With rivalry rife between China and the US, here’s how Unicorn Financial Solutions are investing in them considering their strengths.

Why China?

China’s investibility relies on their growing influence and wealth redistribution.

1. Growing clout

China has been expanding rapidly, especially in the last 2 decades. As it was the only major economy to have positive growth last year, China may overtake US sooner as the largest economy1.

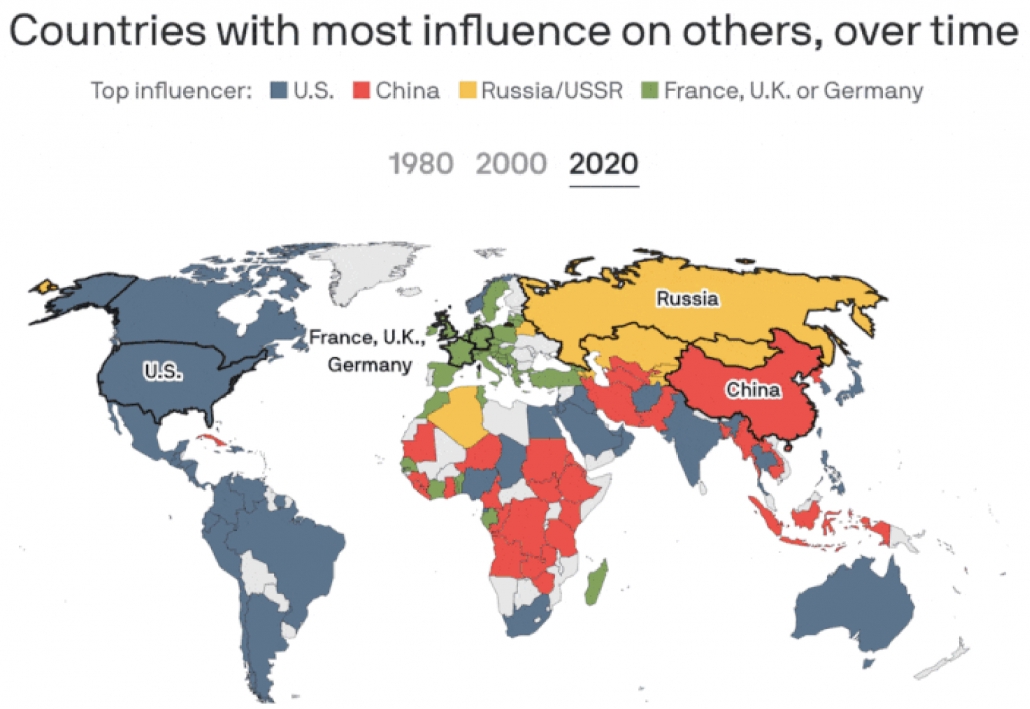

Besides GDP growth, China’s influence has also been growing. Comparing each country’s dependence upon one another, the Atlantic Council was able to measure the influence of each region – and the trend is clear – America’s global influence has stagnated, Europe’s has waned, while China’s has rapidly expanded2.

2. Wealth Redistribution

President Xi Jin Ping is adamant on “common prosperity” instead of massive wealth being accumulated in the hands of the few. This means that there are (and will be) policy changes, regulations and uncertainties which investors do not like, which has caused the current market volatility.

In the longer term, however, Unicorn think that the President’s vision of “common prosperity” will bring about a bigger and wealthier middle class that would drive their consumption and also the economy in the years to come.

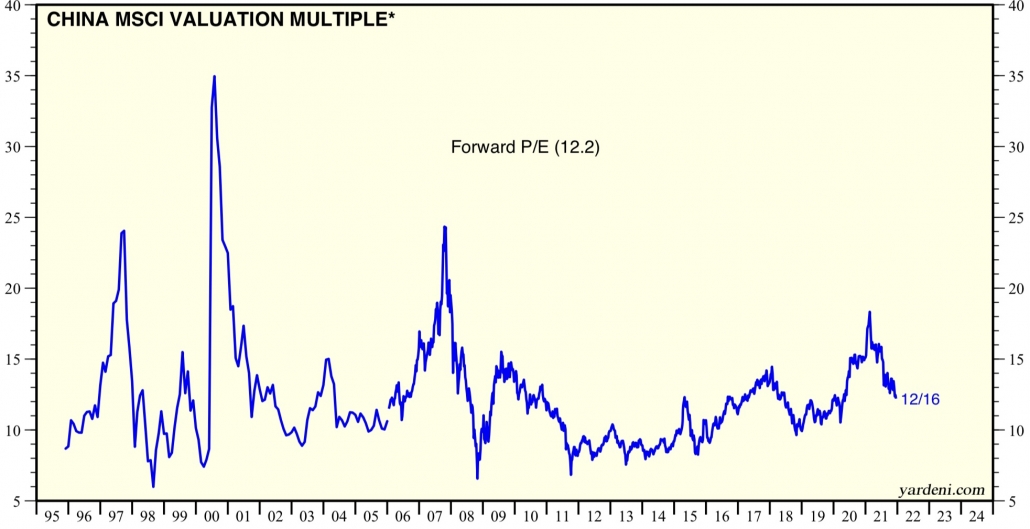

China’s Valuation

Considering the valuations of the Chinese stocks at this moment, it reflects a market that is overly-pessimistic over short-term noise, hence posing great buying opportunities for long-term holders.

Why US?

US wins out in two other areas.

1. Tech supremacy

As the tech boom has to be fueled by semiconductors (the computer chips that power most modern electronics) – the brain in the value chain remains in US’s pocket as long as US continues to block key technologies from China, or until China advances their own. The leaders in semiconductors are now mainly in the US and its allies.

2. Reserve currency

As the US dollar continues to be the world’s reserve currency with 61% of the Central Banks holding its reserves in US dollars and 90% of world trade being conducted in US dollars, US money-printing did not seem to have dampened its currency much. Though the threat is not yet present, Unicorn believe that the US dollar will probably weaken in time to come.

Conclusion

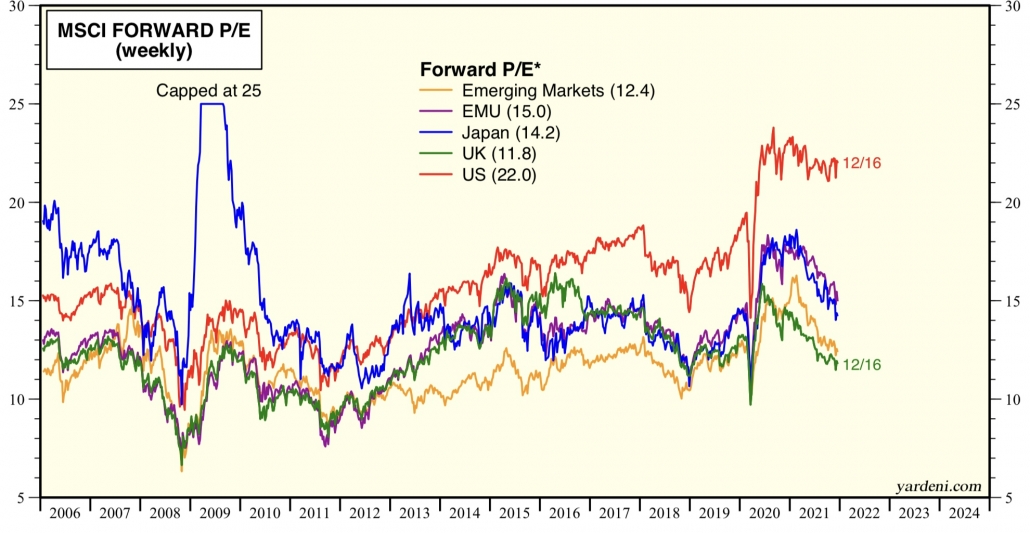

Hence, Unicorn think that investing more broadly across sectors would be appropriate for China, and Unicorn will prefer to be investing very selectively in the US given its equities valuations are high. Unicorn prefers focusing only on its crown jewel, the technology sector. However, a bumpy ride is to be expected in the short-term.

Important Notice

The information herein is published by Unicorn Financial Solutions Pte. Limited. (“Unicorn”) and is for information only. This publication is intended for Unicorn and its clients or prospective clients to whom it has been delivered and may not be reproduced or transmitted to any other person without the prior permission of Unicorn. The information and opinions contained in this publication has been obtained from sources believed to be reliable but Unicorn does not make any representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose. Opinions and estimates are subject to change without notice. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment. Unicorn accepts no liability whatsoever for any direct indirect or consequential losses or damages arising from or in connection with the use or reliance of this publication or its contents. The information herein is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. If this publication has been distributed by electronic transmission, such as e-mail, then such transmission cannot be guaranteed to be secure or error free as information could be intercepted, corrupted, lost, destroyed, arrive late or incomplete, or contain viruses. Unicorn does not accept liability for any errors or omissions in the contents of this publication, which may arise as a result of electronic transmission. This advertisement has not been reviewed by the Monetary Authority of Singapore.

Unicorn Financial Solutions Pte. Limited Reg. No.: 200501540R

Want to find the best mortgage rate in town? Check out our free comparison service to learn more!

Read more of our posts below!