What Is Property Tax & Why Does It Matter?

Property Tax in Singapore is a wealth tax levied on property ownership. It is not a tax on rental income. It is levied on the ownership of properties, irrespective of whether the property is occupied or vacant.

This is a recurring tax and the amount of tax payable depends on 2 factors:

1) Property type

2) Annual value (AV)

This property tax is payable annually on 31st Jan and any late payment will incur a 5% penalty on the unpaid tax.

So, any new property buyers should check its Annual Value (AV) as this is a recurring expense. Existing homeowners should also check, especially if it was previously rented out, and now being used for own stay. This is because the property tax levied is dependent on whether the unit is owner-occupied or rented out for investment.

How Is Property Tax Calculated?

Remember this: Annual Value (AV) x Property Tax Rate = Property Tax Payable

If your AV is $300,000 and you are required to pay 10% tax, then your property tax payable would be $30,000.

Annual Value (AV)

Annual Value (AV) is based on a multitude of factors, including prices of comparable properties in the vicinity and physical attributes such as size, floor level, age of building, as well as locational attributes such as proximity to MRT stations.

One may submit an objection within 30 days of the valuation notice if there is any disagreement with the reassessed AV.

Property Tax

The Property Tax in Singapore is progressive-tiered to allow for more equitable wealth distribution. In short, the higher the AV of your property, the higher the tax rate.

Another factor that IRAS considers is if the property is owner-occupied. If the owner lives in the property, they will be subjected to lower tax rates. On the other hand, non-owner-occupied properties are seen as investment assets and therefore subjected to higher tax rates. If you are currently living in a HDB Flat, you are likely to be subjected to Owner-occupied Property Tax.

As announced in February 2022, Property Tax in Singapore for both owner-occupied and non-owner-occupied properties are expected to rise over the next 2 years. The former will rise from 4% – 16% to 4% – 32% by 2024.

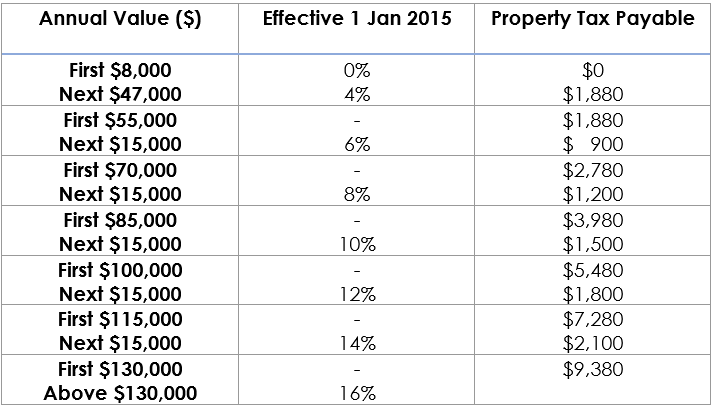

Owner-occupied Property Tax (Residential Properties)

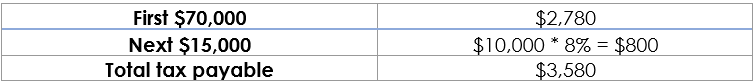

For example, if your property is priced at $80,000, it will be in the 3rd bracket and you will be required to pay relatively low taxes at $3,580.

To give you a better idea, here’s the detailed breakdown:

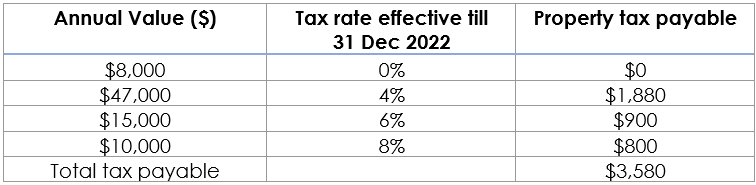

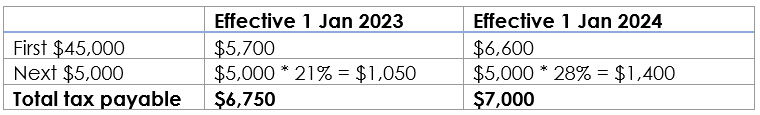

With the revised tax rates, homeowners can expect to pay higher tax rates:

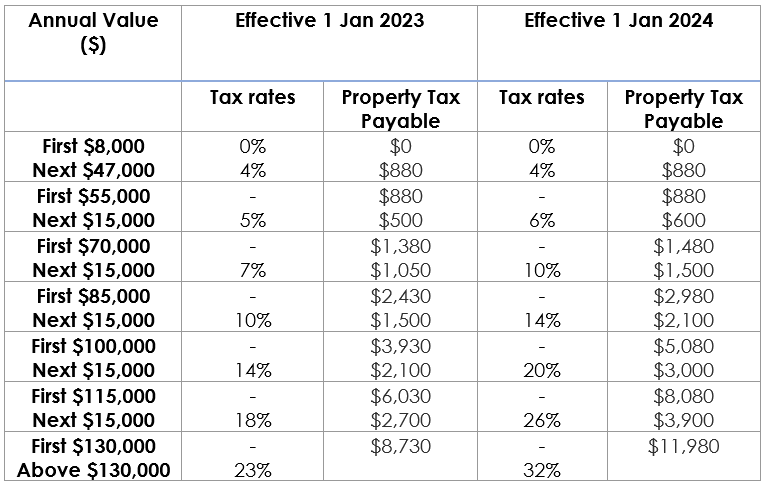

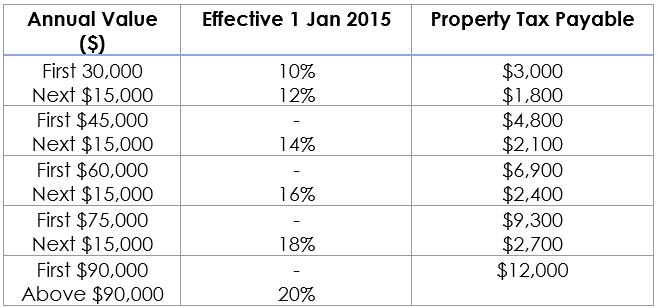

Non Owner-Occupied Property Tax (Residential Properties)

As for properties that are not owner-occupied, these could include residential properties that are rented out.

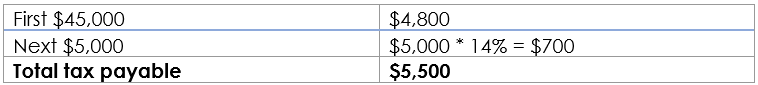

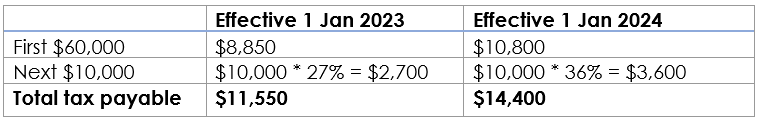

For example, if the property you own, have an AV of $50,000, you will be required to pay $5,500 under prevailing tax rates for non-owner-occupied properties.

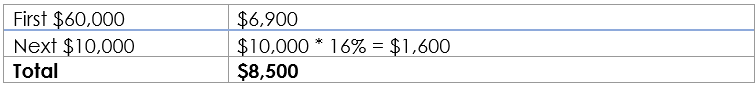

In another example, if your property has AV of $70,000, you will be in the 3rd tax bracket. This means you will be required to pay tax of $8,500 under prevailing tax rates if you are currently not living in this property.

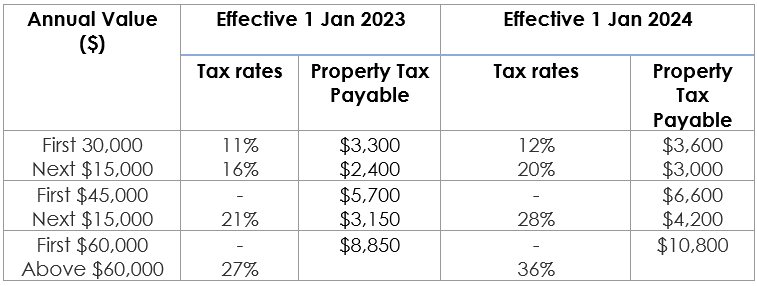

As mentioned, property taxes will be increasing from next year onwards:

Using the earlier example, this means that for properties priced at $50,00, it would be in the second tax bracket and will be subjected to higher tax rates.

If your property has AV of $70,000, you will remain in the 3rd tax bracket. However, due to higher tax rates, you will be required to pay higher taxes.

This means you will be required to pay tax of $8,500 under prevailing tax rates if you are currently not living in this property.

Exceptions

The list of excluded properties is not subjected to non-owner-occupied tax rates as they are required for planning approval for the above use. The list includes:

1. Accommodation facilities within any sports and recreational club

2. Chalet

3. Childcare centre, student care centre, or kindergarten

4. Welfare home

5. Hospital, hospice, or place for rehabilitation, convalescence, nursing care or similar purposes

6. Hotel, backpackers’ hostel, boarding house or guest house

7. Serviced apartment

8. Staff quarters that are part of any property exempted from tax under S6(6) of the Property Tax Act

9. Student’s boarding house or hostel

10. Workers’ dormitory

Rebates

There are generally not many tax rebates applicable for property tax, but if you are demolishing your old home and rebuilding a new one, you may wish to check out the Property Tax Remission For Rebuilding an Owner-Occupied House.

Non-Residential Properties

Most non-residential properties are subjected to a 10% tax rate on their AV. This includes commercial and industrial properties, and there is no distinction on rates even if the property is owner-occupied.

Conclusion

One needs to be well informed about the types of taxes and cost for a property purchase and more often than not, property tax is often overlooked by many homeowners.

In fact, property tax in Singapore is applicable even if the property is vacant.

Thus, a better understanding of how property taxes are calculated and the future hikes would aid one in a more prudent financial planning for their upcoming purchases.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!