. Usage of Proximity Housing Grant (PHG) is restricted

Similar to other CPF grants, the PHG is credited into your CPF Ordinary Account (OA), and can only be used for the down payment or to reduce the housing loan amount. The grant cannot be used for the monthly loan instalments, or any other thing for that matter.

3. CPF grant amounts need to be returned to CPF account upon sale of flat

Upon the sale of your flat, whatever CPF you have withdrawn to pay for the flat has to be returned to your CPF account, with interest. Unfortunately, CPF grants are no different. Now contrary to certain beliefs, money does not vanish into the enigma that is CPF; it is still your money, meant for your retirement. However, it does mean that your cash proceeds from the sale of the flat will be reduced.

For example, say you were to purchase a 4-room resale flat near your parents for $450,000. You are then entitled to a PHG of $20,000, meaning you effectively paid $430,000 for your flat. 5 years later, you decide to sell off your flat, which nets you a cool $480,000. This lands you a profit of $50,000. However, you will need to return $22,628 back to CPF (at 2.5% interest), cutting your cash on hand down to $27,372.

Compare this to if you did not take the grant, your profit and cash on hand would be $30,000. This means you will have $20,000 less profit, but $2,628 more cash on hand. If you greatly prefer cash or for some reason have a deep mistrust for CPF, you can by all means consider not getting the PHG, but that would mean cutting down your profit by $20,000.

4. Minimum Occupation Period (MOP)

Parents do not have to be living in a HDB unit for their children to enjoy the PHG, but they do have to be living in the property that their children have chosen to stay near to – they have to be owner-occupiers of that property and cannot be holding it for purely investment purposes.

Additionally, if you purchase a resale HDB flat near your parents, they will have to remain staying in their current property throughout the MOP (currently 5 years). This means that they are essentially tied down, so it is best to ensure that they have no plans of moving before obtaining the PHG.

Conclusion

The Proximity Housing Grant (PHG) is particularly beneficial for Singaporeans who want to live near their parents even though they live in a mature estate. Mature estates tend to not have many BTO launches, and even if there is one, competition for the units will be extremely high. In that case, resale flats will be the alternative, but resale flat prices in mature estates are high, so the PHG offers a much-needed subsidy. The PHG may put certain flats within reach, which without the grant would have been unaffordable.

However, it is a must to be aware of the various conditions attached to the Proximity Housing Grant (PHG) and also remember to check if the flat you are interested in falls within 4km of your parents’ home by using HDB’s Distance Enquiry for Proximity Housing Grant e-service.

Although the Proximity Housing Grant (PHG) will not be enough to lower the prices of resale flats to BTO levels, the newly enhanced PHG is welcome news to all HDB resale buyers. Going forward, an ideal situation would be where all families live a stone throw away from each other, so that there will never be a chance for a parent to lose touch with a child.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!