Thinking of purchasing your first home? Purchasing a property is a significant financial decision. It is important to plan your finances and budget before commencing your property search. Understanding the foundations of getting a mortgage can help you move through the process of financing your home loan with confidence, making decisions that are well-informed and setting yourself up for a successful home purchase. There are several ways to finance your home: cash and CPF (Ordinary Account) savings, housing loan and CPF housing grants.

This article will help you understand the mortgage loan process in Singapore, shedding light on essential information, requirements and things to look out for when obtaining a loan.

Key terminologies before you begin your mortgage Loan Process

As first-time homeowners, the myriad of financial considerations and decisions that need to be made can be overwhelming. One crucial aspect to grasp before diving into the world of homeownership is understanding the basics of financing your home loan.

Before delving into the details of the loan process, here are some key terminologies that you should know:

Interest rates – The cost of borrowing charged by the lender and is a percentage of the loan amount. Typically, you want to take out a loan from a financial institution that offers a lower interest rate.

Loan tenure – The duration of time you are given to repay your loan in fixed installments. For the same loan quantum, a longer loan tenure will mean a lower monthly installment.

Additionally, how much you can borrow is based on the following:

Loan-to-value (LTV) limit – It determines the maximum amount an individual can borrow from a financial institution for a housing loan. It is calculated based on a percentage of your property’s market value.

Mortgage Servicing Ratio (MSR) – The portion of a borrower’s gross monthly income that goes towards repaying all property loans, including the loan being applied for. MSR is capped at 30% of a borrower’s gross monthly income and it only applies to housing loans for the purchase of an HDB flat or an Executive Condominium (EC).

Total Debt Servicing Ratio (TDSR) – The portion of a borrower’s gross monthly income that goes towards repaying all monthly debt obligations, including the loan being applied for. A borrower’s TDSR should be less than or equal to 55%.

Understanding the Mortgage Loan Process for First-Time Homeowners

1. Determine your budget and affordability

Before embarking on the mortgage loan process, it is crucial to assess your financial situation and determine a realistic budget for purchasing a home. Evaluate your income, existing debts, CPF savings and monthly expenses to understand how much you can comfortably afford to repay each month. Using a mortgage calculator will help you in determining the monthly income needed to finance your home loan. Additionally, consider the down payment needed in cash and any additional costs such as legal fees and stamp duties. Look out for housing grants available too, if you are looking to purchase a HDB flat or EC.

2. Research and compare mortgage loan options

Once you have established your budget, it is time to explore the various mortgage loan options available in Singapore. Conduct thorough research and compare the interest rates, loan terms, repayment options, and fees associated with different lenders.

3. Submit the loan application

Once you have identified the property you wish to purchase, gather all the necessary documents, including the sales and purchase agreement, property valuation report, and your financial statements. Complete the loan application form provided by your chosen lender and submit it along with the required documents. The lender will conduct a thorough assessment of your application.

Your mortgage loan eligibility is typically assessed based on the following criteria:

- Minimum monthly income

- Buyers’ minimum and maximum age

- Loan quantum

- Residency status

- Credit score

4. Loan approval and offer letter

If your application meets the lender’s criteria and is approved, you will receive an offer letter detailing the terms and conditions of the loan. Review the offer carefully, paying attention to interest rates, loan tenure, repayment schedules, penalties and any associated fees. Seek clarification from the lender if you have any doubts or concerns.

Financing your home loan using HDB Loan or Bank Loan?

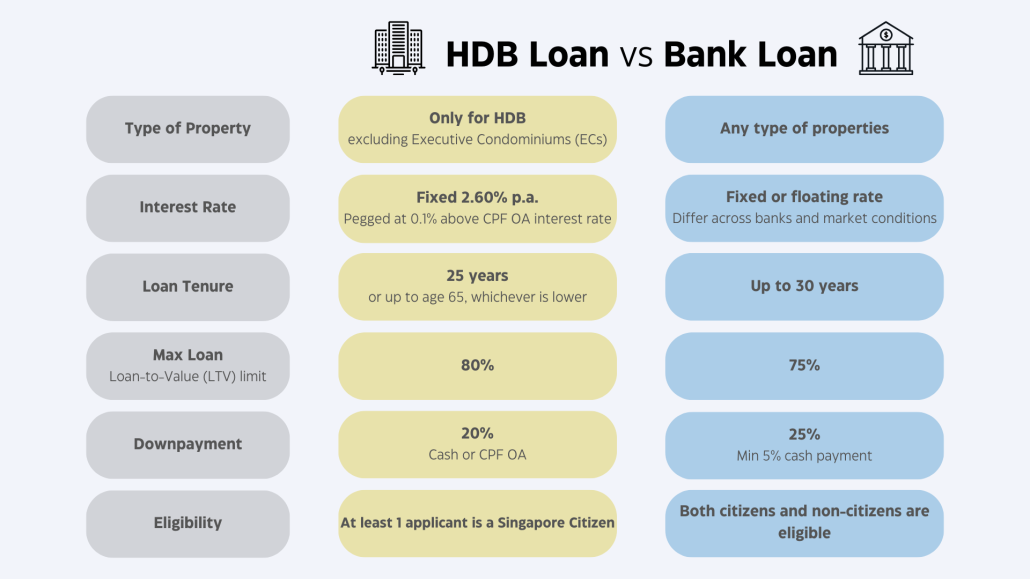

When it comes to financing your home loan in Singapore, you have two primary options: an HDB loan or a bank loan. Let’s take a closer look at each of these loan types to help you make an informed decision.

The key differences between an HDB loan and a bank loan include the downpayment needed, interest rates, eligibility and flexibility for early repayment or refinancing. In general, the eligibility criteria for an HDB loan are stricter and more complex. You will need to apply for an HDB Flat Eligibility (HFE) letter to check for your HDB loan eligibility and more information on your housing finance options with HDB.

It is advisable to compare the pros and cons of each option, seek advice from mortgage specialists and consider your long-term financial goals before making a decision.

Importance of Building a Good Credit Score for Mortgage Eligibility

Building a good credit score is crucial when it comes to mortgage eligibility. Credit scores are used by lenders to determine an individual’s creditworthiness and capacity to repay loans. Here are the key reasons why a good credit score is important for mortgage eligibility:

1. Loan Approval

Lenders use credit scores to assess the risk associated with lending money. A higher credit score indicates a lower risk borrower, increasing the likelihood of loan approval.

2. Interest Rates

Your credit score directly influences the interest rate offered by lenders. A higher credit score can help you secure a mortgage loan at a more favorable interest rate, resulting in significant savings over the life of your mortgage.

3. Loan Terms and Options

A good credit score may provide you with more flexibility and better loan terms. Lenders may be more willing to offer favorable loan terms, such as longer repayment periods to borrowers with strong credit histories.

4. Higher Loan Amounts

A higher credit score can also increase your borrowing capacity. Lenders may be more willing to offer larger loan amounts to borrowers with good credit scores, allowing you to consider more expensive properties. However, the loan quantum is also subjected to the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) to ensure that borrowers borrow within their means.

To build and maintain a good credit score, focus on responsible financial habits. Pay your bills on time, keep credit card balances low, avoid excessive debt, and regularly review your credit report for any inaccuracies. You may check your credit rating history at the Credit Bureau.

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!