“Ladies and gentlemen, we are experiencing some turbulence. Please return to your seats and fasten your seatbelts.”

Have you ever encountered someone jumping out of a plane during a turbulence? It is hard to imagine someone doing that. However, when it comes to investing, people do ‘jump out’ during turbulent times and suffer losses.

By now, everyone from Wall Street to Main Street are expecting such turbulent times ahead, with plenty of predictions of recession and stock market correction. How then can you arrive at your financial destination safely and happily while riding through turbulence? A key proven strategy is dollar cost averaging.

What is Dollar Cost Averaging (DCA)?

In simple terms, dollar cost averaging (DCA) is investing the same amount of money at regular intervals, as opposed to timing the market. In an ideal world, an investor who times the market perfectly would have the largest gains. However, it is rare to be right all the time. On the other hand, DCA can provide an investor a secure way to grow his wealth consistently. Here are exactly 3 reasons why it works well.

1. DCA Enables You to Capture the ‘Best Opportunities’

When the market becomes more turbulent, DCA allows investors to buy in at even lower prices. When we invest the same dollar amount every month, we essentially buy more units when the price is lower. In the chart above, the average price of the 8 points of investment is $10.06. However, the actual average unit cost is $9.61. The difference is because more units are being purchased at those points with lower prices compared to those at the higher prices, hence lowering the average unit cost. When the market recovers, the units appreciate. Investors who have amassed more units during a turbulent market will thus experience greater growth in their investment. As such, even though the price of the investment is the same at the start and the end of the period, the investor made a profit of 4.06% by doing DCA over the period.

2. DCA Takes the Emotion Out of Investing

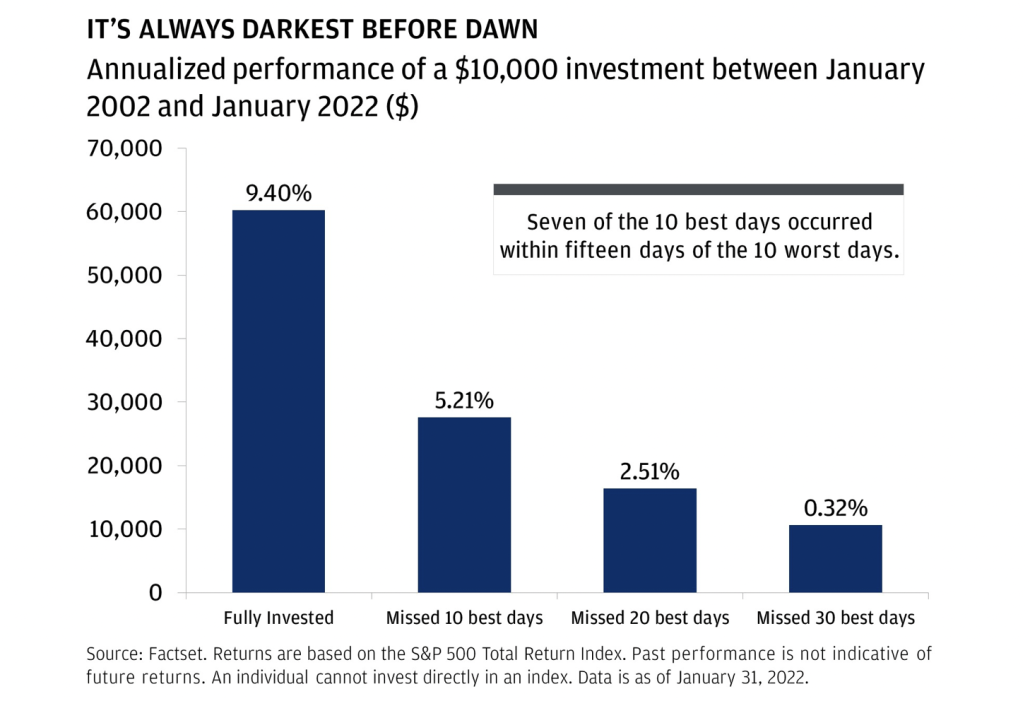

Consider this statistic – seven of the 10 best days of the market occurred within fifteen days of the 10 worst days. Without the benefit of hindsight, it would be easy for someone to miss the best days just because he was trying to avoid the worst days. Sound judgment of the condition of the market may be clouded by the news and market noise. Just like how a math wizard may struggle to do basic math while he is on a roller coaster ride, the best investors may struggle with making sound investment decisions when the market is tumbling. With DCA, there is no need to decide whether to invest or withdraw your money. You will not miss any opportunities if you embark on a system and keep to it.

3. DCA Helps You Cultivate A Powerful Savings Habit

James Clear, author of best-selling book, Atomic Habits, puts it this way. “Goals are good for setting a direction, but systems are best for making progress.”1 Without a system, goals only look good on paper. Given that volatility in the market is a constant characteristic, a person who invest only when he feels the timing is ‘right’, will not be saving consistently towards his financial goals. His important financial goals, such as buying a home or retiring comfortably, will probably be compromised, unless he makes saving and investing a habit.

The crux of the matter here is that most people do not start off in life with a hefty sum of money to invest. Unless they are ‘Crazy Rich Asians’, most individuals will need a lifetime of savings to grow their wealth. A seasoned farmer who plants only one seed, will very likely yield less fruits than a novice who sows a whole plantation worth of seeds. With the current market situation, some investors may be tempted to procrastinate and delay investing. However, a well thought-through and well stuck-through system could enable one to start early and grow his wealth exponentially.

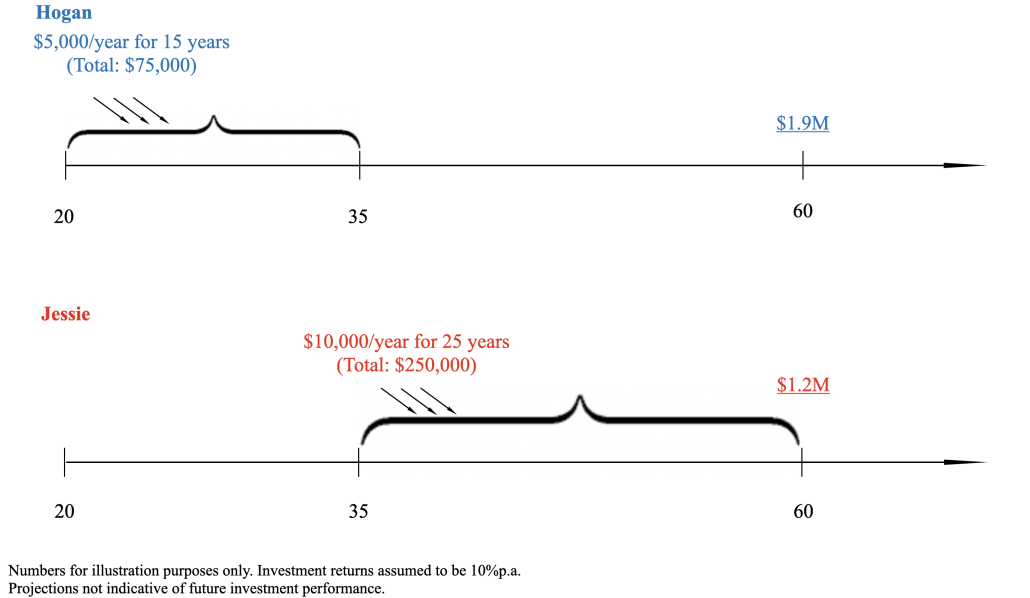

Take for example, a pair of twins named Hogan and Jessie. Hogan starts investing at the beginning of his career at age 20. He invests $5,000 every year. After investing for 15 years, he stops injecting new funds, but keeps his existing funds invested. In total, he would have invested $75,000. Assuming an average return of 10% p.a. By the time he is 65 years old, he would have $1.9M.

Contrast that with his twin, Jessie. Jessie decides to put off investing for the first 15 years of her career. At age 35, she decides to catch up and tries to turbocharge her investment by investing more than Hogan. She invests double the amount each year ($10,000/year) and injects funds for a longer period (25 years). With the same assumed rate of 10% p.a., Jessie ends off with $1.2M at age 65 – a far cry from Hogan’s $1.9M.

Conclusion

Turbulences on flight are caused by strong wind currents. But imagine what happens if there are no wind currents at all – air travel would not be possible. Imagine what life would be if we cannot fly. In the same way, the stock markets may be very volatile now, but this volatility also enables investors with the right strategies to profit greatly and to achieve their goals in life. It is possible to thrive in turbulence. Return to your seats. Fasten your seatbelts, and stay the course of investing with proven strategies like DCA.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!